Wine investing offers the potential for value appreciation driven by rarity, vintage quality, and global demand, while collectible watch investing hinges on brand prestige, limited editions, and craftsmanship. Both markets require expertise in authentication and market trends to maximize returns, with wine being more affected by storage conditions and watches by condition and provenance. Explore the nuances of these unique asset classes to determine which aligns best with your investment goals.

Why it is important

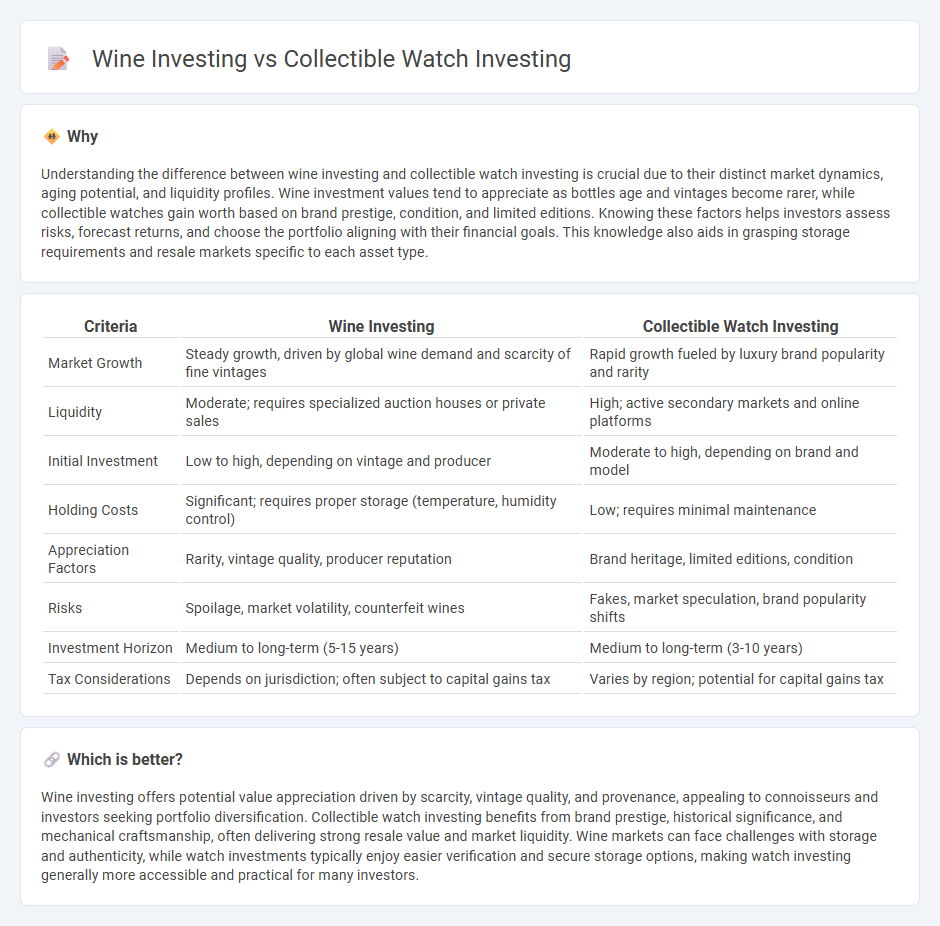

Understanding the difference between wine investing and collectible watch investing is crucial due to their distinct market dynamics, aging potential, and liquidity profiles. Wine investment values tend to appreciate as bottles age and vintages become rarer, while collectible watches gain worth based on brand prestige, condition, and limited editions. Knowing these factors helps investors assess risks, forecast returns, and choose the portfolio aligning with their financial goals. This knowledge also aids in grasping storage requirements and resale markets specific to each asset type.

Comparison Table

| Criteria | Wine Investing | Collectible Watch Investing |

|---|---|---|

| Market Growth | Steady growth, driven by global wine demand and scarcity of fine vintages | Rapid growth fueled by luxury brand popularity and rarity |

| Liquidity | Moderate; requires specialized auction houses or private sales | High; active secondary markets and online platforms |

| Initial Investment | Low to high, depending on vintage and producer | Moderate to high, depending on brand and model |

| Holding Costs | Significant; requires proper storage (temperature, humidity control) | Low; requires minimal maintenance |

| Appreciation Factors | Rarity, vintage quality, producer reputation | Brand heritage, limited editions, condition |

| Risks | Spoilage, market volatility, counterfeit wines | Fakes, market speculation, brand popularity shifts |

| Investment Horizon | Medium to long-term (5-15 years) | Medium to long-term (3-10 years) |

| Tax Considerations | Depends on jurisdiction; often subject to capital gains tax | Varies by region; potential for capital gains tax |

Which is better?

Wine investing offers potential value appreciation driven by scarcity, vintage quality, and provenance, appealing to connoisseurs and investors seeking portfolio diversification. Collectible watch investing benefits from brand prestige, historical significance, and mechanical craftsmanship, often delivering strong resale value and market liquidity. Wine markets can face challenges with storage and authenticity, while watch investments typically enjoy easier verification and secure storage options, making watch investing generally more accessible and practical for many investors.

Connection

Wine investing and collectible watch investing both capitalize on rarity and provenance as key drivers of value appreciation. Collectors seek limited editions and vintage items with authenticated histories, creating niche markets where scarcity boosts demand and long-term returns. Both asset classes benefit from passionate communities and expert valuations that enhance market liquidity and investment confidence.

Key Terms

**Collectible Watch Investing:**

Collectible watch investing leverages the rising global demand for luxury timepieces from brands like Rolex, Patek Philippe, and Audemars Piguet, known for their historical value and limited production runs that ensure scarcity and price appreciation. High-quality vintage watches and limited-edition models often outperform traditional investments, driven by a passionate collector community and well-documented provenance that adds credibility and value. Discover how to build a resilient portfolio by understanding key market trends and authenticated sourcing in collectible watch investing.

Provenance

Provenance plays a critical role in both collectible watch and wine investing, where documented history and authenticity directly influence value and market demand. Watches with verified ownership history, original packaging, and service records can command premium prices, while fine wines with detailed provenance, including vineyard origin and storage conditions, are highly sought after by collectors. Explore deeper insights on how provenance impacts the investment potential in these luxury asset classes.

Rarity

Both collectible watch investing and wine investing heavily depend on rarity to drive value, with limited-edition timepieces from brands like Rolex and Patek Philippe commanding high premiums due to their scarcity and craftsmanship. Similarly, rare vintage wines, particularly those from renowned vineyards such as Chateau Lafite Rothschild or Domaine de la Romanee-Conti, appreciate significantly as supply diminishes over time. Explore more about how rarity influences investment potential in these luxury asset classes.

Source and External Links

How to Invest in Vintage Watches: A Complete Guide - Vintage watches have significant potential for value appreciation and offer portfolio diversification benefits, with options like fractional investing making luxury watch investment more accessible.

Investing in Luxury Watches: Tax Benefits and More - Successful watch investing requires clear long-term goals, diversification, and selecting undervalued or potentially popular models, with luxury watches historically showing resilience in economic downturns.

Investing in Luxury Watches - The Complete Guide - Limited edition or discontinued luxury watches tend to appreciate the most, with proper market research and buying from trusted dealers being crucial for profitable watch investments.

dowidth.com

dowidth.com