Alternative data analytics leverages unconventional sources such as social media, satellite imagery, and transaction data to uncover unique investment insights beyond traditional financial metrics. Quantitative analysis relies on mathematical models and historical financial data to identify patterns and optimize portfolio decisions. Explore these methodologies to enhance your investment strategies with diverse, data-driven approaches.

Why it is important

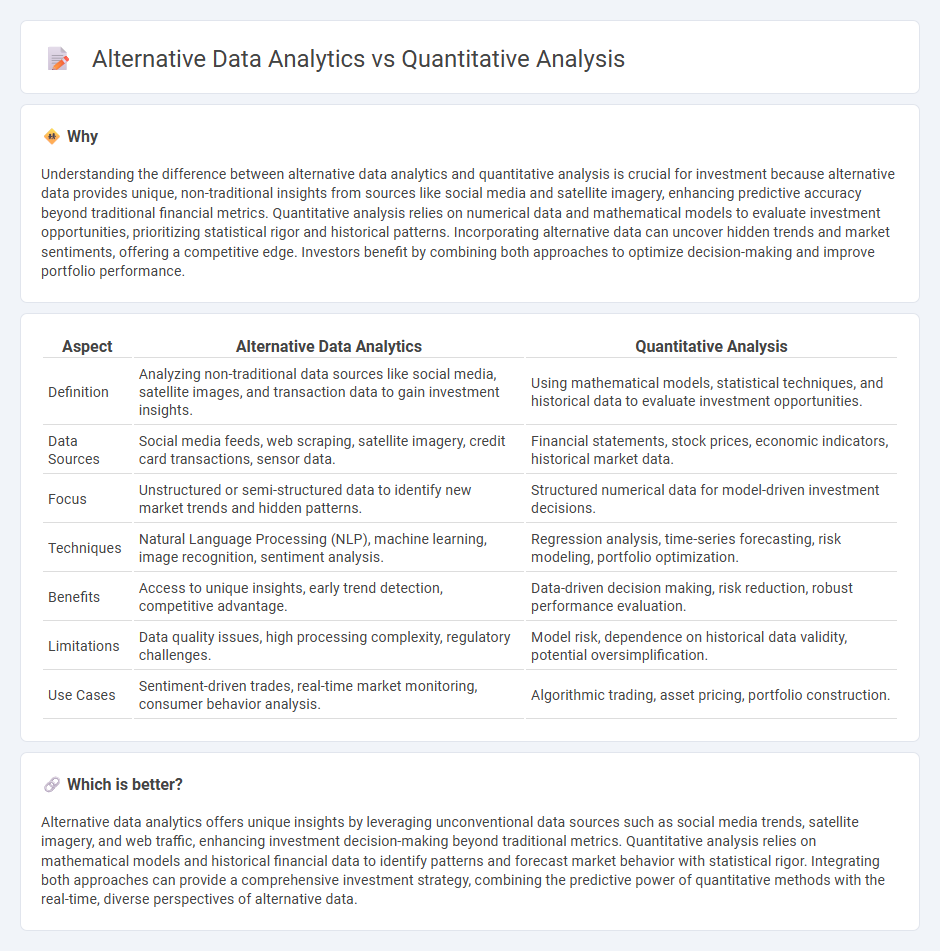

Understanding the difference between alternative data analytics and quantitative analysis is crucial for investment because alternative data provides unique, non-traditional insights from sources like social media and satellite imagery, enhancing predictive accuracy beyond traditional financial metrics. Quantitative analysis relies on numerical data and mathematical models to evaluate investment opportunities, prioritizing statistical rigor and historical patterns. Incorporating alternative data can uncover hidden trends and market sentiments, offering a competitive edge. Investors benefit by combining both approaches to optimize decision-making and improve portfolio performance.

Comparison Table

| Aspect | Alternative Data Analytics | Quantitative Analysis |

|---|---|---|

| Definition | Analyzing non-traditional data sources like social media, satellite images, and transaction data to gain investment insights. | Using mathematical models, statistical techniques, and historical data to evaluate investment opportunities. |

| Data Sources | Social media feeds, web scraping, satellite imagery, credit card transactions, sensor data. | Financial statements, stock prices, economic indicators, historical market data. |

| Focus | Unstructured or semi-structured data to identify new market trends and hidden patterns. | Structured numerical data for model-driven investment decisions. |

| Techniques | Natural Language Processing (NLP), machine learning, image recognition, sentiment analysis. | Regression analysis, time-series forecasting, risk modeling, portfolio optimization. |

| Benefits | Access to unique insights, early trend detection, competitive advantage. | Data-driven decision making, risk reduction, robust performance evaluation. |

| Limitations | Data quality issues, high processing complexity, regulatory challenges. | Model risk, dependence on historical data validity, potential oversimplification. |

| Use Cases | Sentiment-driven trades, real-time market monitoring, consumer behavior analysis. | Algorithmic trading, asset pricing, portfolio construction. |

Which is better?

Alternative data analytics offers unique insights by leveraging unconventional data sources such as social media trends, satellite imagery, and web traffic, enhancing investment decision-making beyond traditional metrics. Quantitative analysis relies on mathematical models and historical financial data to identify patterns and forecast market behavior with statistical rigor. Integrating both approaches can provide a comprehensive investment strategy, combining the predictive power of quantitative methods with the real-time, diverse perspectives of alternative data.

Connection

Alternative data analytics enhances quantitative analysis by providing non-traditional data sources such as social media trends, satellite imagery, and transaction records. Quantitative analysis applies statistical models and algorithms to this diverse data, identifying patterns and generating predictive insights for investment decisions. Integrating these methodologies optimizes portfolio management and risk assessment by uncovering hidden market signals beyond conventional financial data.

Key Terms

Statistical Modeling

Quantitative analysis employs traditional statistical modeling techniques such as regression analysis, time series forecasting, and hypothesis testing to interpret structured numerical data for decision-making. Alternative data analytics incorporates unconventional datasets like social media trends, geolocation data, and satellite imagery, enhancing predictive models with real-time insights beyond standard statistics. Explore deeper into how integrating alternative data transforms statistical modeling for comprehensive analytics solutions.

Machine Learning Algorithms

Quantitative analysis utilizes statistical and mathematical models to interpret structured numerical data, while alternative data analytics leverages unconventional datasets such as social media, satellite imagery, and sensor data to derive insights. Machine learning algorithms enhance both approaches by enabling predictive modeling, pattern recognition, and real-time decision-making, improving accuracy and scalability in data interpretation. Explore how integrating machine learning with diverse data sources transforms analytics in finance, marketing, and risk management.

Unstructured Data Sources

Quantitative analysis primarily relies on structured data sets such as numerical and categorical information, making it ideal for statistical modeling and trend identification. In contrast, alternative data analytics emphasizes unstructured data sources like social media posts, satellite images, and customer reviews, unlocking insights that traditional methods often overlook. Explore further to understand how integrating unstructured data can enhance predictive accuracy and decision-making.

Source and External Links

What Is Quantitative Analysis? Definition and Methods - Quantitative analysis is a process of collecting, evaluating, and assessing numerical data to understand patterns and predict outcomes for better decision-making.

Quantitative Analysis - Definition, Techniques and Applications - Quantitative analysis involves collecting measurable and verifiable data (like revenues and market share) to understand and improve business performance using methods such as regression analysis, linear programming, and data mining.

Quantitative analysis (finance) - In finance, quantitative analysis uses mathematical and statistical methods to find patterns in data, manage investment risks, and develop trading strategies.

dowidth.com

dowidth.com