Sports memorabilia funds offer investors exposure to rare collectibles with potential for high appreciation based on athlete popularity and market trends. Timberland funds provide sustainable investment through ownership of forested land, generating steady returns via timber sales and land value appreciation. Explore the differences in risk, liquidity, and growth potential between these alternative asset classes to make informed investment decisions.

Why it is important

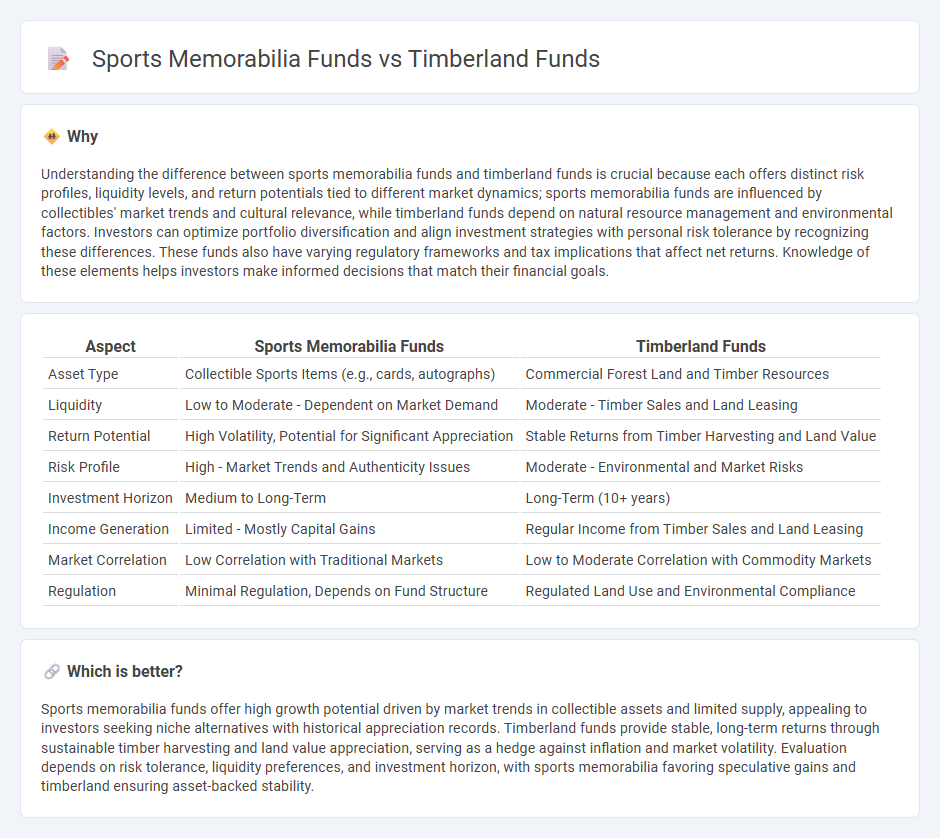

Understanding the difference between sports memorabilia funds and timberland funds is crucial because each offers distinct risk profiles, liquidity levels, and return potentials tied to different market dynamics; sports memorabilia funds are influenced by collectibles' market trends and cultural relevance, while timberland funds depend on natural resource management and environmental factors. Investors can optimize portfolio diversification and align investment strategies with personal risk tolerance by recognizing these differences. These funds also have varying regulatory frameworks and tax implications that affect net returns. Knowledge of these elements helps investors make informed decisions that match their financial goals.

Comparison Table

| Aspect | Sports Memorabilia Funds | Timberland Funds |

|---|---|---|

| Asset Type | Collectible Sports Items (e.g., cards, autographs) | Commercial Forest Land and Timber Resources |

| Liquidity | Low to Moderate - Dependent on Market Demand | Moderate - Timber Sales and Land Leasing |

| Return Potential | High Volatility, Potential for Significant Appreciation | Stable Returns from Timber Harvesting and Land Value |

| Risk Profile | High - Market Trends and Authenticity Issues | Moderate - Environmental and Market Risks |

| Investment Horizon | Medium to Long-Term | Long-Term (10+ years) |

| Income Generation | Limited - Mostly Capital Gains | Regular Income from Timber Sales and Land Leasing |

| Market Correlation | Low Correlation with Traditional Markets | Low to Moderate Correlation with Commodity Markets |

| Regulation | Minimal Regulation, Depends on Fund Structure | Regulated Land Use and Environmental Compliance |

Which is better?

Sports memorabilia funds offer high growth potential driven by market trends in collectible assets and limited supply, appealing to investors seeking niche alternatives with historical appreciation records. Timberland funds provide stable, long-term returns through sustainable timber harvesting and land value appreciation, serving as a hedge against inflation and market volatility. Evaluation depends on risk tolerance, liquidity preferences, and investment horizon, with sports memorabilia favoring speculative gains and timberland ensuring asset-backed stability.

Connection

Sports memorabilia funds and timberland funds share a connection through their appeal as alternative investment assets that diversify traditional portfolios. Both asset classes offer tangible value with relatively low correlation to stock and bond markets, helping investors hedge against inflation and economic volatility. Timberland funds generate returns through timber sales and land appreciation, while sports memorabilia funds rely on the rarity and historical significance of collectibles to drive value growth.

Key Terms

Asset Liquidity

Timberland funds typically offer moderate asset liquidity through timber sales and land leases, balancing long-term growth with periodic cash flow. Sports memorabilia funds often have lower liquidity due to niche market demand and the time required to authenticate and sell high-value collectibles. Explore detailed comparisons of liquidity profiles and risk factors between these alternative investments to make informed decisions.

Valuation Methods

Timberland funds typically rely on income-based valuation methods, such as discounted cash flow (DCF) analysis, which accounts for anticipated timber harvest revenue and land appreciation over time. In contrast, sports memorabilia funds often use market-based valuation approaches, focusing on recent auction prices, rarity, provenance, and condition to estimate asset value. Explore the detailed valuation techniques and metrics for these alternative investment funds to understand their unique financial dynamics.

Market Cycles

Timberland funds exhibit resilience during economic downturns due to the asset's intrinsic value and long growth periods, benefiting from long-term market cycles and environmental factors. In contrast, sports memorabilia funds experience more volatility influenced by trends, celebrity status, and collectors' demand, making them sensitive to shorter market cycles and sentiment shifts. Explore deeper insights into how these distinct asset classes respond to market cycles and optimize portfolio strategies.

Source and External Links

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland funds involve investing in managed tree plantations or natural forests, offering investors stable growth through biological tree growth, diversification, and protection against economic volatility, commonly favored by institutional investors like pension funds and university endowments.

Timberland - Meketa Investment Group - Timberland funds raised about $3.7 billion in 2008 with a slowdown post-financial crisis; from 2015 to 2019, $6.4 billion was raised for closed-end timberland funds, representing a small but reliable subset of natural resources investments.

Timberland - Stafford Capital Partners - Stafford Timberland manages global timberland investment funds and advisory services focusing on diverse geographic portfolios including North and South America and Oceania with additional emphasis on sustainable and carbon-related timberland investments.

dowidth.com

dowidth.com