Investment in the space economy is rapidly growing, driven by advancements in satellite technology, space tourism, and extraterrestrial resource exploration, attracting billions in venture capital annually. Green energy investment focuses on renewable technologies such as solar, wind, and battery storage, aiming to reduce carbon emissions and promote sustainable development globally. Explore further to understand how these sectors compare in innovation potential, risk, and long-term returns.

Why it is important

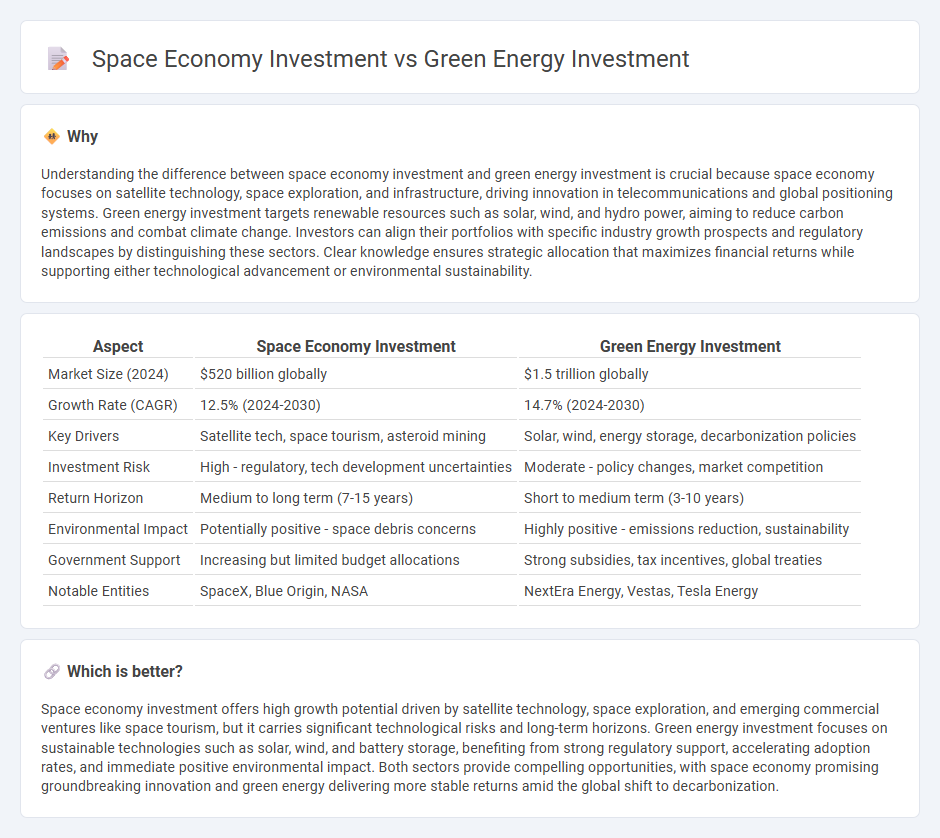

Understanding the difference between space economy investment and green energy investment is crucial because space economy focuses on satellite technology, space exploration, and infrastructure, driving innovation in telecommunications and global positioning systems. Green energy investment targets renewable resources such as solar, wind, and hydro power, aiming to reduce carbon emissions and combat climate change. Investors can align their portfolios with specific industry growth prospects and regulatory landscapes by distinguishing these sectors. Clear knowledge ensures strategic allocation that maximizes financial returns while supporting either technological advancement or environmental sustainability.

Comparison Table

| Aspect | Space Economy Investment | Green Energy Investment |

|---|---|---|

| Market Size (2024) | $520 billion globally | $1.5 trillion globally |

| Growth Rate (CAGR) | 12.5% (2024-2030) | 14.7% (2024-2030) |

| Key Drivers | Satellite tech, space tourism, asteroid mining | Solar, wind, energy storage, decarbonization policies |

| Investment Risk | High - regulatory, tech development uncertainties | Moderate - policy changes, market competition |

| Return Horizon | Medium to long term (7-15 years) | Short to medium term (3-10 years) |

| Environmental Impact | Potentially positive - space debris concerns | Highly positive - emissions reduction, sustainability |

| Government Support | Increasing but limited budget allocations | Strong subsidies, tax incentives, global treaties |

| Notable Entities | SpaceX, Blue Origin, NASA | NextEra Energy, Vestas, Tesla Energy |

Which is better?

Space economy investment offers high growth potential driven by satellite technology, space exploration, and emerging commercial ventures like space tourism, but it carries significant technological risks and long-term horizons. Green energy investment focuses on sustainable technologies such as solar, wind, and battery storage, benefiting from strong regulatory support, accelerating adoption rates, and immediate positive environmental impact. Both sectors provide compelling opportunities, with space economy promising groundbreaking innovation and green energy delivering more stable returns amid the global shift to decarbonization.

Connection

Investment in the space economy drives advancements in satellite technology, which enhances data collection for monitoring renewable energy sources and optimizing their efficiency. Green energy investment benefits from space-based solar power research and global climate data, enabling more precise forecasting and sustainable resource management. Both sectors attract increasing capital due to their potential for long-term environmental impact and technological innovation.

Key Terms

**Green Energy Investment:**

Green energy investment targets renewable resources such as solar, wind, and hydroelectric power, aiming to reduce carbon emissions and combat climate change. In 2023, global green energy investments reached over $500 billion, reflecting accelerating commitments from governments and private sectors toward sustainability. Explore more about how investing in green energy can drive economic growth and environmental stewardship.

Renewable Energy

Investing in renewable energy, particularly solar, wind, and bioenergy, drives significant growth in reducing carbon emissions and fostering sustainable development. The space economy, while innovative, currently allocates a smaller share of global investment budgets compared to the rapidly expanding green energy sector, which benefits from government incentives and increasing corporate commitments. Discover how renewable energy investment shapes the future of both environmental sustainability and economic growth.

Carbon Credits

Investing in green energy initiatives significantly contributes to reducing carbon footprints by generating renewable power and supporting carbon credit markets that incentivize emission reductions. The space economy, while emerging as a frontier for technological advancements and resource exploration, holds potential for carbon credit applications through satellite monitoring of environmental impacts and climate data accuracy. Explore how these sectors intersect to maximize sustainability efforts and financial returns via carbon credit strategies.

Source and External Links

Clean Energy Investment in Every State | Climate Central - Public and private investment in clean energy in the U.S. has more than tripled from 2018 to 2023, totaling nearly $248 billion annually, with leading investments in zero-emission vehicles, wind power, and heat pumps across various regions.

Overview and key findings - World Energy Investment 2024 - IEA - Global energy investment is set to exceed $3 trillion in 2024, with $2 trillion directed toward clean energy technologies and infrastructure, reflecting accelerated spending on renewable power, grids, and storage surpassing fossil fuels spending.

Investing in Renewable Energy Transition | Morgan Stanley - The falling costs of solar and wind energy production alongside rising demand highlight significant long-term investment opportunities linked to the global decarbonization and clean energy transition.

dowidth.com

dowidth.com