Fine art micro-shares enable investors to purchase fractional ownership in high-value artworks, offering liquidity and portfolio diversification in the luxury asset space. Collectible sneakers platforms provide access to rare footwear investments, capitalizing on limited editions and cultural trends driving market demand. Explore the key differences and benefits of these alternative investment markets to optimize your asset allocation.

Why it is important

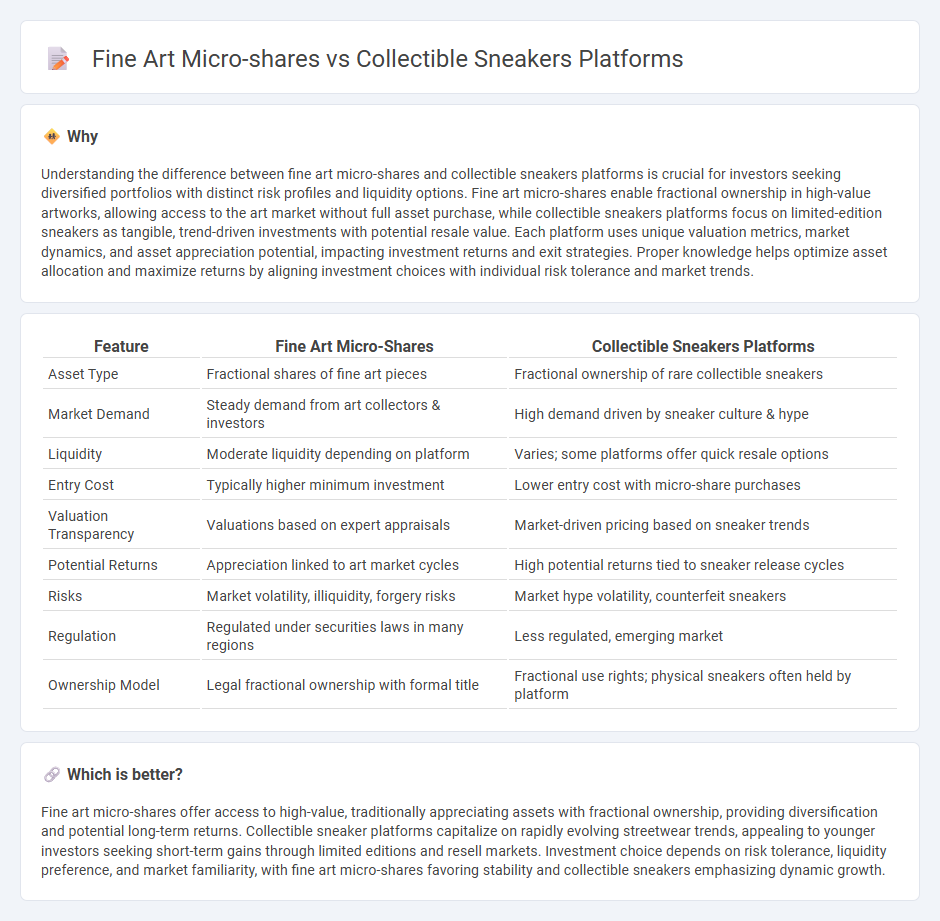

Understanding the difference between fine art micro-shares and collectible sneakers platforms is crucial for investors seeking diversified portfolios with distinct risk profiles and liquidity options. Fine art micro-shares enable fractional ownership in high-value artworks, allowing access to the art market without full asset purchase, while collectible sneakers platforms focus on limited-edition sneakers as tangible, trend-driven investments with potential resale value. Each platform uses unique valuation metrics, market dynamics, and asset appreciation potential, impacting investment returns and exit strategies. Proper knowledge helps optimize asset allocation and maximize returns by aligning investment choices with individual risk tolerance and market trends.

Comparison Table

| Feature | Fine Art Micro-Shares | Collectible Sneakers Platforms |

|---|---|---|

| Asset Type | Fractional shares of fine art pieces | Fractional ownership of rare collectible sneakers |

| Market Demand | Steady demand from art collectors & investors | High demand driven by sneaker culture & hype |

| Liquidity | Moderate liquidity depending on platform | Varies; some platforms offer quick resale options |

| Entry Cost | Typically higher minimum investment | Lower entry cost with micro-share purchases |

| Valuation Transparency | Valuations based on expert appraisals | Market-driven pricing based on sneaker trends |

| Potential Returns | Appreciation linked to art market cycles | High potential returns tied to sneaker release cycles |

| Risks | Market volatility, illiquidity, forgery risks | Market hype volatility, counterfeit sneakers |

| Regulation | Regulated under securities laws in many regions | Less regulated, emerging market |

| Ownership Model | Legal fractional ownership with formal title | Fractional use rights; physical sneakers often held by platform |

Which is better?

Fine art micro-shares offer access to high-value, traditionally appreciating assets with fractional ownership, providing diversification and potential long-term returns. Collectible sneaker platforms capitalize on rapidly evolving streetwear trends, appealing to younger investors seeking short-term gains through limited editions and resell markets. Investment choice depends on risk tolerance, liquidity preference, and market familiarity, with fine art micro-shares favoring stability and collectible sneakers emphasizing dynamic growth.

Connection

Fine art micro-shares and collectible sneakers platforms both leverage fractional ownership to democratize access to high-value alternative investments, enabling broader participation in markets traditionally dominated by wealthy collectors. These platforms utilize blockchain technology or secure digital registries to authenticate assets and facilitate seamless trading of shares, enhancing liquidity and transparency. By tokenizing rare art pieces and limited-edition sneakers, investors can diversify portfolios with collectible assets that exhibit potential appreciation tied to cultural trends and scarcity.

Key Terms

Liquidity

Collectible sneakers platforms leverage high demand and limited edition drops to generate rapid liquidity, often supported by a vibrant secondary market with real-time trading features. Fine art micro-shares provide fractional ownership in high-value artworks, enhancing liquidity in a traditionally illiquid asset class by enabling smaller investments and easier transferability. Explore the nuances of liquidity dynamics in both markets to make informed investment decisions.

Provenance

Collectible sneakers platforms leverage blockchain technology to ensure transparent provenance, authenticating each pair's history and ownership records. Fine art micro-shares enable fractional ownership but rely heavily on verified provenance documentation to maintain asset value and investor trust. Explore further to understand how provenance impacts asset security and market liquidity in both sectors.

Fractional ownership

Fractional ownership in collectible sneakers platforms allows investors to buy shares of high-value limited edition shoes, enabling affordable access and diverse portfolio building without full purchase. Fine art micro-shares provide a similar investment model by dividing ownership of expensive artworks into smaller, tradeable shares, democratizing art investment and liquidity. Explore how fractional ownership transforms asset accessibility and investment strategies across these unique markets.

Source and External Links

Platform Sneakers with Free Shipping* - Famous Footwear - Famous Footwear offers a wide selection of stylish and comfortable platform sneakers from top brands like Nike, Adidas, Puma, and Converse, including classic and chunky styles.

90s Platform Sneakers - Etsy - Etsy features a variety of unique and handmade 90s style platform sneakers, including vintage, club kid, and custom designs ideal for collectors.

Women's Platform Shoes - Reebok - Reebok's Platform Collection offers bold platform sneakers with exaggerated midsoles, including the Classic Leather SP Extra Platform and Club C Extra Platform, designed for a chic and sporty look.

dowidth.com

dowidth.com