Blue economy funds focus on sustainable investments in marine and aquatic resources, targeting industries such as fisheries, renewable ocean energy, and coastal tourism to promote environmental conservation and economic growth. Private equity funds invest in a broad array of sectors, acquiring equity stakes in private companies to drive expansion, operational improvements, and increased returns. Discover how these distinct investment approaches align with your financial goals and values by exploring their unique strategies and impacts.

Why it is important

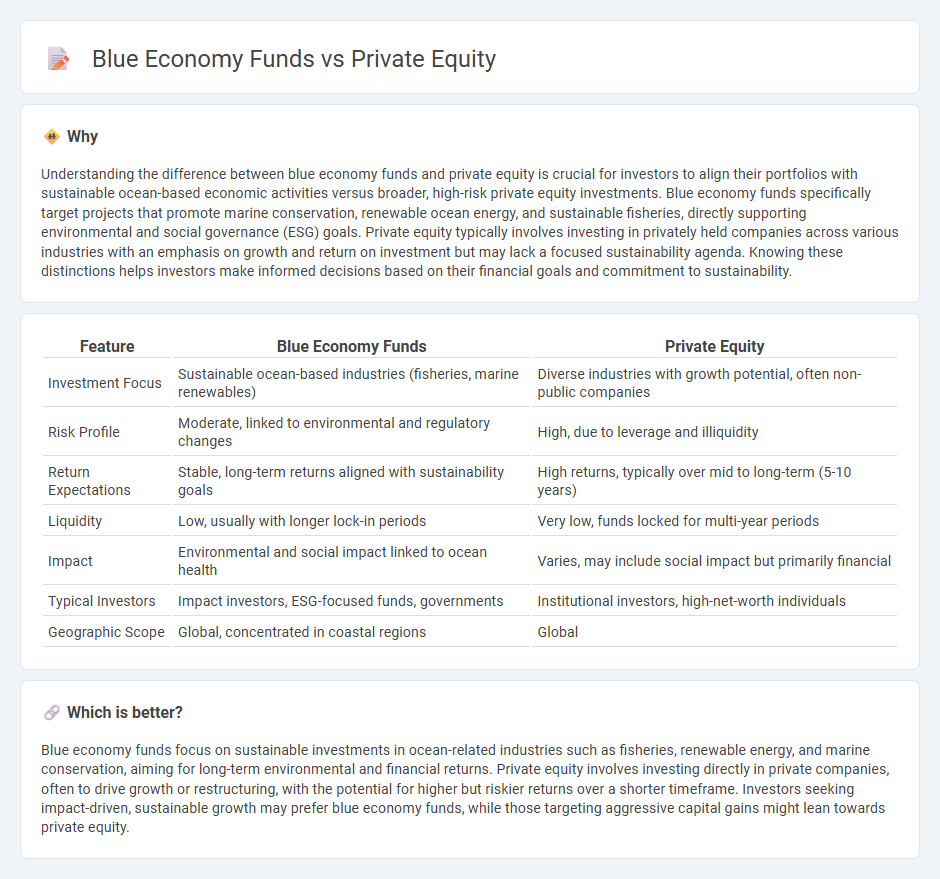

Understanding the difference between blue economy funds and private equity is crucial for investors to align their portfolios with sustainable ocean-based economic activities versus broader, high-risk private equity investments. Blue economy funds specifically target projects that promote marine conservation, renewable ocean energy, and sustainable fisheries, directly supporting environmental and social governance (ESG) goals. Private equity typically involves investing in privately held companies across various industries with an emphasis on growth and return on investment but may lack a focused sustainability agenda. Knowing these distinctions helps investors make informed decisions based on their financial goals and commitment to sustainability.

Comparison Table

| Feature | Blue Economy Funds | Private Equity |

|---|---|---|

| Investment Focus | Sustainable ocean-based industries (fisheries, marine renewables) | Diverse industries with growth potential, often non-public companies |

| Risk Profile | Moderate, linked to environmental and regulatory changes | High, due to leverage and illiquidity |

| Return Expectations | Stable, long-term returns aligned with sustainability goals | High returns, typically over mid to long-term (5-10 years) |

| Liquidity | Low, usually with longer lock-in periods | Very low, funds locked for multi-year periods |

| Impact | Environmental and social impact linked to ocean health | Varies, may include social impact but primarily financial |

| Typical Investors | Impact investors, ESG-focused funds, governments | Institutional investors, high-net-worth individuals |

| Geographic Scope | Global, concentrated in coastal regions | Global |

Which is better?

Blue economy funds focus on sustainable investments in ocean-related industries such as fisheries, renewable energy, and marine conservation, aiming for long-term environmental and financial returns. Private equity involves investing directly in private companies, often to drive growth or restructuring, with the potential for higher but riskier returns over a shorter timeframe. Investors seeking impact-driven, sustainable growth may prefer blue economy funds, while those targeting aggressive capital gains might lean towards private equity.

Connection

Blue economy funds target sustainable investments in ocean-related industries such as fisheries, renewable energy, and marine biotechnology, driving growth in sectors critical to environmental and economic resilience. Private equity provides essential capital and strategic management expertise to scale innovative blue economy ventures, enhancing operational efficiency and long-term profitability. Collaboration between blue economy funds and private equity accelerates sustainable development while generating competitive financial returns through responsible oceanic resource utilization.

Key Terms

Buyouts

Private equity buyouts target established companies with potential for operational improvement and value creation, often leveraging financial restructuring and strategic management to enhance returns. Blue economy funds focus on sustainable investments in marine and ocean-based industries, balancing profit with environmental and social impact by supporting companies committed to ocean conservation and responsible resource use. Explore the distinct strategies and performance metrics that differentiate private equity buyouts from blue economy funds to understand their market implications.

Sustainable fisheries

Private equity funds targeting sustainable fisheries prioritize scalable investments that drive profitability alongside environmental stewardship, leveraging advanced fishing technologies and supply chain optimization to enhance stock management and reduce ecological impact. Blue economy funds focus on holistic ocean-based growth, integrating sustainable fisheries with marine conservation, coastal community development, and renewable marine energy projects to create socio-economic value and biodiversity preservation. Explore how these investment models blend financial returns with ocean sustainability goals to revolutionize the fishing industry.

Impact investing

Private equity focuses on generating financial returns through investments in private companies, often emphasizing operational improvements and growth potential, while blue economy funds invest specifically in ocean and marine-based sectors to promote sustainable development and environmental conservation. Impact investing in private equity targets measurable social and environmental benefits alongside profits, whereas blue economy funds prioritize funding projects that foster ocean health, renewable energy, and sustainable fisheries. Explore how these investment approaches align with your impact goals and drive sustainable change in diverse sectors.

Source and External Links

What is Private Equity? - Private equity is medium to long-term finance provided in return for equity stakes in potentially high-growth, unquoted companies, involving active ownership where managers work closely with company leadership to drive sustainable growth and operational improvements over a typical holding period of 4-7 years.

Private equity - Private equity involves investment managers raising funds from institutional investors to buy equity stakes in private companies using equity and debt, aiming to generate returns via revenue growth, margin expansion, cash flow generation, and valuation multiple expansion within a 4-7 year horizon.

Private Equity: What You Need to Know - Private equity fund managers invest in companies not publicly traded, actively enhance company performance through management strengthening, operational improvements, strategy shaping, and capital structure optimization to generate returns for investors.

dowidth.com

dowidth.com