Wine investing platforms offer a tangible asset with historical value and steady appreciation potential, appealing to collectors and connoisseurs seeking portfolio diversification. Cryptocurrency exchanges provide fast, high-volatility trading options with decentralized digital assets, attracting tech-savvy investors aiming for rapid gains. Explore the advantages and risks of wine investing platforms versus cryptocurrency exchanges to make an informed choice.

Why it is important

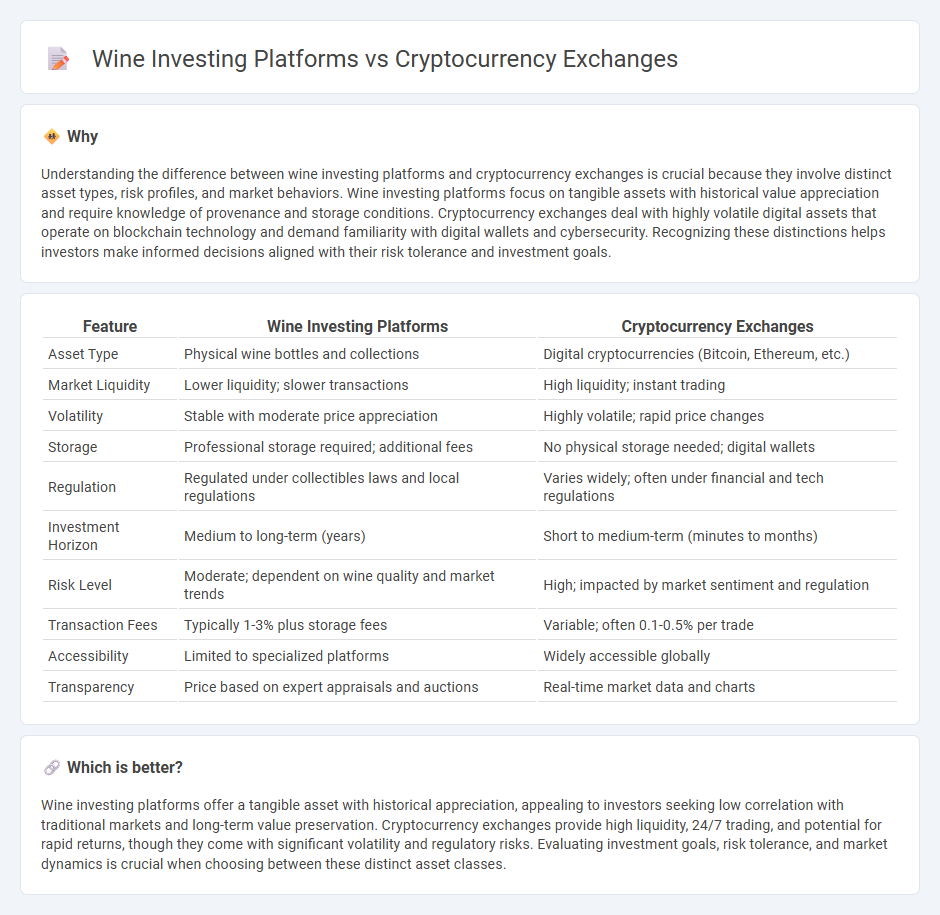

Understanding the difference between wine investing platforms and cryptocurrency exchanges is crucial because they involve distinct asset types, risk profiles, and market behaviors. Wine investing platforms focus on tangible assets with historical value appreciation and require knowledge of provenance and storage conditions. Cryptocurrency exchanges deal with highly volatile digital assets that operate on blockchain technology and demand familiarity with digital wallets and cybersecurity. Recognizing these distinctions helps investors make informed decisions aligned with their risk tolerance and investment goals.

Comparison Table

| Feature | Wine Investing Platforms | Cryptocurrency Exchanges |

|---|---|---|

| Asset Type | Physical wine bottles and collections | Digital cryptocurrencies (Bitcoin, Ethereum, etc.) |

| Market Liquidity | Lower liquidity; slower transactions | High liquidity; instant trading |

| Volatility | Stable with moderate price appreciation | Highly volatile; rapid price changes |

| Storage | Professional storage required; additional fees | No physical storage needed; digital wallets |

| Regulation | Regulated under collectibles laws and local regulations | Varies widely; often under financial and tech regulations |

| Investment Horizon | Medium to long-term (years) | Short to medium-term (minutes to months) |

| Risk Level | Moderate; dependent on wine quality and market trends | High; impacted by market sentiment and regulation |

| Transaction Fees | Typically 1-3% plus storage fees | Variable; often 0.1-0.5% per trade |

| Accessibility | Limited to specialized platforms | Widely accessible globally |

| Transparency | Price based on expert appraisals and auctions | Real-time market data and charts |

Which is better?

Wine investing platforms offer a tangible asset with historical appreciation, appealing to investors seeking low correlation with traditional markets and long-term value preservation. Cryptocurrency exchanges provide high liquidity, 24/7 trading, and potential for rapid returns, though they come with significant volatility and regulatory risks. Evaluating investment goals, risk tolerance, and market dynamics is crucial when choosing between these distinct asset classes.

Connection

Wine investing platforms and cryptocurrency exchanges are connected through blockchain technology, which provides transparency, security, and traceability in asset transactions. Both sectors utilize tokenization to fractionalize ownership, enabling investors to trade shares of fine wines or digital currencies on decentralized platforms. This integration enhances liquidity in traditionally illiquid markets, attracting a broader range of investors seeking diversified portfolios.

Key Terms

Liquidity

Cryptocurrency exchanges offer high liquidity, enabling rapid buying and selling of assets due to continuous market activity and large user bases. Wine investing platforms typically have lower liquidity, as wine markets involve physical asset transactions and longer holding periods before resale. Explore deeper insights into liquidity factors shaping these investment choices.

Volatility

Cryptocurrency exchanges experience extreme price volatility with fluctuations often exceeding 10% in a single day, driven by market speculation, regulatory news, and technological developments. Wine investing platforms offer significantly lower volatility as fine wine prices tend to appreciate steadily over time with less susceptibility to sudden market swings due to limited supply and collector demand. Discover detailed comparisons of risk factors and portfolio strategies for these distinct asset classes.

Custody

Cryptocurrency exchanges prioritize secure digital asset custody through cold storage and multi-signature wallets to protect against hacking and theft risks. Wine investing platforms emphasize physical custody, implementing climate-controlled storage facilities with insurance coverage to preserve the quality and authenticity of valuable bottles. Explore more about how custody solutions impact asset security and investor confidence in both markets.

Source and External Links

Cryptocurrency Exchanges - Overview, Advantages, Top 10 - This resource provides an overview of cryptocurrency exchanges, highlighting popular platforms like Binance and Coinbase, and explaining how they operate.

Best Crypto Exchanges, Platforms & Apps for 2025 - NerdWallet - NerdWallet reviews and ranks various crypto exchanges based on factors like fees, usability, and promotions, naming Coinbase as best for beginners.

Binance.US: Crypto Trading Platform - Binance.US is a U.S.-based cryptocurrency exchange where users can buy, sell, and trade over 160 cryptocurrencies with low fees and secure storage.

dowidth.com

dowidth.com