Fractional ownership allows investors to purchase a portion of high-value assets like real estate or artwork, offering diversified exposure and potential for capital appreciation. Fixed deposits provide a secure, predictable return by locking funds at a fixed interest rate for a set period, prioritizing capital preservation. Explore more to understand how these investment options can fit your financial strategy.

Why it is important

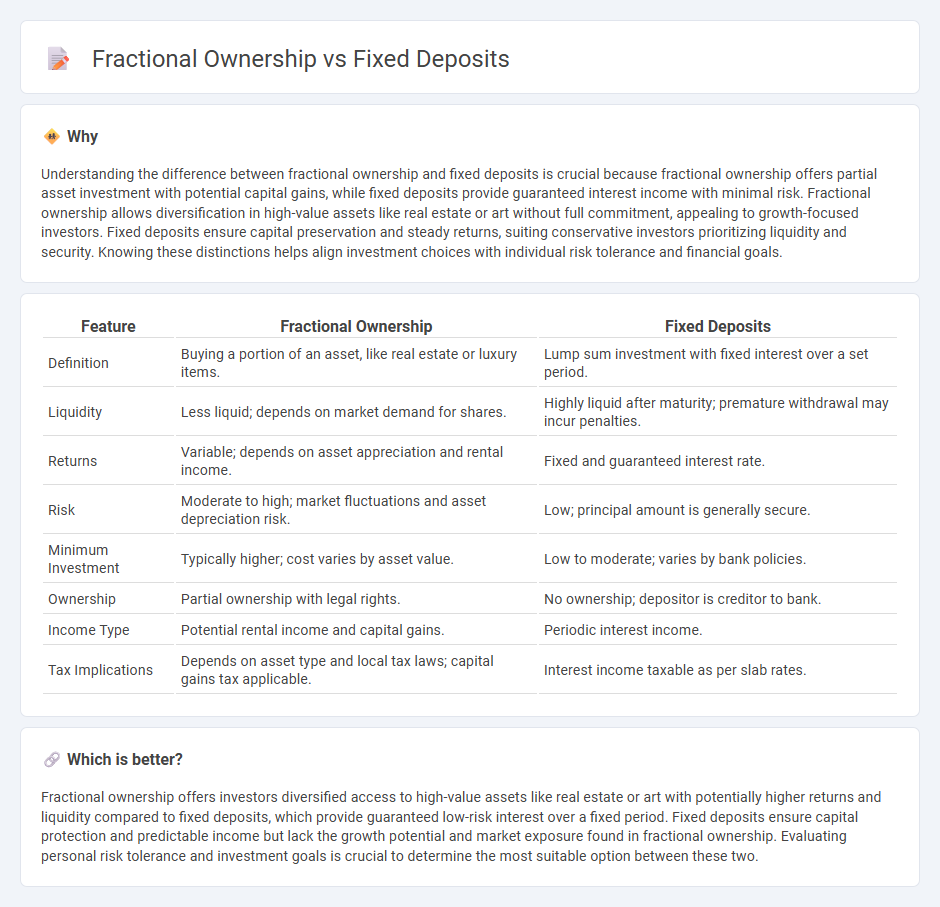

Understanding the difference between fractional ownership and fixed deposits is crucial because fractional ownership offers partial asset investment with potential capital gains, while fixed deposits provide guaranteed interest income with minimal risk. Fractional ownership allows diversification in high-value assets like real estate or art without full commitment, appealing to growth-focused investors. Fixed deposits ensure capital preservation and steady returns, suiting conservative investors prioritizing liquidity and security. Knowing these distinctions helps align investment choices with individual risk tolerance and financial goals.

Comparison Table

| Feature | Fractional Ownership | Fixed Deposits |

|---|---|---|

| Definition | Buying a portion of an asset, like real estate or luxury items. | Lump sum investment with fixed interest over a set period. |

| Liquidity | Less liquid; depends on market demand for shares. | Highly liquid after maturity; premature withdrawal may incur penalties. |

| Returns | Variable; depends on asset appreciation and rental income. | Fixed and guaranteed interest rate. |

| Risk | Moderate to high; market fluctuations and asset depreciation risk. | Low; principal amount is generally secure. |

| Minimum Investment | Typically higher; cost varies by asset value. | Low to moderate; varies by bank policies. |

| Ownership | Partial ownership with legal rights. | No ownership; depositor is creditor to bank. |

| Income Type | Potential rental income and capital gains. | Periodic interest income. |

| Tax Implications | Depends on asset type and local tax laws; capital gains tax applicable. | Interest income taxable as per slab rates. |

Which is better?

Fractional ownership offers investors diversified access to high-value assets like real estate or art with potentially higher returns and liquidity compared to fixed deposits, which provide guaranteed low-risk interest over a fixed period. Fixed deposits ensure capital protection and predictable income but lack the growth potential and market exposure found in fractional ownership. Evaluating personal risk tolerance and investment goals is crucial to determine the most suitable option between these two.

Connection

Fractional ownership and fixed deposits both offer accessible investment opportunities with defined returns, appealing to risk-averse investors seeking steady income streams. Fractional ownership enables investors to buy shares of high-value assets like real estate or art, similar to fixed deposits providing fixed interest rates on deposited funds with minimal risk. Both investment types enhance portfolio diversification by combining asset-backed equity stakes with secure, predictable financial products.

Key Terms

Principal

Fixed deposits guarantee the principal amount with a predetermined interest rate, offering capital preservation and steady returns. In fractional ownership, the principal is tied to asset value fluctuations, which can increase or decrease investment worth based on market conditions. Explore detailed comparisons to decide which option matches your financial goals and risk tolerance.

Liquidity

Fixed deposits offer high liquidity with fixed tenure and predictable returns, allowing investors to withdraw funds after maturity without significant loss. Fractional ownership provides varying liquidity depending on the asset type, market demand, and platform regulations, often involving secondary market trading or holding periods. Explore more to understand which investment matches your liquidity needs better.

Diversification

Fixed deposits offer stable returns with low risk by investing in a single financial product, whereas fractional ownership enables diversification across multiple high-value assets like real estate, art, or vehicles, balancing risk and potential growth. Diversification through fractional ownership reduces exposure to market volatility compared to the fixed, predetermined interest of fixed deposits. Explore more to understand how each option can fit your investment portfolio goals.

Source and External Links

Fixed deposit - Wikipedia - A fixed deposit (FD) is a bank account that offers a higher interest rate for a fixed tenure, with funds locked in until maturity and typically used in India and the US, also known as a term deposit or time deposit elsewhere.

What is a Fixed Deposit - DBS Bank - A fixed deposit is a secure investment where you deposit a lump sum for a fixed period at a set interest rate, earning either regular periodic interest or a lump sum at maturity, with early withdrawal usually attracting a penalty.

Fixed Deposit - ICICI Bank - ICICI Bank offers FDs with interest rates up to 7.10% p.a. for senior citizens and up to 6.60% p.a. for others, allowing quick online investment and flexible payout options, with penalties for premature withdrawal.

dowidth.com

dowidth.com