Psychedelic stocks represent a high-growth investment sector driven by emerging research and increasing legalization of mental health treatments, offering potential for substantial returns but with considerable volatility. In contrast, value stocks are established companies trading below their intrinsic value, providing more stability and consistent dividends, appealing to risk-averse investors. Explore the distinct risk profiles and market dynamics of psychedelic and value stocks to optimize your investment strategy.

Why it is important

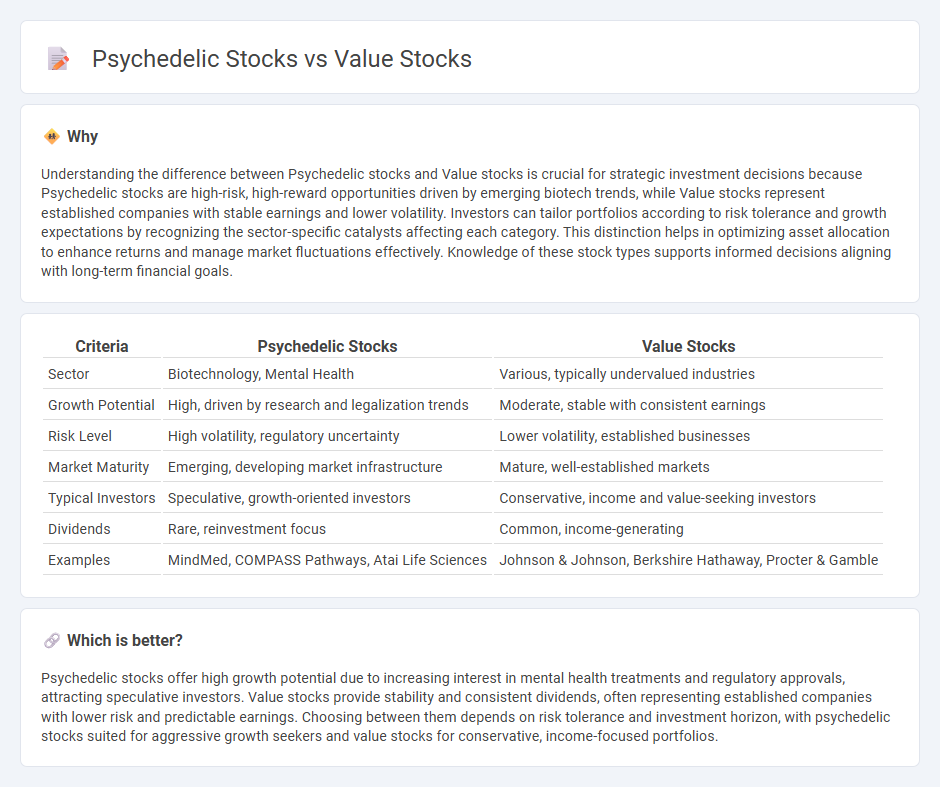

Understanding the difference between Psychedelic stocks and Value stocks is crucial for strategic investment decisions because Psychedelic stocks are high-risk, high-reward opportunities driven by emerging biotech trends, while Value stocks represent established companies with stable earnings and lower volatility. Investors can tailor portfolios according to risk tolerance and growth expectations by recognizing the sector-specific catalysts affecting each category. This distinction helps in optimizing asset allocation to enhance returns and manage market fluctuations effectively. Knowledge of these stock types supports informed decisions aligning with long-term financial goals.

Comparison Table

| Criteria | Psychedelic Stocks | Value Stocks |

|---|---|---|

| Sector | Biotechnology, Mental Health | Various, typically undervalued industries |

| Growth Potential | High, driven by research and legalization trends | Moderate, stable with consistent earnings |

| Risk Level | High volatility, regulatory uncertainty | Lower volatility, established businesses |

| Market Maturity | Emerging, developing market infrastructure | Mature, well-established markets |

| Typical Investors | Speculative, growth-oriented investors | Conservative, income and value-seeking investors |

| Dividends | Rare, reinvestment focus | Common, income-generating |

| Examples | MindMed, COMPASS Pathways, Atai Life Sciences | Johnson & Johnson, Berkshire Hathaway, Procter & Gamble |

Which is better?

Psychedelic stocks offer high growth potential due to increasing interest in mental health treatments and regulatory approvals, attracting speculative investors. Value stocks provide stability and consistent dividends, often representing established companies with lower risk and predictable earnings. Choosing between them depends on risk tolerance and investment horizon, with psychedelic stocks suited for aggressive growth seekers and value stocks for conservative, income-focused portfolios.

Connection

Psychedelic stocks and value stocks intersect through the increasing recognition of mental health industries as viable long-term investments, driven by emerging research and regulatory shifts supporting psychedelic therapies. Both sectors attract investors seeking growth potential; psychedelic stocks offer innovation-led returns, while value stocks provide stability with established market presence and financial metrics. This connection underscores a broader investment strategy that balances high-growth disruptive sectors with traditional undervalued assets.

Key Terms

Valuation

Value stocks typically trade at lower price-to-earnings (P/E) ratios, reflecting their focus on stable earnings and dividend yields, making them attractive for risk-averse investors. Psychedelic stocks, often early-stage and speculative, have high volatility with valuations driven by potential breakthroughs in mental health treatments rather than current earnings. Explore detailed comparisons to understand how valuation metrics impact investment strategies in these contrasting sectors.

Volatility

Value stocks typically exhibit lower volatility due to their stable earnings, solid fundamentals, and established market presence, making them attractive for conservative investors. Psychedelic stocks, driven by emerging research, regulatory changes, and speculative interest, often experience higher volatility with rapid price fluctuations. Explore the distinct risk-reward profiles of these sectors to understand investment opportunities better.

Growth Potential

Value stocks typically offer stable returns with established market presence, providing consistent dividends and lower volatility. Psychedelic stocks, driven by emerging medical research and legalization trends, present higher growth potential but come with increased risk and market uncertainty. Explore the dynamic landscape of these investment opportunities to make informed portfolio decisions.

Source and External Links

Value stocks: what they are and why you should care - Saxo Bank - Value stocks are shares of companies trading below their intrinsic value based on fundamentals like earnings or sales, and classic examples include Berkshire Hathaway, Volkswagen, Johnson & Johnson, and TotalEnergies.

Value Stock Investments: Build a Durable Portfolio | Charles Schwab - Value stocks are typically priced below their intrinsic value, offering the potential for price appreciation as the market corrects over time, while also potentially reducing portfolio drawdowns compared to overpriced stocks.

The 10 Best Companies to Invest in Now | Morningstar - Morningstar highlights undervalued stocks such as Constellation Brands and GSK, which currently trade significantly below their estimated fair value, indicating strong potential for value investors.

dowidth.com

dowidth.com