Collectibles investment focuses on acquiring physical items such as art, coins, or rare memorabilia that may appreciate in value over time, driven by rarity and demand in niche markets. Intellectual property investment involves securing rights to creations like patents, trademarks, and copyrights, generating revenue through licensing or royalties based on legal protections. Explore the unique advantages and risks associated with each investment type to make informed financial decisions.

Why it is important

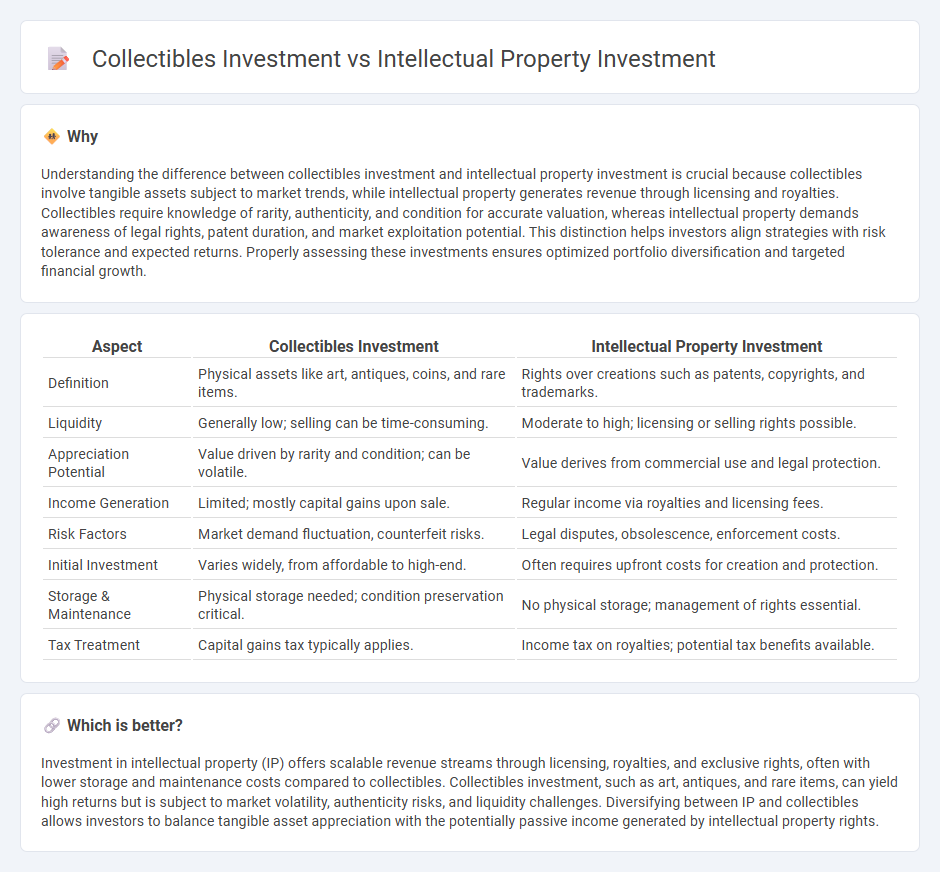

Understanding the difference between collectibles investment and intellectual property investment is crucial because collectibles involve tangible assets subject to market trends, while intellectual property generates revenue through licensing and royalties. Collectibles require knowledge of rarity, authenticity, and condition for accurate valuation, whereas intellectual property demands awareness of legal rights, patent duration, and market exploitation potential. This distinction helps investors align strategies with risk tolerance and expected returns. Properly assessing these investments ensures optimized portfolio diversification and targeted financial growth.

Comparison Table

| Aspect | Collectibles Investment | Intellectual Property Investment |

|---|---|---|

| Definition | Physical assets like art, antiques, coins, and rare items. | Rights over creations such as patents, copyrights, and trademarks. |

| Liquidity | Generally low; selling can be time-consuming. | Moderate to high; licensing or selling rights possible. |

| Appreciation Potential | Value driven by rarity and condition; can be volatile. | Value derives from commercial use and legal protection. |

| Income Generation | Limited; mostly capital gains upon sale. | Regular income via royalties and licensing fees. |

| Risk Factors | Market demand fluctuation, counterfeit risks. | Legal disputes, obsolescence, enforcement costs. |

| Initial Investment | Varies widely, from affordable to high-end. | Often requires upfront costs for creation and protection. |

| Storage & Maintenance | Physical storage needed; condition preservation critical. | No physical storage; management of rights essential. |

| Tax Treatment | Capital gains tax typically applies. | Income tax on royalties; potential tax benefits available. |

Which is better?

Investment in intellectual property (IP) offers scalable revenue streams through licensing, royalties, and exclusive rights, often with lower storage and maintenance costs compared to collectibles. Collectibles investment, such as art, antiques, and rare items, can yield high returns but is subject to market volatility, authenticity risks, and liquidity challenges. Diversifying between IP and collectibles allows investors to balance tangible asset appreciation with the potentially passive income generated by intellectual property rights.

Connection

Collectibles investment and intellectual property investment are connected through their shared reliance on unique assets that appreciate in value due to rarity and exclusivity. Both markets require deep knowledge of provenance, authenticity, and market trends to maximize returns. Investors leverage intellectual property rights to protect and monetize collectibles, enhancing their investment potential.

Key Terms

**Intellectual Property Investment:**

Intellectual property investment involves acquiring rights to patents, trademarks, copyrights, or trade secrets, offering potential for significant long-term revenue through licensing, royalties, or commercialization. This type of investment can generate steady income streams with higher scalability compared to collectibles, which are often subject to market trends and require physical maintenance. Explore more about how intellectual property investment can diversify and strengthen your portfolio.

Licensing Agreements

Licensing agreements in intellectual property investment generate ongoing royalty revenue by granting rights to use patents, trademarks, or copyrights, establishing a scalable income stream unlike collectibles, which primarily appreciate through market demand and rarity. Intellectual property assets benefit from legal protections that enhance their value and revenue potential, while collectibles depend heavily on physical condition and market trends. Explore how strategic licensing agreements can unlock sustained financial returns compared to the fluctuating nature of collectibles.

Royalties

Intellectual property investment generates ongoing revenue streams through royalties from patents, copyrights, trademarks, and licensing agreements, providing a scalable and often passive income source. Collectibles investment, such as art or rare items, typically yields returns through appreciation in market value and occasional auction sales rather than continuous royalty payments. Explore how focusing on royalties can enhance your investment strategy by unlocking consistent cash flow and long-term wealth building.

Source and External Links

Investors' Perspective on Intellectual Property Financing - Intellectual property financing helps investors by securing returns, providing useful signals for investment decisions, and coordinating relationships among stakeholders, although uncertainty and legal unpredictability pose significant challenges for investors.

Investing in Intellectual Property - Chicago-Kent - Intellectual property investment offers high risk and high reward opportunities by generating value through licensing, sales, or collateralization, supporting innovation, and providing competitive advantages for companies like Apple and Starbucks.

Intellectual property can generate financial returns - IP investments generate revenue through royalties and capital appreciation; securitization of IP assets provides liquidity and enables participation in the asset's future growth without affecting borrower risk.

dowidth.com

dowidth.com