Music royalties offer a unique investment opportunity with potential for steady, inflation-resistant income derived from intellectual property rights, contrasting with gold's status as a tangible asset and traditional store of value against market volatility. While gold prices fluctuate based on market demand, currency strength, and geopolitical stability, music royalties generate continuous cash flow through licensing, streaming, and performance fees. Explore the distinctive benefits and risks of investing in music royalties versus gold to diversify and strengthen your portfolio.

Why it is important

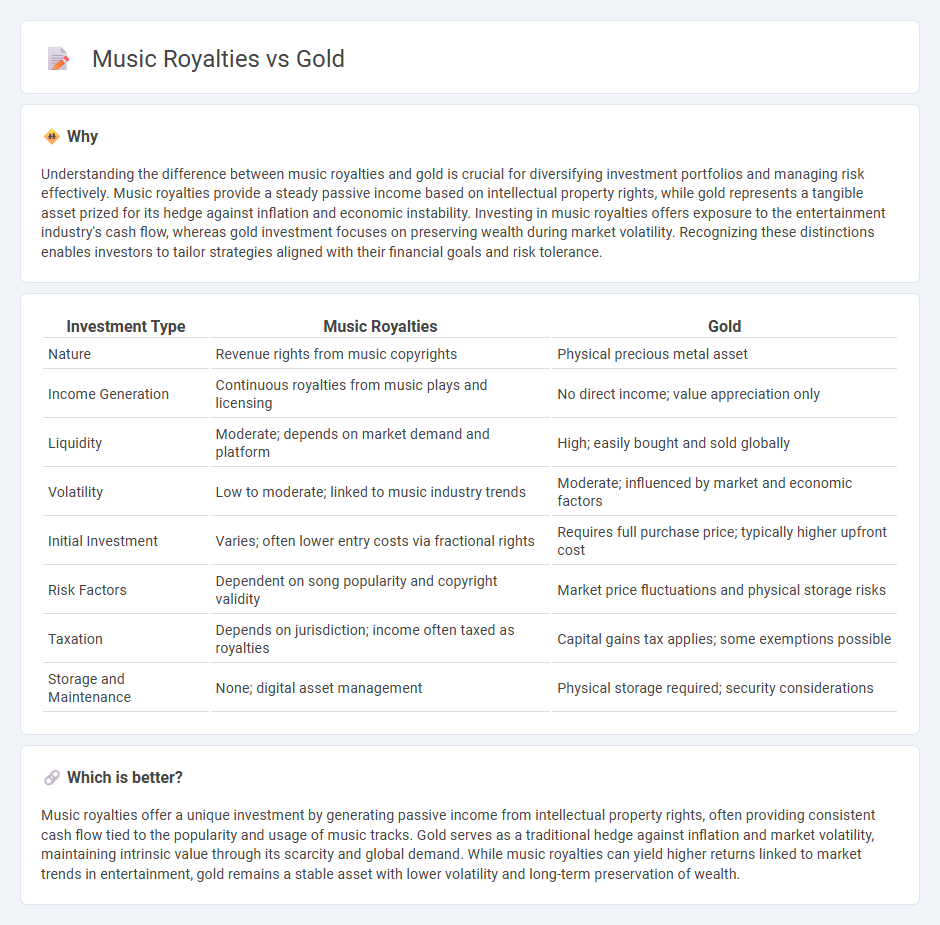

Understanding the difference between music royalties and gold is crucial for diversifying investment portfolios and managing risk effectively. Music royalties provide a steady passive income based on intellectual property rights, while gold represents a tangible asset prized for its hedge against inflation and economic instability. Investing in music royalties offers exposure to the entertainment industry's cash flow, whereas gold investment focuses on preserving wealth during market volatility. Recognizing these distinctions enables investors to tailor strategies aligned with their financial goals and risk tolerance.

Comparison Table

| Investment Type | Music Royalties | Gold |

|---|---|---|

| Nature | Revenue rights from music copyrights | Physical precious metal asset |

| Income Generation | Continuous royalties from music plays and licensing | No direct income; value appreciation only |

| Liquidity | Moderate; depends on market demand and platform | High; easily bought and sold globally |

| Volatility | Low to moderate; linked to music industry trends | Moderate; influenced by market and economic factors |

| Initial Investment | Varies; often lower entry costs via fractional rights | Requires full purchase price; typically higher upfront cost |

| Risk Factors | Dependent on song popularity and copyright validity | Market price fluctuations and physical storage risks |

| Taxation | Depends on jurisdiction; income often taxed as royalties | Capital gains tax applies; some exemptions possible |

| Storage and Maintenance | None; digital asset management | Physical storage required; security considerations |

Which is better?

Music royalties offer a unique investment by generating passive income from intellectual property rights, often providing consistent cash flow tied to the popularity and usage of music tracks. Gold serves as a traditional hedge against inflation and market volatility, maintaining intrinsic value through its scarcity and global demand. While music royalties can yield higher returns linked to market trends in entertainment, gold remains a stable asset with lower volatility and long-term preservation of wealth.

Connection

Music royalties and gold share intrinsic value as alternative investment assets, offering diversification and protection against inflation. Both generate steady income streams or tangible wealth, with music royalties providing ongoing royalties from intellectual property and gold serving as a physical store of value. Investors often include these assets in portfolios to hedge against market volatility and enhance long-term financial stability.

Key Terms

Asset Class

Gold serves as a tangible asset class with intrinsic value, often sought for its stability and inflation hedge properties. Music royalties represent an alternative asset class that generates consistent cash flow through intellectual property rights and licensing revenue. Explore the dynamics between these asset classes to enhance your diversified investment strategy.

Liquidity

Gold offers tangible asset value with high liquidity through global markets and easy conversion into cash, making it a reliable store of wealth. Music royalties provide steady, passive income streams derived from copyright ownership, but liquidity can be limited due to complex rights transfers and valuation challenges. Explore the nuances of liquidity differences between gold investments and music royalties to optimize your portfolio strategy.

Income Generation

Gold serves as a tangible asset with inherent value, often used for wealth preservation and long-term financial security. Music royalties provide a steady income stream derived from intellectual property rights, offering potential for recurring revenue through licensing, streaming, and public performances. Explore how diversifying your portfolio with both gold and music royalties can optimize income generation strategies.

Source and External Links

Gold Price Today | Gold Spot Price Charts - APMEX - Gold reached an all-time high of $3,500.20 per troy ounce on April 22, 2025, driven by economic uncertainty, low interest rates, a weakening U.S. dollar, and increased demand for safe-haven assets.

Gold - Price - Chart - Historical Data - News - Trading Economics - As of July 21, 2025, gold rose to $3,357.78 per troy ounce, remaining about 40% higher than a year ago, with expectations it could reach $3,546.72 within 12 months.

Gold Price Today - Live Gold Spot Price Charts - JM Bullion - Factors influencing gold prices include supply and demand, US dollar strength, economic stability, inflation, interest rates, geopolitical risks, and central bank activities; typically, gold price rises with inflation and geopolitical uncertainty but falls with stronger economic stability and higher interest rates.

dowidth.com

dowidth.com