Fractional real estate offers investors the opportunity to own a portion of a property, providing diversified exposure with lower capital requirements compared to traditional real estate investments. Private equity real estate involves pooled capital from accredited investors to acquire, manage, and sell properties, often focusing on higher returns through active asset management. Explore the differences and benefits of these investment strategies to determine which aligns best with your financial goals.

Why it is important

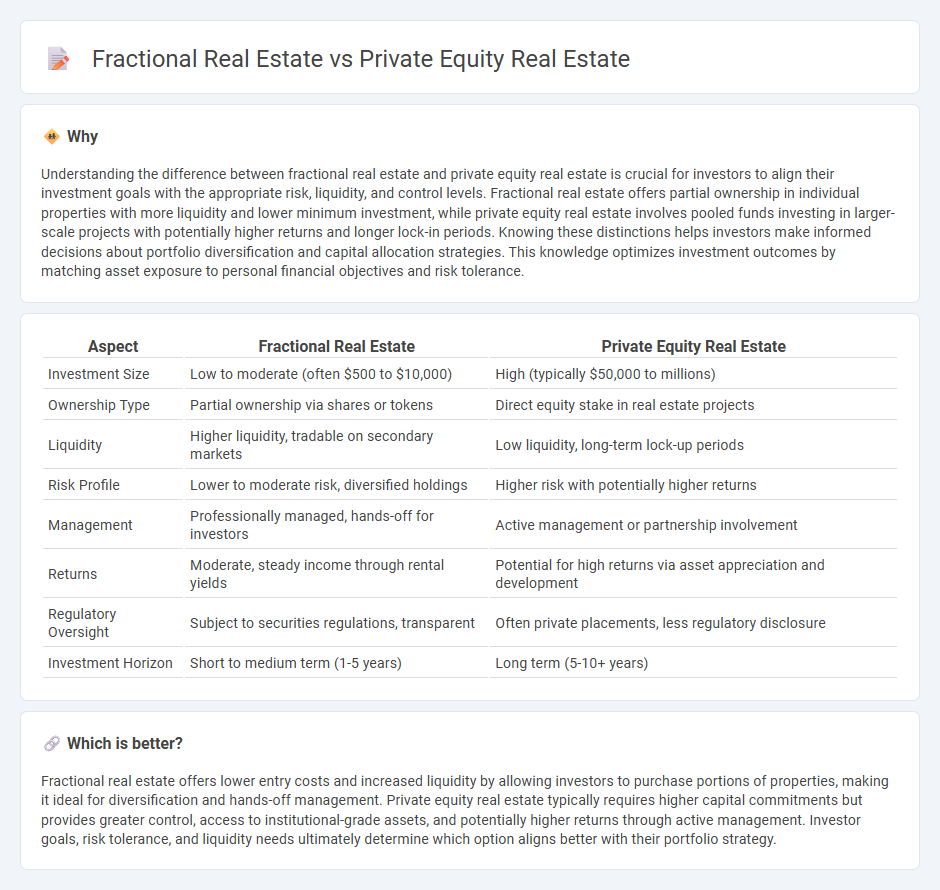

Understanding the difference between fractional real estate and private equity real estate is crucial for investors to align their investment goals with the appropriate risk, liquidity, and control levels. Fractional real estate offers partial ownership in individual properties with more liquidity and lower minimum investment, while private equity real estate involves pooled funds investing in larger-scale projects with potentially higher returns and longer lock-in periods. Knowing these distinctions helps investors make informed decisions about portfolio diversification and capital allocation strategies. This knowledge optimizes investment outcomes by matching asset exposure to personal financial objectives and risk tolerance.

Comparison Table

| Aspect | Fractional Real Estate | Private Equity Real Estate |

|---|---|---|

| Investment Size | Low to moderate (often $500 to $10,000) | High (typically $50,000 to millions) |

| Ownership Type | Partial ownership via shares or tokens | Direct equity stake in real estate projects |

| Liquidity | Higher liquidity, tradable on secondary markets | Low liquidity, long-term lock-up periods |

| Risk Profile | Lower to moderate risk, diversified holdings | Higher risk with potentially higher returns |

| Management | Professionally managed, hands-off for investors | Active management or partnership involvement |

| Returns | Moderate, steady income through rental yields | Potential for high returns via asset appreciation and development |

| Regulatory Oversight | Subject to securities regulations, transparent | Often private placements, less regulatory disclosure |

| Investment Horizon | Short to medium term (1-5 years) | Long term (5-10+ years) |

Which is better?

Fractional real estate offers lower entry costs and increased liquidity by allowing investors to purchase portions of properties, making it ideal for diversification and hands-off management. Private equity real estate typically requires higher capital commitments but provides greater control, access to institutional-grade assets, and potentially higher returns through active management. Investor goals, risk tolerance, and liquidity needs ultimately determine which option aligns better with their portfolio strategy.

Connection

Fractional real estate and private equity real estate are interconnected as both allow investors to pool capital to acquire high-value properties, offering access to real estate markets typically reserved for institutional players. Fractional real estate breaks down ownership into smaller, more affordable shares, while private equity real estate involves managing a portfolio of properties through pooled investment funds. These models leverage collective investment strategies to optimize asset diversification, risk management, and potential returns.

Key Terms

Ownership Structure

Private equity real estate typically involves pooled funds where investors own limited partnership interests, granting them indirect stakes in large-scale property portfolios managed by professional firms. Fractional real estate offers individual investors direct partial ownership of specific properties, allowing shared usage rights and more transparent control over the asset. Explore deeper insights into how these ownership structures impact liquidity, control, and returns by learning more about private equity and fractional real estate models.

Capital Commitment

Private equity real estate typically requires high capital commitments, often ranging from hundreds of thousands to millions of dollars, limiting access to institutional or accredited investors. Fractional real estate drastically lowers entry barriers by allowing investors to buy smaller ownership shares, often starting at a few thousand dollars, thus democratizing real estate investment. Explore how these investment structures influence portfolio diversification and risk management by learning more about their capital commitment requirements.

Liquidity

Private equity real estate typically involves significant capital commitment with limited liquidity due to long lock-up periods and exit through sales or IPOs, making it less accessible for investors needing quick access to funds. Fractional real estate offers enhanced liquidity by allowing investors to buy and sell smaller ownership shares on secondary markets or platforms, providing more flexibility and quicker access to capital. Explore detailed comparisons to understand which investment suits your liquidity needs best.

Source and External Links

Real Estate Private Equity: Overview, Careers, Salaries & Interviews - Real estate private equity (REPE) firms raise capital from outside investors called Limited Partners to acquire, develop, operate, and sell commercial properties like offices, industrial, retail, and multifamily, aiming to generate returns for investors such as pension funds and high-net-worth individuals.

Private equity real estate - Wikipedia - Private equity real estate investing involves direct or indirect ownership of properties through pooled funds or other structures, with investors ranging from accredited individuals to institutional players, focusing on illiquid private securities primarily suitable for accredited investors.

Private Real Estate Investments: What You Need to Know - KKR - Private real estate investment includes both equity ownership and credit lending, aiming to provide portfolio diversification, a potential inflation hedge, and exposure to a large commercial real estate market that historically outpaces inflation.

dowidth.com

dowidth.com