Digital real estate offers investors virtual properties within online platforms, providing scalable opportunities with lower entry costs compared to physical assets. Collectibles, such as rare art or vintage items, hold intrinsic value driven by rarity and cultural significance, often appealing to niche markets. Explore the unique benefits and risks associated with digital real estate and collectibles to refine your investment strategy.

Why it is important

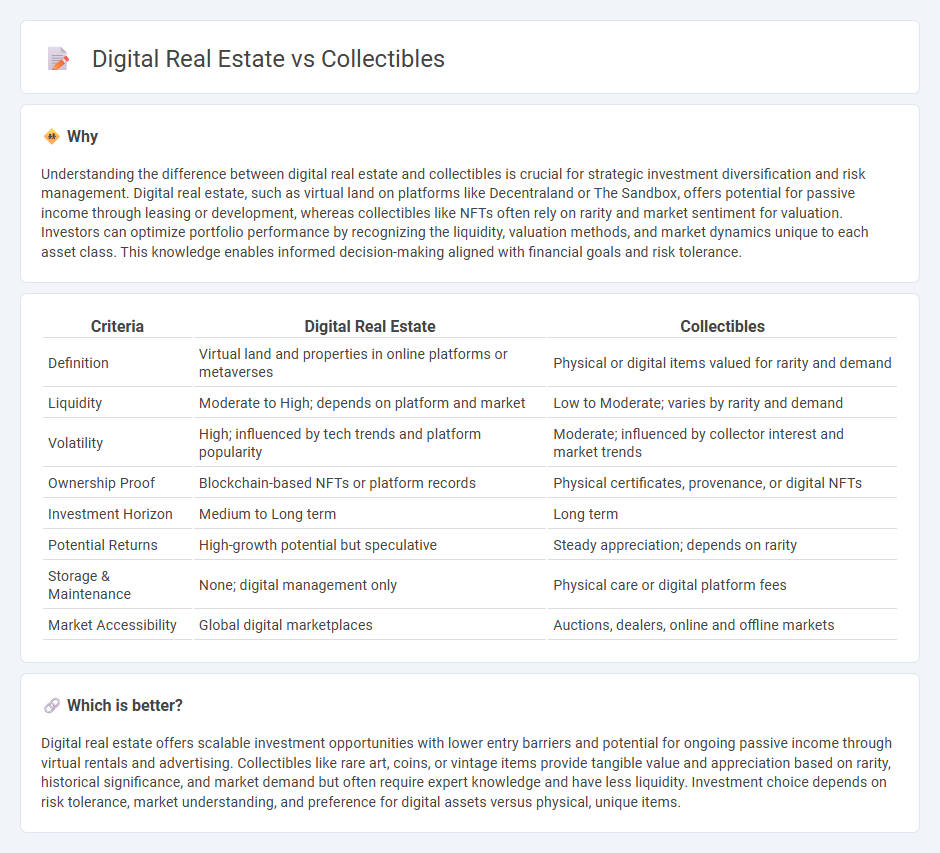

Understanding the difference between digital real estate and collectibles is crucial for strategic investment diversification and risk management. Digital real estate, such as virtual land on platforms like Decentraland or The Sandbox, offers potential for passive income through leasing or development, whereas collectibles like NFTs often rely on rarity and market sentiment for valuation. Investors can optimize portfolio performance by recognizing the liquidity, valuation methods, and market dynamics unique to each asset class. This knowledge enables informed decision-making aligned with financial goals and risk tolerance.

Comparison Table

| Criteria | Digital Real Estate | Collectibles |

|---|---|---|

| Definition | Virtual land and properties in online platforms or metaverses | Physical or digital items valued for rarity and demand |

| Liquidity | Moderate to High; depends on platform and market | Low to Moderate; varies by rarity and demand |

| Volatility | High; influenced by tech trends and platform popularity | Moderate; influenced by collector interest and market trends |

| Ownership Proof | Blockchain-based NFTs or platform records | Physical certificates, provenance, or digital NFTs |

| Investment Horizon | Medium to Long term | Long term |

| Potential Returns | High-growth potential but speculative | Steady appreciation; depends on rarity |

| Storage & Maintenance | None; digital management only | Physical care or digital platform fees |

| Market Accessibility | Global digital marketplaces | Auctions, dealers, online and offline markets |

Which is better?

Digital real estate offers scalable investment opportunities with lower entry barriers and potential for ongoing passive income through virtual rentals and advertising. Collectibles like rare art, coins, or vintage items provide tangible value and appreciation based on rarity, historical significance, and market demand but often require expert knowledge and have less liquidity. Investment choice depends on risk tolerance, market understanding, and preference for digital assets versus physical, unique items.

Connection

Digital real estate and collectibles are interconnected as emerging asset classes within the blockchain ecosystem, both leveraging non-fungible tokens (NFTs) to establish verifiable ownership and scarcity. Virtual land parcels in metaverses correspond with digital collectibles, creating immersive investment opportunities driven by user engagement and platform growth. Their value is influenced by market demand, rarity, and the expanding digital economy, attracting diversified portfolios and speculative investments.

Key Terms

Tangibility

Collectibles offer tangible, physical assets that can be held, displayed, and enjoyed in the real world, enhancing their emotional and sensory value. Digital real estate exists exclusively online, providing virtual ownership and presence in metaverse platforms without physical form or sensory experience. Explore the unique benefits and challenges of both tangible and digital investments to make informed choices.

Scarcity

Collectibles derive value primarily from their scarcity, with limited editions or unique items driving demand in markets such as rare coins, art, and trading cards. Digital real estate scarcity is created through finite virtual land parcels within metaverses, where location and size significantly influence value. Explore how scarcity principles shape investment potential in both collectibles and digital real estate for deeper insights.

Liquidity

Collectibles often face liquidity challenges due to their niche markets and the need for physical inspection before purchase, resulting in slower transaction times. Digital real estate benefits from enhanced liquidity through blockchain technology and established marketplaces that facilitate faster, transparent exchanges. Explore the evolving landscape of liquidity between collectibles and digital real estate to make informed investment decisions.

Source and External Links

Collectibles.com - Scan, identify and value all collectibles - A comprehensive platform for enthusiasts to scan, value, and organize collections across numerous categories such as sports cards, stamps, coins, comics, dolls, trading cards, and more.

Collectibles - Walmart.com - Online store offering a wide variety of collectibles including new releases, exclusives, action figures, coins, and collectibles from popular franchises like Star Wars, Marvel, DC, and Pokemon.

Collectibles | Home Decor - Features elegant and charming collectible items including fine plush toys, Limoges boxes, and crystal pieces from vendors like Baccarat and Steiff.

dowidth.com

dowidth.com