Wine investing offers tangible assets with historic appreciation tied to rare vintages and global demand, appealing to collectors seeking portfolio diversification. Crowdfunding enables access to a broader range of startups and projects with potentially higher returns, leveraging pooled capital through digital platforms. Discover the unique benefits and risks of each investment approach to make informed financial decisions.

Why it is important

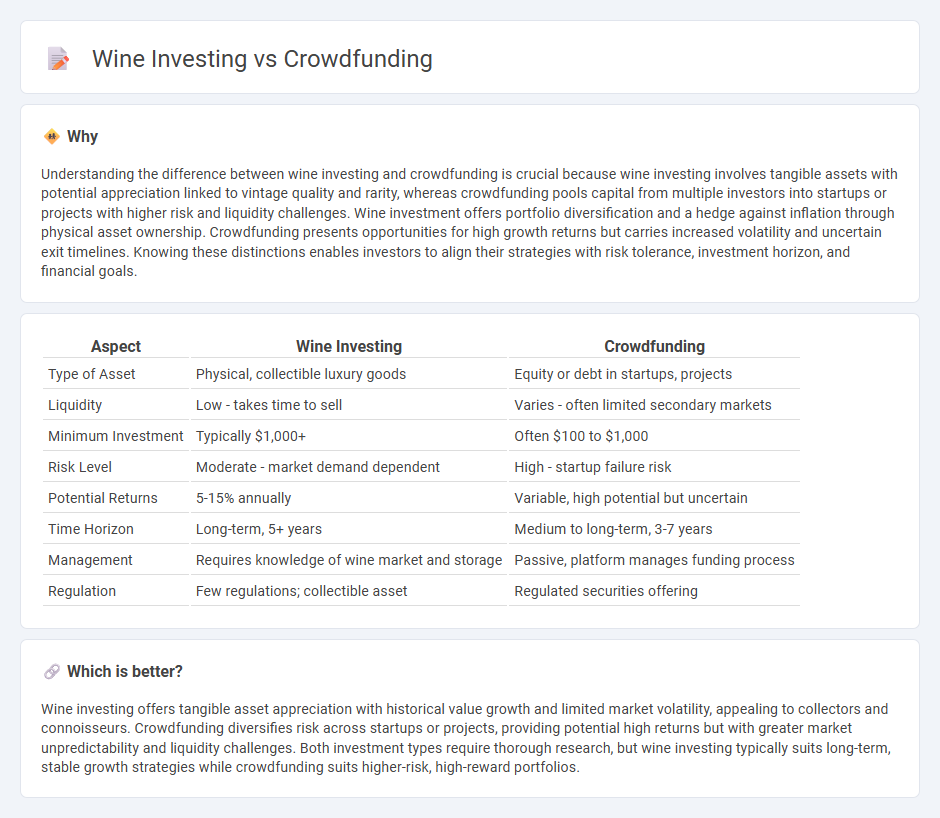

Understanding the difference between wine investing and crowdfunding is crucial because wine investing involves tangible assets with potential appreciation linked to vintage quality and rarity, whereas crowdfunding pools capital from multiple investors into startups or projects with higher risk and liquidity challenges. Wine investment offers portfolio diversification and a hedge against inflation through physical asset ownership. Crowdfunding presents opportunities for high growth returns but carries increased volatility and uncertain exit timelines. Knowing these distinctions enables investors to align their strategies with risk tolerance, investment horizon, and financial goals.

Comparison Table

| Aspect | Wine Investing | Crowdfunding |

|---|---|---|

| Type of Asset | Physical, collectible luxury goods | Equity or debt in startups, projects |

| Liquidity | Low - takes time to sell | Varies - often limited secondary markets |

| Minimum Investment | Typically $1,000+ | Often $100 to $1,000 |

| Risk Level | Moderate - market demand dependent | High - startup failure risk |

| Potential Returns | 5-15% annually | Variable, high potential but uncertain |

| Time Horizon | Long-term, 5+ years | Medium to long-term, 3-7 years |

| Management | Requires knowledge of wine market and storage | Passive, platform manages funding process |

| Regulation | Few regulations; collectible asset | Regulated securities offering |

Which is better?

Wine investing offers tangible asset appreciation with historical value growth and limited market volatility, appealing to collectors and connoisseurs. Crowdfunding diversifies risk across startups or projects, providing potential high returns but with greater market unpredictability and liquidity challenges. Both investment types require thorough research, but wine investing typically suits long-term, stable growth strategies while crowdfunding suits higher-risk, high-reward portfolios.

Connection

Wine investing leverages the growing market for fine wines as alternative assets, attracting investors seeking portfolio diversification and inflation hedging. Crowdfunding platforms facilitate access to wine investment opportunities by pooling capital from multiple investors, enabling participation in vineyards, wine production, or wine funds. This synergy democratizes investment in rare wines, expanding market liquidity and fostering community-driven growth in the wine industry.

Key Terms

Equity Stake

Equity stake in crowdfunding allows investors to directly own shares of a startup, offering potential for high returns tied to company performance. Wine investing, on the other hand, typically involves purchasing physical assets without equity ownership, with value appreciation driven by rarity and market demand. Explore the differences further to decide which investment aligns best with your financial goals.

Platform Fees

Crowdfunding platforms typically charge fees ranging from 5% to 10% of the total funds raised, impacting overall returns for wine investors. Wine investment platforms often impose annual management fees between 1% and 2%, plus transaction costs, which can affect long-term profitability. Explore detailed comparisons of platform fees to make informed wine investment decisions.

Asset Liquidity

Crowdfunding platforms offer relatively high asset liquidity, allowing investors to buy and sell shares in wine projects quickly through digital marketplaces. Wine investing typically involves physical bottles or futures, which can be less liquid due to the need for auctions or private sales and market demand fluctuations. Explore deeper insights on asset liquidity differences between crowdfunding and wine investing to optimize your portfolio strategy.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, often without traditional financial intermediaries, and it supports a wide range of entrepreneurial and social projects.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows startups and projects to raise money collectively through individual contributions, mostly online, enabling funding by anyone interested, including friends, family, and customers.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to gather small amounts from many people and can operate as donation, rewards-based, or equity-based funding models, with platforms like GoFundMe and Kickstarter popular examples.

dowidth.com

dowidth.com