Investment in song catalog purchases offers long-term revenue through royalties from music streaming, licensing, and synchronization rights, attracting investors seeking stable cash flows. Wine futures involve buying wine before it is bottled, allowing investors to purchase at lower prices with potential appreciation as the wine matures, but carry risks from market fluctuations and storage costs. Explore further to understand which investment aligns with your financial goals and risk tolerance.

Why it is important

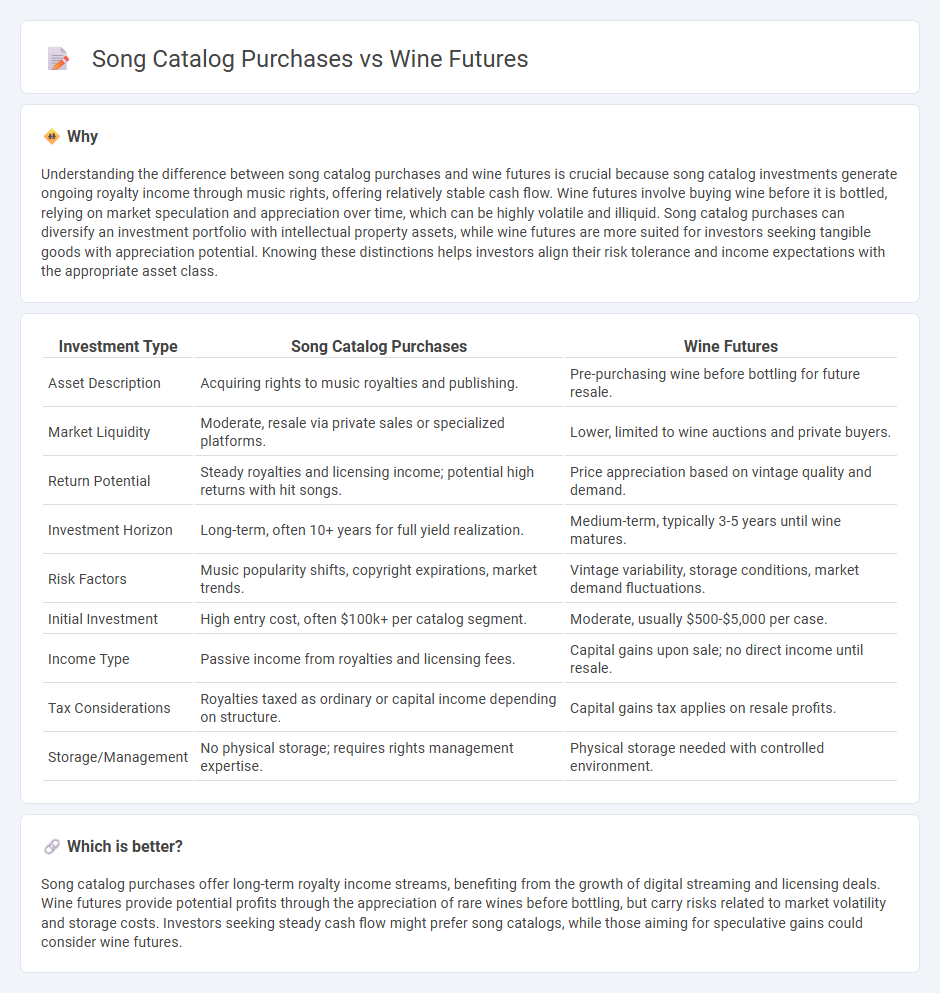

Understanding the difference between song catalog purchases and wine futures is crucial because song catalog investments generate ongoing royalty income through music rights, offering relatively stable cash flow. Wine futures involve buying wine before it is bottled, relying on market speculation and appreciation over time, which can be highly volatile and illiquid. Song catalog purchases can diversify an investment portfolio with intellectual property assets, while wine futures are more suited for investors seeking tangible goods with appreciation potential. Knowing these distinctions helps investors align their risk tolerance and income expectations with the appropriate asset class.

Comparison Table

| Investment Type | Song Catalog Purchases | Wine Futures |

|---|---|---|

| Asset Description | Acquiring rights to music royalties and publishing. | Pre-purchasing wine before bottling for future resale. |

| Market Liquidity | Moderate, resale via private sales or specialized platforms. | Lower, limited to wine auctions and private buyers. |

| Return Potential | Steady royalties and licensing income; potential high returns with hit songs. | Price appreciation based on vintage quality and demand. |

| Investment Horizon | Long-term, often 10+ years for full yield realization. | Medium-term, typically 3-5 years until wine matures. |

| Risk Factors | Music popularity shifts, copyright expirations, market trends. | Vintage variability, storage conditions, market demand fluctuations. |

| Initial Investment | High entry cost, often $100k+ per catalog segment. | Moderate, usually $500-$5,000 per case. |

| Income Type | Passive income from royalties and licensing fees. | Capital gains upon sale; no direct income until resale. |

| Tax Considerations | Royalties taxed as ordinary or capital income depending on structure. | Capital gains tax applies on resale profits. |

| Storage/Management | No physical storage; requires rights management expertise. | Physical storage needed with controlled environment. |

Which is better?

Song catalog purchases offer long-term royalty income streams, benefiting from the growth of digital streaming and licensing deals. Wine futures provide potential profits through the appreciation of rare wines before bottling, but carry risks related to market volatility and storage costs. Investors seeking steady cash flow might prefer song catalogs, while those aiming for speculative gains could consider wine futures.

Connection

Song catalog purchases and wine futures both represent alternative investment opportunities offering diversification beyond traditional asset classes like stocks and bonds. Investing in song catalogs provides revenue through royalties generated by streaming, licensing, and sales, while wine futures involve purchasing wine before it is bottled, potentially yielding profits from increased market value and scarcity. Both assets appeal to investors seeking tangible or intellectual property-based income streams with unique risk and return profiles.

Key Terms

Speculation

Wine futures involve investing in wines before they are bottled, capitalizing on anticipated market appreciation based on vineyard reputation and vintage quality. Song catalog purchases provide speculative opportunities by acquiring rights to future royalties, benefiting from streaming growth and music consumption trends. Explore deeper insights into these speculative investment strategies to enhance portfolio diversification.

Asset Liquidity

Wine futures provide an opportunity to invest in wine before bottling, offering potential appreciation but with limited liquidity due to long holding periods and niche secondary markets. Song catalog purchases generate income through royalties, often delivering more predictable cash flow and relatively higher liquidity as music rights can be sold or licensed more readily. Explore the comparative liquidity and cash flow benefits of these alternative assets to optimize your investment portfolio.

Revenue Streams

Wine futures offer revenue streams through advance sales of vintages before bottling, providing wineries with immediate capital and consumers exclusive access to limited releases. Song catalog purchases generate long-term income by acquiring rights to music royalties, synchronization licenses, and performance royalties, often yielding consistent cash flow over years or decades. Explore the intricacies of these investment models to better understand their impact on revenue diversification and growth.

Source and External Links

Why Buy Wine Futures ? - Millesima USA - Wine futures allow buyers to purchase highly sought-after Bordeaux wines 1-2 years before they are bottled and released, often securing rare formats and the best prices through registered merchants.

Invest in Wine Futures | Bordeaux Futures | Gordon's Fine Wine - The wine futures system (en primeur) lets enthusiasts and collectors buy rare or limited-edition wines before bottling, providing winemakers with early funding and buyers with access to exclusive releases.

Wine Futures and En Primeur - Wine-Searcher - Buying wine futures means purchasing wine after fermentation but before bottling, typically at the lowest release price, with Bordeaux as the classic market though the practice is spreading to other regions.

dowidth.com

dowidth.com