Crypto staking offers passive income by locking digital assets to support blockchain networks, yielding rewards often higher than traditional investments. Real estate rental income provides a tangible asset with steady cash flow and potential appreciation, but requires property management and maintenance. Explore the advantages and risks of both to determine which investment aligns with your financial goals.

Why it is important

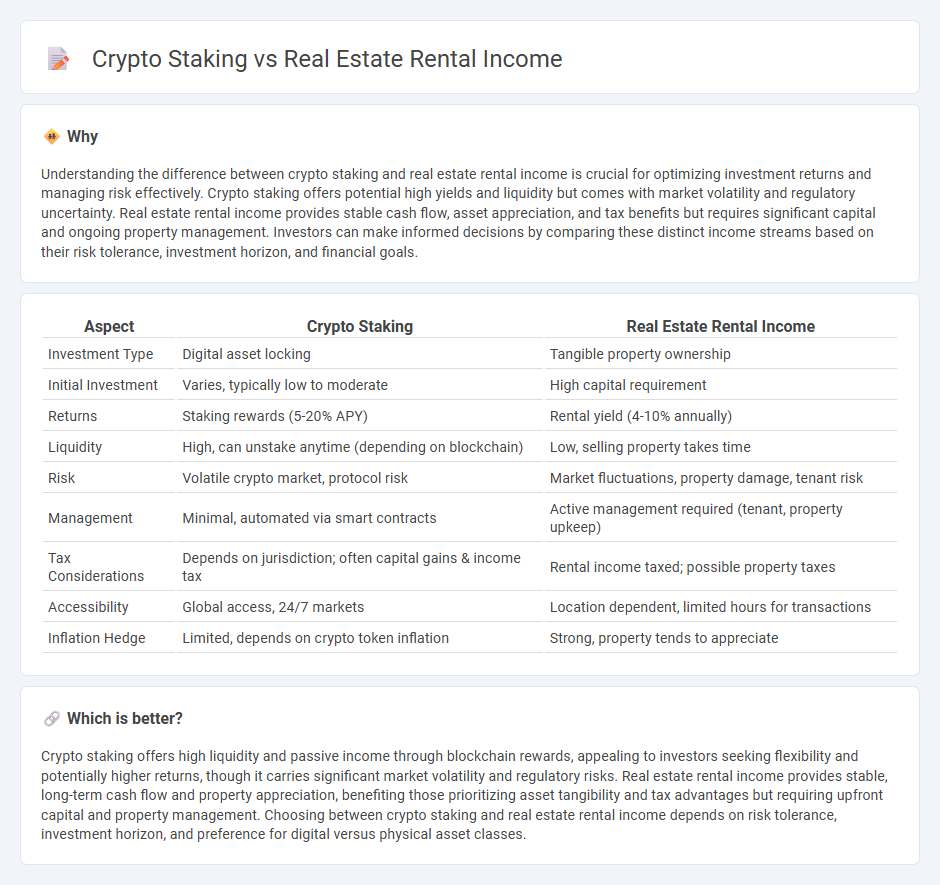

Understanding the difference between crypto staking and real estate rental income is crucial for optimizing investment returns and managing risk effectively. Crypto staking offers potential high yields and liquidity but comes with market volatility and regulatory uncertainty. Real estate rental income provides stable cash flow, asset appreciation, and tax benefits but requires significant capital and ongoing property management. Investors can make informed decisions by comparing these distinct income streams based on their risk tolerance, investment horizon, and financial goals.

Comparison Table

| Aspect | Crypto Staking | Real Estate Rental Income |

|---|---|---|

| Investment Type | Digital asset locking | Tangible property ownership |

| Initial Investment | Varies, typically low to moderate | High capital requirement |

| Returns | Staking rewards (5-20% APY) | Rental yield (4-10% annually) |

| Liquidity | High, can unstake anytime (depending on blockchain) | Low, selling property takes time |

| Risk | Volatile crypto market, protocol risk | Market fluctuations, property damage, tenant risk |

| Management | Minimal, automated via smart contracts | Active management required (tenant, property upkeep) |

| Tax Considerations | Depends on jurisdiction; often capital gains & income tax | Rental income taxed; possible property taxes |

| Accessibility | Global access, 24/7 markets | Location dependent, limited hours for transactions |

| Inflation Hedge | Limited, depends on crypto token inflation | Strong, property tends to appreciate |

Which is better?

Crypto staking offers high liquidity and passive income through blockchain rewards, appealing to investors seeking flexibility and potentially higher returns, though it carries significant market volatility and regulatory risks. Real estate rental income provides stable, long-term cash flow and property appreciation, benefiting those prioritizing asset tangibility and tax advantages but requiring upfront capital and property management. Choosing between crypto staking and real estate rental income depends on risk tolerance, investment horizon, and preference for digital versus physical asset classes.

Connection

Crypto staking and real estate rental income both generate passive cash flow by leveraging asset ownership to earn rewards or rental payments. Staking cryptocurrencies like Ethereum provides regular returns through network validation rewards, similar to how property investors receive steady rental income from tenants. Both investment strategies offer diversification benefits and potential long-term appreciation, balancing risk by blending digital assets with tangible real estate holdings.

Key Terms

Cash Flow

Real estate rental income generates consistent cash flow through monthly lease payments, offering stability and potential tax benefits, while crypto staking provides variable rewards based on blockchain protocols and cryptocurrency market volatility. Rental properties require ongoing management and maintenance expenses, whereas staking demands minimal active involvement but carries higher liquidity risk. Explore how these differing cash flow dynamics impact your investment portfolio by learning more.

Yield

Real estate rental income typically offers a stable and tangible yield, often ranging from 4% to 10% annually depending on location and market conditions, while crypto staking yields can fluctuate significantly, commonly between 5% and 20% but with higher volatility. Rental income benefits from long-term asset appreciation and steady cash flow, whereas staking rewards depend on blockchain protocol inflation and token price movements. Explore detailed comparisons to understand the risk-reward dynamics of real estate versus crypto staking yields.

Volatility

Real estate rental income offers stable cash flow with low volatility, driven by long-term leases and consistent tenant demand, making it a reliable investment for steady returns. Crypto staking, in contrast, involves higher volatility due to rapid fluctuations in cryptocurrency prices, though it can yield significant rewards through network validation and inflation incentives. Explore the detailed risks and benefits of each to optimize your investment strategy.

Source and External Links

What is Rental Income and How Do I Report It - This article explains what rental income is and how to report it using Schedule E for supplemental income and loss.

How is Rental Income Taxed - This guide outlines what counts as rental income and how it is taxed, including advance rent payments and security deposits.

Rental Income and Expenses - This IRS topic discusses the types of rental income, including cash and fair market value of property or services received, and how to report them on tax returns.

dowidth.com

dowidth.com