Dark kitchen real estate offers lower overhead costs and flexible lease terms compared to traditional retail storefronts, making it an attractive investment in the growing food delivery market. Retail storefronts demand higher upfront capital and ongoing expenses but benefit from direct customer engagement and visibility. Explore the distinct advantages and investment potential of dark kitchens versus retail storefront properties to make an informed decision.

Why it is important

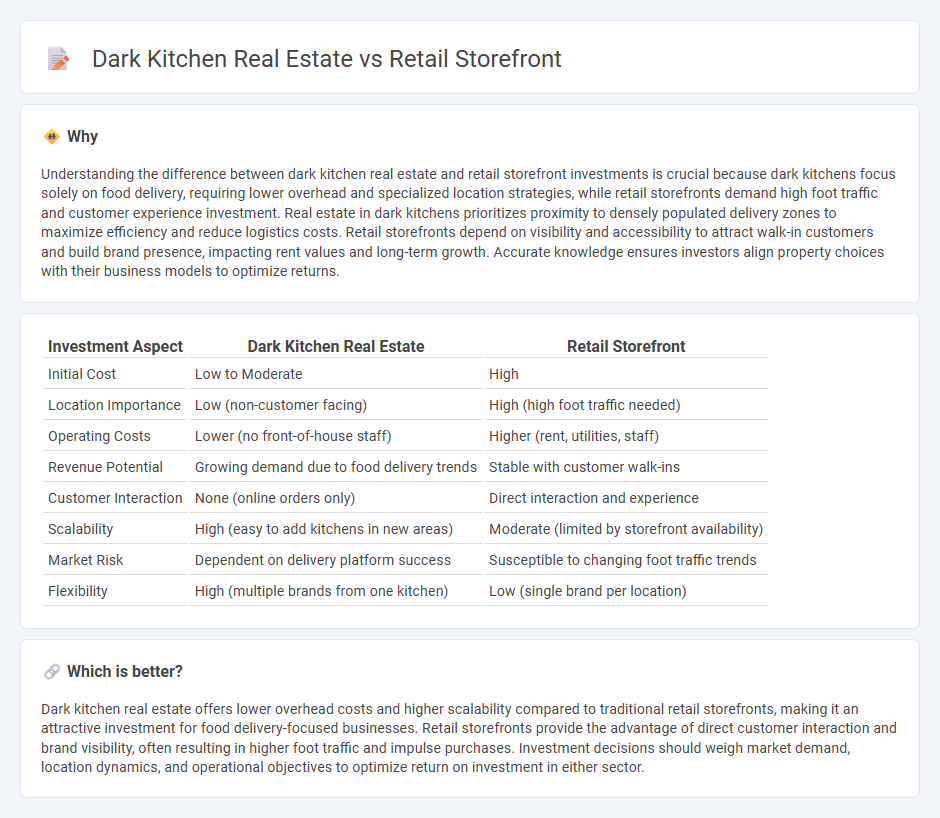

Understanding the difference between dark kitchen real estate and retail storefront investments is crucial because dark kitchens focus solely on food delivery, requiring lower overhead and specialized location strategies, while retail storefronts demand high foot traffic and customer experience investment. Real estate in dark kitchens prioritizes proximity to densely populated delivery zones to maximize efficiency and reduce logistics costs. Retail storefronts depend on visibility and accessibility to attract walk-in customers and build brand presence, impacting rent values and long-term growth. Accurate knowledge ensures investors align property choices with their business models to optimize returns.

Comparison Table

| Investment Aspect | Dark Kitchen Real Estate | Retail Storefront |

|---|---|---|

| Initial Cost | Low to Moderate | High |

| Location Importance | Low (non-customer facing) | High (high foot traffic needed) |

| Operating Costs | Lower (no front-of-house staff) | Higher (rent, utilities, staff) |

| Revenue Potential | Growing demand due to food delivery trends | Stable with customer walk-ins |

| Customer Interaction | None (online orders only) | Direct interaction and experience |

| Scalability | High (easy to add kitchens in new areas) | Moderate (limited by storefront availability) |

| Market Risk | Dependent on delivery platform success | Susceptible to changing foot traffic trends |

| Flexibility | High (multiple brands from one kitchen) | Low (single brand per location) |

Which is better?

Dark kitchen real estate offers lower overhead costs and higher scalability compared to traditional retail storefronts, making it an attractive investment for food delivery-focused businesses. Retail storefronts provide the advantage of direct customer interaction and brand visibility, often resulting in higher foot traffic and impulse purchases. Investment decisions should weigh market demand, location dynamics, and operational objectives to optimize return on investment in either sector.

Connection

Dark kitchen real estate and retail storefront investments are interconnected through their shared reliance on strategic location and real estate optimization to maximize operational efficiency and customer access. Investors leverage dark kitchens' minimal physical footprint to reduce costs while retail storefronts focus on high-traffic areas to drive direct consumer sales, creating a complementary dynamic in urban commercial real estate portfolios. This synergy enhances diversified investment strategies by balancing low-overhead culinary operations with customer-facing retail assets.

Key Terms

Location Analysis

Retail storefront locations demand high foot traffic and visibility in commercial hubs to maximize customer engagement and sales potential. Dark kitchens prioritize proximity to dense residential areas and efficient delivery zones, optimizing for logistics and rapid order fulfillment rather than walk-in traffic. Explore in-depth strategies for location analysis to determine which real estate type aligns best with your business goals.

Lease Structure

Retail storefront leases typically involve long-term agreements with fixed base rent plus percentage rent based on sales, offering landlords steady income and tenants predictable costs. Dark kitchen leases often feature flexible, short-term contracts with lower base rents due to reduced foot traffic reliance, emphasizing shared utilities and maintenance expenses. Explore detailed lease structures to optimize real estate strategies for your food business.

Source and External Links

Baltimore City, MD Retail Space for Lease - PropertyShark - Browse over 100 retail storefront listings for lease in Baltimore City, including options for stores and other retail properties.

Baltimore City, MD Retail Space for Lease - Commercial Cafe - Offers a curated list of 66 retail spaces for lease in Baltimore, with detailed property specs like size, location, and availability for each listing.

Pop Up Shops For Rent in Baltimore, Md. - Storefront - Connects users with flexible, pop-up retail venues in Baltimore available for short-term rental, ideal for testing new concepts or products in unique, curated spaces.

dowidth.com

dowidth.com