Crowdlending platforms enable investors to directly lend money to businesses or individuals in exchange for interest payments, offering predictable returns and portfolio diversification beyond traditional stocks. Stock market investing, on the other hand, involves purchasing shares in publicly traded companies, providing opportunities for capital appreciation and dividend income but with higher volatility. Explore the advantages and risks of each investment option to determine the best fit for your financial goals.

Why it is important

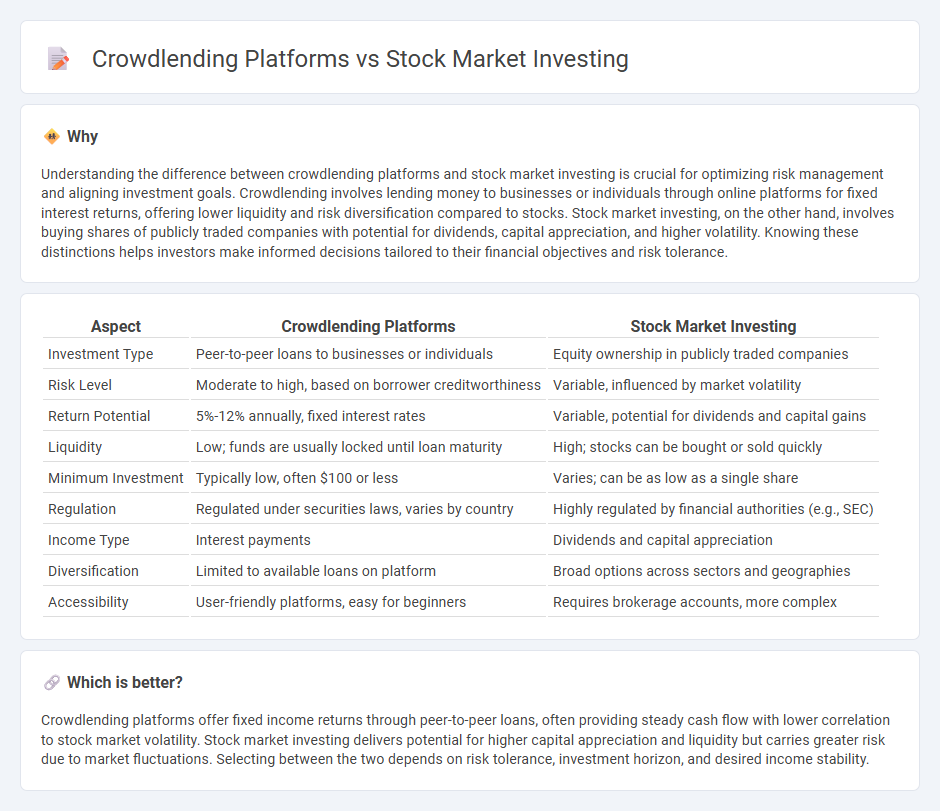

Understanding the difference between crowdlending platforms and stock market investing is crucial for optimizing risk management and aligning investment goals. Crowdlending involves lending money to businesses or individuals through online platforms for fixed interest returns, offering lower liquidity and risk diversification compared to stocks. Stock market investing, on the other hand, involves buying shares of publicly traded companies with potential for dividends, capital appreciation, and higher volatility. Knowing these distinctions helps investors make informed decisions tailored to their financial objectives and risk tolerance.

Comparison Table

| Aspect | Crowdlending Platforms | Stock Market Investing |

|---|---|---|

| Investment Type | Peer-to-peer loans to businesses or individuals | Equity ownership in publicly traded companies |

| Risk Level | Moderate to high, based on borrower creditworthiness | Variable, influenced by market volatility |

| Return Potential | 5%-12% annually, fixed interest rates | Variable, potential for dividends and capital gains |

| Liquidity | Low; funds are usually locked until loan maturity | High; stocks can be bought or sold quickly |

| Minimum Investment | Typically low, often $100 or less | Varies; can be as low as a single share |

| Regulation | Regulated under securities laws, varies by country | Highly regulated by financial authorities (e.g., SEC) |

| Income Type | Interest payments | Dividends and capital appreciation |

| Diversification | Limited to available loans on platform | Broad options across sectors and geographies |

| Accessibility | User-friendly platforms, easy for beginners | Requires brokerage accounts, more complex |

Which is better?

Crowdlending platforms offer fixed income returns through peer-to-peer loans, often providing steady cash flow with lower correlation to stock market volatility. Stock market investing delivers potential for higher capital appreciation and liquidity but carries greater risk due to market fluctuations. Selecting between the two depends on risk tolerance, investment horizon, and desired income stability.

Connection

Crowdlending platforms and stock market investing are connected through their roles as alternative investment channels that diversify portfolios while providing access to different asset classes. Crowdlending offers fixed income through loans to businesses or individuals, complementing stock market equity investments, which carry variable returns linked to company performance. Both platforms leverage online technology to increase investor accessibility, transparency, and liquidity in the financial ecosystem.

Key Terms

Equity

Equity investment in the stock market offers ownership in publicly traded companies with potential for capital appreciation and dividends, subject to market volatility and regulatory oversight. Crowdlending platforms allow investors to provide loans to businesses or projects, typically receiving fixed interest returns but with comparatively higher risk due to less liquidity and fewer protections. Explore detailed comparisons to understand which investment aligns best with your financial goals and risk tolerance.

Dividend

Stock market investing offers dividends as a share of company profits distributed to shareholders, often providing a steady income stream with potential for capital appreciation. Crowdlending platforms generate returns through interest payments on loans funded by investors, typically yielding higher but riskier income compared to traditional dividends. Explore how these investment methods compare in risk, return, and income stability to determine which aligns best with your financial goals.

Interest rate

Stock market investing offers variable returns influenced by market trends, while crowdlending platforms provide fixed interest rates typically ranging from 5% to 12%, offering predictable income streams. Crowdlending's interest rates often exceed traditional savings accounts, but carry higher credit risk depending on the platform's borrower vetting process. Explore detailed comparisons of risk, returns, and platform credibility to make informed investment decisions.

Source and External Links

Stocks - Stocks represent ownership shares in a company and can be purchased via direct stock plans, dividend reinvestment plans, brokers, or stock funds, each offering different ways to invest and trade.

How to Invest in Stocks: 2025 Beginner's Guide - Beginners can start investing by opening an online brokerage account with little money, buying fractional shares if needed, and diversifying between individual stocks and stock funds for balanced risk and reward.

Stock Investment Tips for Beginners - Using technical indicators such as moving averages helps investors spot trends, while applying quantitative analysis aids in assessing risk versus potential reward in stock investing.

dowidth.com

dowidth.com