Wine investing offers a tangible asset with historical value appreciation, often providing portfolio diversification and lower volatility compared to traditional markets. Cryptocurrency investing involves digital assets with high risk and potential for rapid gains due to market volatility and decentralized blockchain technology. Discover more about the advantages and challenges of wine and cryptocurrency investments to make informed financial decisions.

Why it is important

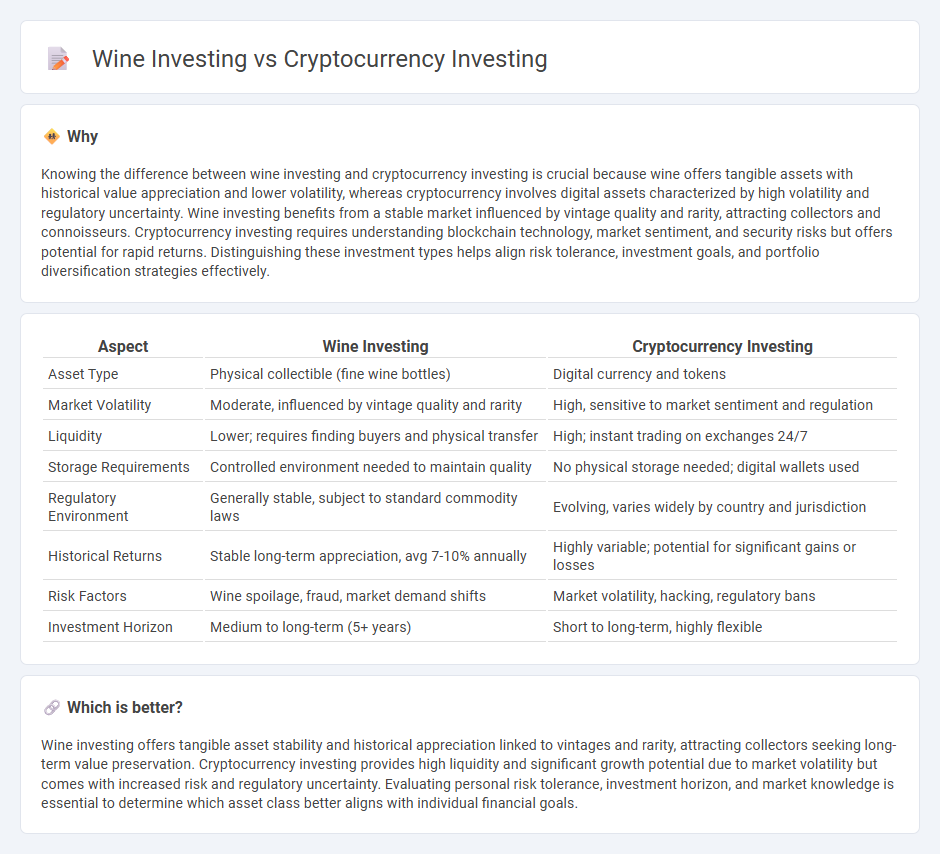

Knowing the difference between wine investing and cryptocurrency investing is crucial because wine offers tangible assets with historical value appreciation and lower volatility, whereas cryptocurrency involves digital assets characterized by high volatility and regulatory uncertainty. Wine investing benefits from a stable market influenced by vintage quality and rarity, attracting collectors and connoisseurs. Cryptocurrency investing requires understanding blockchain technology, market sentiment, and security risks but offers potential for rapid returns. Distinguishing these investment types helps align risk tolerance, investment goals, and portfolio diversification strategies effectively.

Comparison Table

| Aspect | Wine Investing | Cryptocurrency Investing |

|---|---|---|

| Asset Type | Physical collectible (fine wine bottles) | Digital currency and tokens |

| Market Volatility | Moderate, influenced by vintage quality and rarity | High, sensitive to market sentiment and regulation |

| Liquidity | Lower; requires finding buyers and physical transfer | High; instant trading on exchanges 24/7 |

| Storage Requirements | Controlled environment needed to maintain quality | No physical storage needed; digital wallets used |

| Regulatory Environment | Generally stable, subject to standard commodity laws | Evolving, varies widely by country and jurisdiction |

| Historical Returns | Stable long-term appreciation, avg 7-10% annually | Highly variable; potential for significant gains or losses |

| Risk Factors | Wine spoilage, fraud, market demand shifts | Market volatility, hacking, regulatory bans |

| Investment Horizon | Medium to long-term (5+ years) | Short to long-term, highly flexible |

Which is better?

Wine investing offers tangible asset stability and historical appreciation linked to vintages and rarity, attracting collectors seeking long-term value preservation. Cryptocurrency investing provides high liquidity and significant growth potential due to market volatility but comes with increased risk and regulatory uncertainty. Evaluating personal risk tolerance, investment horizon, and market knowledge is essential to determine which asset class better aligns with individual financial goals.

Connection

Wine investing and cryptocurrency investing share a common appeal through diversification and alternative asset strategies that attract investors seeking non-traditional portfolios. Both markets leverage scarcity and market trends, with wine offering tangible, collectible assets influenced by vintage quality and provenance, while cryptocurrency relies on digital scarcity and blockchain technology. The intersection lies in growing investor interest driven by potential high returns and portfolio hedging against traditional financial market volatility.

Key Terms

Cryptocurrency investing:

Cryptocurrency investing offers high liquidity and 24/7 market access, with assets like Bitcoin and Ethereum providing significant growth potential despite volatility. Unlike wine investing, which requires storage expertise and long-term aging, cryptocurrencies can be bought, sold, and transferred rapidly via digital exchanges and wallets. Explore detailed comparisons and strategies to optimize your investment portfolio with cryptocurrency insights.

Blockchain

Cryptocurrency investing leverages blockchain technology, offering decentralized, transparent transactions and real-time market liquidity. Wine investing relies on physical asset appreciation without blockchain traceability, making it less liquid and subject to market opacity. Explore how blockchain transforms asset security and liquidity in modern investing.

Volatility

Cryptocurrency investing exhibits extreme volatility due to market speculation, regulatory changes, and technological shifts, with price fluctuations reaching double-digit percentages within hours. Wine investing offers more stability as its value is influenced by vintage quality, storage conditions, and rarity, typically appreciating steadily over time. Explore further to understand how volatility impacts your investment strategy in these diverse assets.

Source and External Links

What is Cryptocurrency and How Does it Work? - Offers four key tips for cryptocurrency investing safely, including researching exchanges, knowing how to store digital currency, diversifying investments, and preparing for market volatility.

Cryptocurrency Investments: ETFs, Stocks & Futures - Details multiple ways to invest in crypto indirectly through ETFs, ETPs, coin trusts, and futures without owning cryptocurrency directly, all accessible via brokerage accounts or IRAs.

Cryptocurrency Investment Types - Provides a range of crypto investment options including spot bitcoin and ether funds, crypto-linked exchange-traded products, stocks, mutual funds, crypto futures, and coin trusts, with no account minimums and commission-free trades available.

dowidth.com

dowidth.com