Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions to balance out carbon footprints, while renewable infrastructure funds invest directly in the development and operation of renewable energy assets like solar, wind, and hydroelectric power plants. Both investment types contribute to sustainability goals but offer different risk profiles, returns, and impact scopes. Explore these options further to understand which aligns best with your investment strategy and environmental objectives.

Why it is important

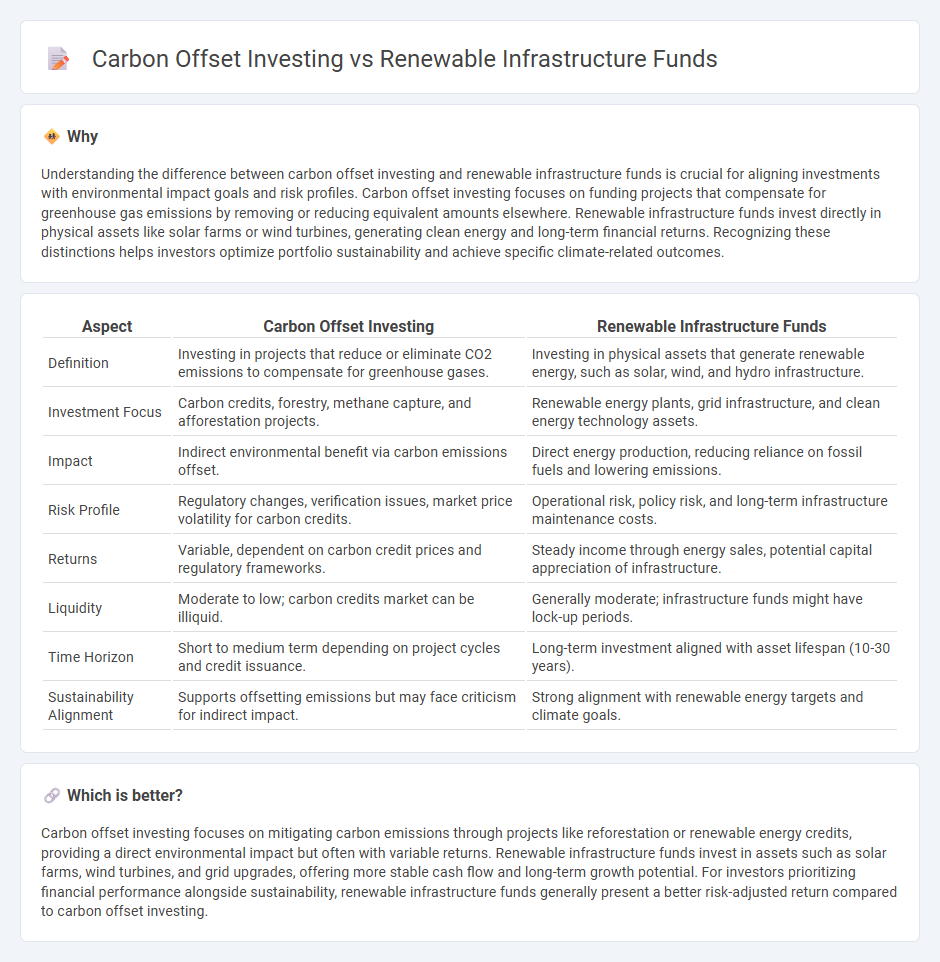

Understanding the difference between carbon offset investing and renewable infrastructure funds is crucial for aligning investments with environmental impact goals and risk profiles. Carbon offset investing focuses on funding projects that compensate for greenhouse gas emissions by removing or reducing equivalent amounts elsewhere. Renewable infrastructure funds invest directly in physical assets like solar farms or wind turbines, generating clean energy and long-term financial returns. Recognizing these distinctions helps investors optimize portfolio sustainability and achieve specific climate-related outcomes.

Comparison Table

| Aspect | Carbon Offset Investing | Renewable Infrastructure Funds |

|---|---|---|

| Definition | Investing in projects that reduce or eliminate CO2 emissions to compensate for greenhouse gases. | Investing in physical assets that generate renewable energy, such as solar, wind, and hydro infrastructure. |

| Investment Focus | Carbon credits, forestry, methane capture, and afforestation projects. | Renewable energy plants, grid infrastructure, and clean energy technology assets. |

| Impact | Indirect environmental benefit via carbon emissions offset. | Direct energy production, reducing reliance on fossil fuels and lowering emissions. |

| Risk Profile | Regulatory changes, verification issues, market price volatility for carbon credits. | Operational risk, policy risk, and long-term infrastructure maintenance costs. |

| Returns | Variable, dependent on carbon credit prices and regulatory frameworks. | Steady income through energy sales, potential capital appreciation of infrastructure. |

| Liquidity | Moderate to low; carbon credits market can be illiquid. | Generally moderate; infrastructure funds might have lock-up periods. |

| Time Horizon | Short to medium term depending on project cycles and credit issuance. | Long-term investment aligned with asset lifespan (10-30 years). |

| Sustainability Alignment | Supports offsetting emissions but may face criticism for indirect impact. | Strong alignment with renewable energy targets and climate goals. |

Which is better?

Carbon offset investing focuses on mitigating carbon emissions through projects like reforestation or renewable energy credits, providing a direct environmental impact but often with variable returns. Renewable infrastructure funds invest in assets such as solar farms, wind turbines, and grid upgrades, offering more stable cash flow and long-term growth potential. For investors prioritizing financial performance alongside sustainability, renewable infrastructure funds generally present a better risk-adjusted return compared to carbon offset investing.

Connection

Carbon offset investing and renewable infrastructure funds are interconnected through their shared goal of promoting sustainable energy solutions and reducing greenhouse gas emissions. Investments in renewable infrastructure, such as wind and solar farms, generate measurable carbon offsets by displacing fossil fuel-based energy sources. This synergy enables investors to support projects that deliver both financial returns and verifiable environmental benefits, aligning portfolio growth with climate impact objectives.

Key Terms

**Renewable Infrastructure Funds:**

Renewable infrastructure funds direct capital towards projects like wind farms, solar parks, and hydroelectric facilities, offering investors exposure to sustainable energy assets that generate long-term cash flows and contribute to decarbonization. These funds typically provide more tangible asset-backed investments with measurable environmental impacts compared to carbon offset investing, which involves purchasing credits to compensate for emissions rather than reducing them directly. Explore how renewable infrastructure funds align with ESG goals and deliver financial returns by learning more about their strategic advantages.

Clean Energy Assets

Renewable infrastructure funds primarily invest in physical clean energy assets such as solar farms, wind turbines, and hydroelectric plants that generate long-term, sustainable power. Carbon offset investing focuses on projects that reduce or capture greenhouse gas emissions, including reforestation and carbon capture technologies, but may lack direct asset ownership. Explore how these investment strategies complement global efforts to transition towards a low-carbon economy and achieve net-zero targets.

Yield (Dividend Returns)

Renewable infrastructure funds typically offer stable dividend returns due to long-term contracts and regulated cash flows from assets like wind farms and solar projects. Carbon offset investing, while important for sustainability, generally provides lower or less predictable yield since it often involves project-based credits without steady income streams. Explore detailed comparisons of dividend yields and risk profiles to better understand which investment aligns with your income goals.

Source and External Links

Octopus Renewables Infrastructure Trust - An investment company providing diversified exposure to multiple renewable energy technologies across several countries, targeting sustainable income and capital growth with an emphasis on ESG impact and net zero transition.

Capital Dynamics Clean Energy Investment - A global platform focused on direct equity investments in carbon-reducing renewable power generation projects including solar farms under construction.

Sixth Street Energy, Renewables and Infrastructure - Provides customized capital solutions in global infrastructure including renewables with a portfolio spanning wind, solar, hydro, and storage, investing over 6GW of renewable power.

dowidth.com

dowidth.com