Collectible sneakers have emerged as a unique asset class, offering potential high returns through limited editions and cultural trends, contrasting sharply with private equity's longer-term investment approach in established businesses. While sneaker investments require understanding market demand and authenticity, private equity focuses on strategic management and financial restructuring to maximize value. Explore deeper insights into how each investment type suits different portfolios and risk appetites.

Why it is important

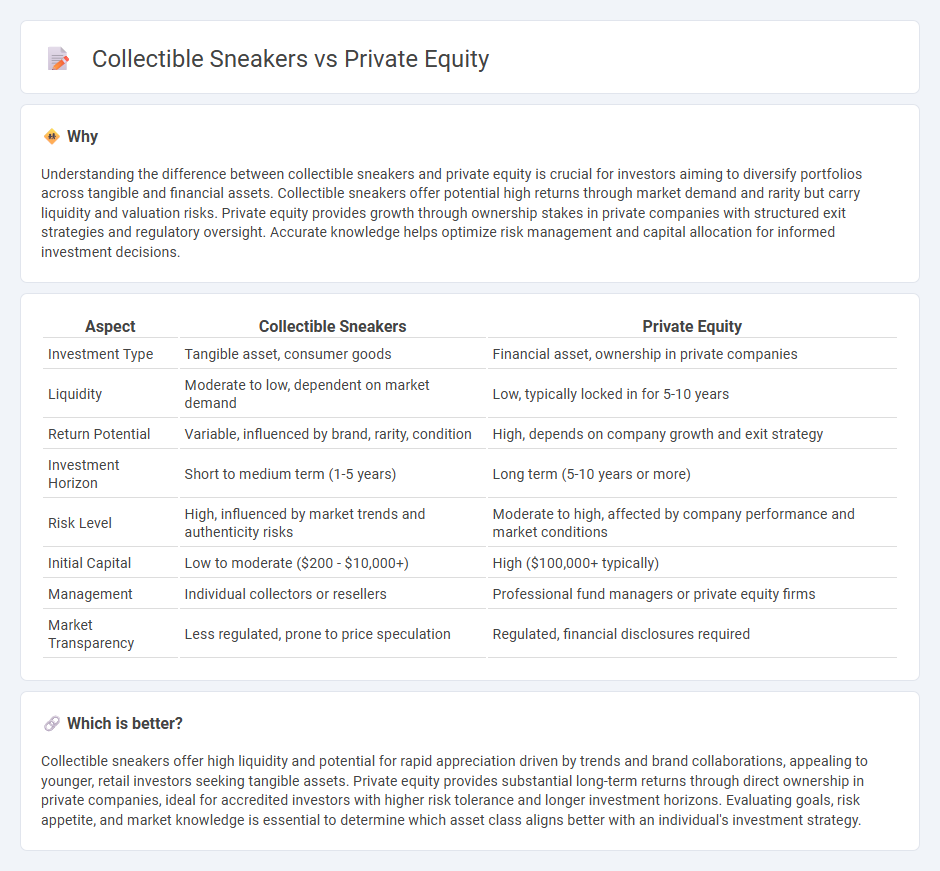

Understanding the difference between collectible sneakers and private equity is crucial for investors aiming to diversify portfolios across tangible and financial assets. Collectible sneakers offer potential high returns through market demand and rarity but carry liquidity and valuation risks. Private equity provides growth through ownership stakes in private companies with structured exit strategies and regulatory oversight. Accurate knowledge helps optimize risk management and capital allocation for informed investment decisions.

Comparison Table

| Aspect | Collectible Sneakers | Private Equity |

|---|---|---|

| Investment Type | Tangible asset, consumer goods | Financial asset, ownership in private companies |

| Liquidity | Moderate to low, dependent on market demand | Low, typically locked in for 5-10 years |

| Return Potential | Variable, influenced by brand, rarity, condition | High, depends on company growth and exit strategy |

| Investment Horizon | Short to medium term (1-5 years) | Long term (5-10 years or more) |

| Risk Level | High, influenced by market trends and authenticity risks | Moderate to high, affected by company performance and market conditions |

| Initial Capital | Low to moderate ($200 - $10,000+) | High ($100,000+ typically) |

| Management | Individual collectors or resellers | Professional fund managers or private equity firms |

| Market Transparency | Less regulated, prone to price speculation | Regulated, financial disclosures required |

Which is better?

Collectible sneakers offer high liquidity and potential for rapid appreciation driven by trends and brand collaborations, appealing to younger, retail investors seeking tangible assets. Private equity provides substantial long-term returns through direct ownership in private companies, ideal for accredited investors with higher risk tolerance and longer investment horizons. Evaluating goals, risk appetite, and market knowledge is essential to determine which asset class aligns better with an individual's investment strategy.

Connection

Collectible sneakers have emerged as high-value alternative assets within private equity portfolios, driven by soaring demand and limited supply in the resale market. Private equity firms capitalize on this trend by investing in sneaker-focused startups, marketplaces, and authentication technologies to enhance transactional security and market liquidity. Leveraging data analytics and brand partnerships, these firms unlock significant returns through strategic scaling and market consolidation in the sneaker investment sector.

Key Terms

Liquidity

Private equity investments typically offer lower liquidity due to lengthy lock-up periods ranging from 7 to 10 years, whereas collectible sneakers provide higher liquidity with the ability to sell through various online marketplaces quickly. The secondary market for sneakers has grown exponentially, benefiting from trends, limited releases, and sneaker culture, making it easier for collectors to convert assets into cash. Explore the detailed dynamics of liquidity in private equity and sneaker investments to optimize your portfolio strategy.

Valuation

Private equity valuation relies on financial metrics such as EBITDA multiples, discounted cash flow models, and comparable company analysis to determine intrinsic business value. Collectible sneakers valuation depends on rarity, historical significance, brand collaborations, market demand, and condition, often driven by auction results and resale platforms like StockX and GOAT. Explore the nuanced valuation methodologies to better understand investment potential in both asset classes.

Due diligence

Due diligence in private equity involves in-depth financial analysis, market evaluation, and risk assessment to ensure investment viability and maximize returns. When evaluating collectible sneakers, due diligence requires authenticating the sneakers' provenance, assessing market trends, and verifying condition to determine rarity and value. Explore more insights on due diligence strategies across investment types.

Source and External Links

Private equity - Wikipedia - Private equity involves investment managers raising capital from institutional investors to buy equity stakes in companies, using strategies like revenue growth and margin expansion to generate returns over 4-7 years.

What is Private Equity? - BVCA - Private equity is medium to long-term finance provided for equity stakes in mature companies, focusing on active ownership and close collaboration with management to enhance growth and value before exiting in 4-7 years.

Private Equity: What You Need to Know - KKR - Private equity fund managers invest in non-public companies, aiming to improve performance through strategic management, operational improvements, and capital structure optimization to generate strong returns and diversification benefits.

dowidth.com

dowidth.com