Fractional farmland ownership offers investors partial equity in agricultural land, providing potential profit from land appreciation and crop yields without the need for full ownership. Land lease investments involve renting farmland to farmers or agribusinesses, generating steady income through lease payments with lower upfront capital requirements. Explore these strategies to determine the optimal approach for diversifying your agricultural investment portfolio.

Why it is important

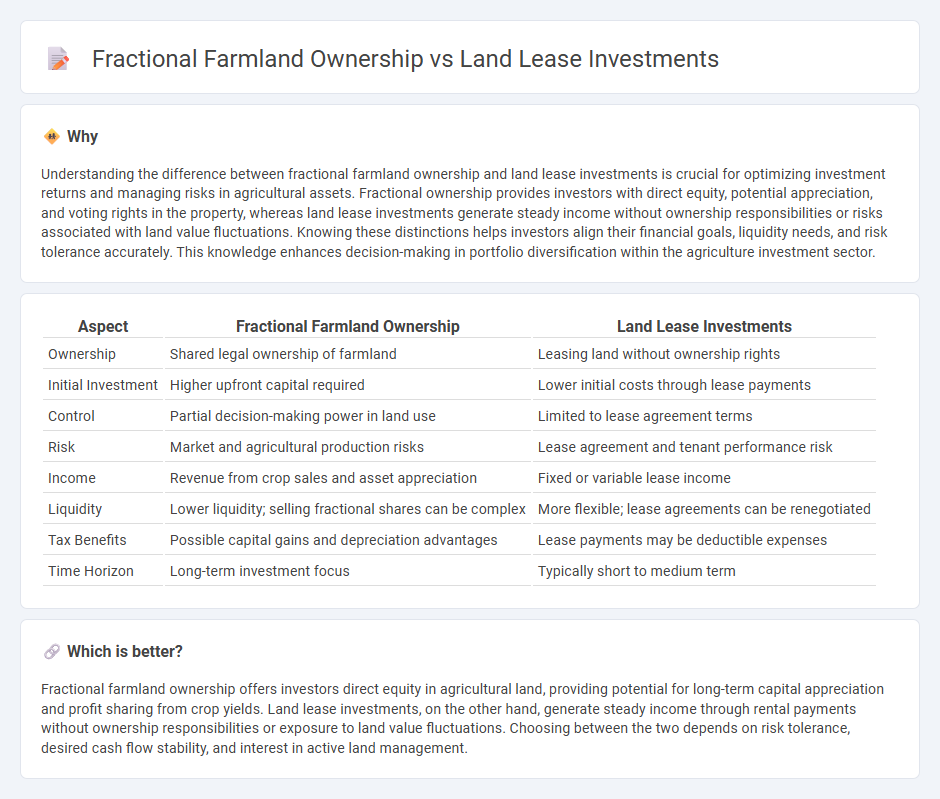

Understanding the difference between fractional farmland ownership and land lease investments is crucial for optimizing investment returns and managing risks in agricultural assets. Fractional ownership provides investors with direct equity, potential appreciation, and voting rights in the property, whereas land lease investments generate steady income without ownership responsibilities or risks associated with land value fluctuations. Knowing these distinctions helps investors align their financial goals, liquidity needs, and risk tolerance accurately. This knowledge enhances decision-making in portfolio diversification within the agriculture investment sector.

Comparison Table

| Aspect | Fractional Farmland Ownership | Land Lease Investments |

|---|---|---|

| Ownership | Shared legal ownership of farmland | Leasing land without ownership rights |

| Initial Investment | Higher upfront capital required | Lower initial costs through lease payments |

| Control | Partial decision-making power in land use | Limited to lease agreement terms |

| Risk | Market and agricultural production risks | Lease agreement and tenant performance risk |

| Income | Revenue from crop sales and asset appreciation | Fixed or variable lease income |

| Liquidity | Lower liquidity; selling fractional shares can be complex | More flexible; lease agreements can be renegotiated |

| Tax Benefits | Possible capital gains and depreciation advantages | Lease payments may be deductible expenses |

| Time Horizon | Long-term investment focus | Typically short to medium term |

Which is better?

Fractional farmland ownership offers investors direct equity in agricultural land, providing potential for long-term capital appreciation and profit sharing from crop yields. Land lease investments, on the other hand, generate steady income through rental payments without ownership responsibilities or exposure to land value fluctuations. Choosing between the two depends on risk tolerance, desired cash flow stability, and interest in active land management.

Connection

Fractional farmland ownership and land lease investments are interconnected as both provide scalable and diversified access to agricultural assets without requiring full property purchase. Fractional ownership allows multiple investors to share costs and risks, while land lease agreements generate steady income by leasing farmland to operators. This combination enhances capital efficiency and market entry flexibility for investors seeking exposure to agriculture.

Key Terms

Lease Agreement

Land lease investments provide fixed-term agreements allowing investors to generate steady rental income without ownership responsibilities, whereas fractional farmland ownership offers shared equity and potential appreciation in agricultural land value. Lease agreements in land leases typically specify rent, duration, and land use, minimizing investor risk but limiting profit potential compared to fractional ownership. Explore detailed comparisons of lease terms and ownership benefits to choose the best investment strategy in agricultural real estate.

Ownership Shares

Land lease investments offer temporary usage rights without equity, limiting long-term asset appreciation and control compared to fractional farmland ownership, which provides investors with actual ownership shares in agricultural property. Fractional ownership enables shared equity benefits, including asset appreciation, tax advantages, and decision-making input in farm management, enhancing investment value. Explore further to understand which ownership model aligns with your investment goals and risk tolerance.

Cash Flow Distribution

Land lease investments generate consistent cash flow through fixed rental payments from tenants, offering predictable income with minimal management involvement. Fractional farmland ownership provides potential for higher distributable cash flow tied to agricultural profits, but income can fluctuate based on crop yields and market prices. Explore detailed comparisons to determine which investment aligns with your cash flow goals.

Source and External Links

Pros & Cons of Investing in a Ground Lease - Caliber - Ground leases allow investors to own the land for long periods (50-99 years), giving tenants full development rights while providing landlords with long-term, predictable income and eventual building ownership if the lease expires or rent is unpaid.

Why Ground Lease REITs Are Building in Popularity - Kiplinger - Ground lease REITs are gaining traction as they offer property owners liquidity by allowing them to lease land beneath buildings, with developers gaining capital flexibility and investors receiving steady, increased lease payments over decades.

10 Benefits of Leasing Land in 2025 - Landgate - Leasing land streamlines operations, accelerates infrastructure development, and creates potential for passive income through subleasing, rental agreements, or renewable energy royalties, making it an efficient investment strategy.

dowidth.com

dowidth.com