Sports team ownership shares offer investors a unique chance to be part of high-profile franchises with potential for significant capital appreciation and revenue from merchandising, media rights, and ticket sales. Art investment funds provide diversified exposure to the art market, allowing investors to benefit from the appreciation of curated collections managed by experts without the need for individual art expertise. Explore more to understand which investment aligns best with your financial goals and risk tolerance.

Why it is important

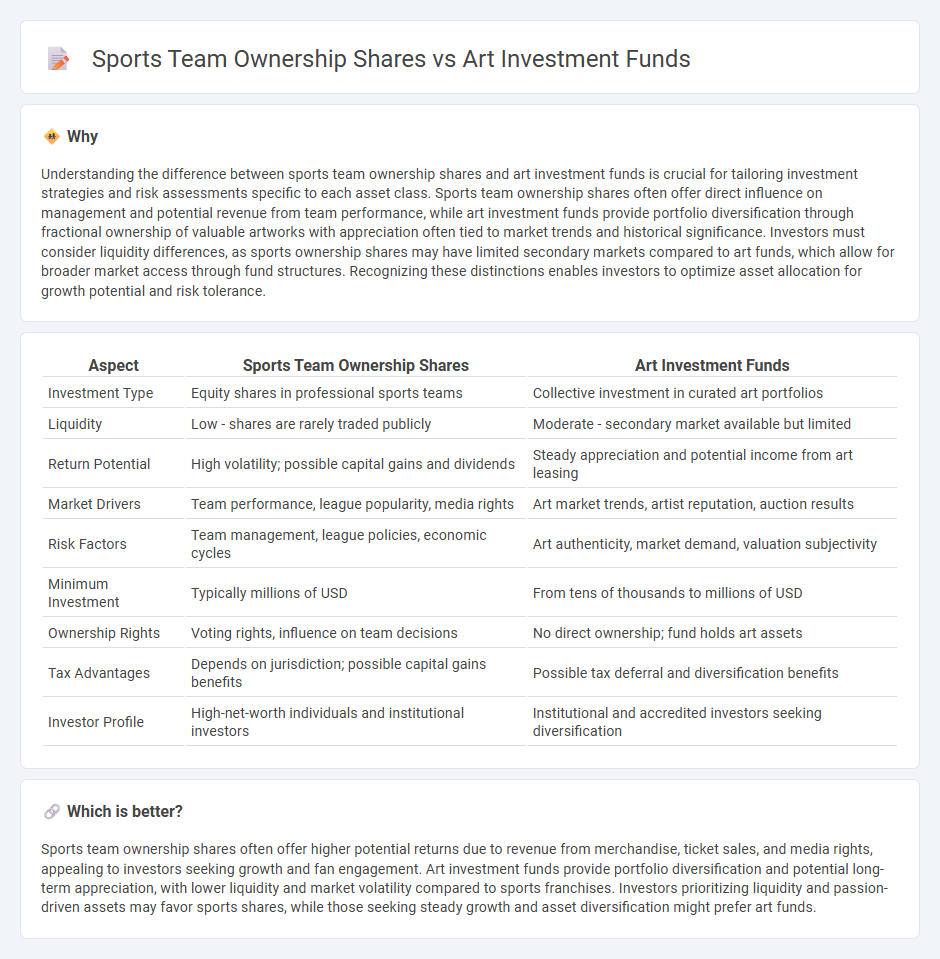

Understanding the difference between sports team ownership shares and art investment funds is crucial for tailoring investment strategies and risk assessments specific to each asset class. Sports team ownership shares often offer direct influence on management and potential revenue from team performance, while art investment funds provide portfolio diversification through fractional ownership of valuable artworks with appreciation often tied to market trends and historical significance. Investors must consider liquidity differences, as sports ownership shares may have limited secondary markets compared to art funds, which allow for broader market access through fund structures. Recognizing these distinctions enables investors to optimize asset allocation for growth potential and risk tolerance.

Comparison Table

| Aspect | Sports Team Ownership Shares | Art Investment Funds |

|---|---|---|

| Investment Type | Equity shares in professional sports teams | Collective investment in curated art portfolios |

| Liquidity | Low - shares are rarely traded publicly | Moderate - secondary market available but limited |

| Return Potential | High volatility; possible capital gains and dividends | Steady appreciation and potential income from art leasing |

| Market Drivers | Team performance, league popularity, media rights | Art market trends, artist reputation, auction results |

| Risk Factors | Team management, league policies, economic cycles | Art authenticity, market demand, valuation subjectivity |

| Minimum Investment | Typically millions of USD | From tens of thousands to millions of USD |

| Ownership Rights | Voting rights, influence on team decisions | No direct ownership; fund holds art assets |

| Tax Advantages | Depends on jurisdiction; possible capital gains benefits | Possible tax deferral and diversification benefits |

| Investor Profile | High-net-worth individuals and institutional investors | Institutional and accredited investors seeking diversification |

Which is better?

Sports team ownership shares often offer higher potential returns due to revenue from merchandise, ticket sales, and media rights, appealing to investors seeking growth and fan engagement. Art investment funds provide portfolio diversification and potential long-term appreciation, with lower liquidity and market volatility compared to sports franchises. Investors prioritizing liquidity and passion-driven assets may favor sports shares, while those seeking steady growth and asset diversification might prefer art funds.

Connection

Sports team ownership shares and art investment funds both represent alternative asset classes that attract high-net-worth investors seeking portfolio diversification. These investments leverage the potential for value appreciation driven by market demand, exclusivity, and cultural significance. Both asset types benefit from fractional ownership structures, enabling liquidity and broader investor access to traditionally illiquid markets.

Key Terms

**Art investment funds:**

Art investment funds pool capital to acquire valuable artworks, diversifying risk across multiple pieces and artists while leveraging expert curatorship to maximize returns. These funds often offer fractional ownership and can provide liquidity through secondary markets, contrasting with the typically less liquid and higher-risk nature of sports team ownership shares. Explore how art investment funds can enhance portfolio diversification and long-term wealth growth today.

Art valuation

Art investment funds pool capital to acquire diversified artworks, leveraging expert appraisals and market trends to optimize asset valuation. Unlike sports team ownership shares that fluctuate based on team performance and league dynamics, art valuations depend on provenance, artist reputation, and rarity. Explore the nuances of art valuation and investment strategies for a deeper understanding.

Provenance

Art investment funds offer traceable provenance through detailed historical ownership records and expert valuations, ensuring authenticity and reducing fraud risks. In contrast, sports team ownership shares derive value more from market dynamics, fan base loyalty, and revenue streams rather than provenance data. Discover how provenance impacts investment security and value in these sectors by exploring their unique attributes further.

Source and External Links

Basics of Art Funds and their Managers - Art investment funds are privately offered investment funds focusing on returns through buying and selling art, using various strategies like geographic arbitrage, investing in emerging artists, or leveraging their art holdings.

Art Investment Opportunities: A Guide to Traditional and ... - Art funds pool resources from multiple investors to professionally manage collections, letting investors benefit from the art market growth without owning individual pieces.

Strategic or speculative? Once again, art investment funds are on the rise - Art funds like Arte Collectum are expanding, focusing on acquiring undervalued artists to combine financial upside with cultural impact, supported by experts with museum backgrounds.

dowidth.com

dowidth.com