Royalty stream investing involves acquiring rights to a percentage of revenue from intellectual property or natural resources, offering steady cash flow with lower risk compared to equity stakes. Private equity investing requires purchasing ownership in private companies, aiming for substantial capital gains through active management and business growth. Explore the distinct advantages and risks of each to optimize your investment strategy.

Why it is important

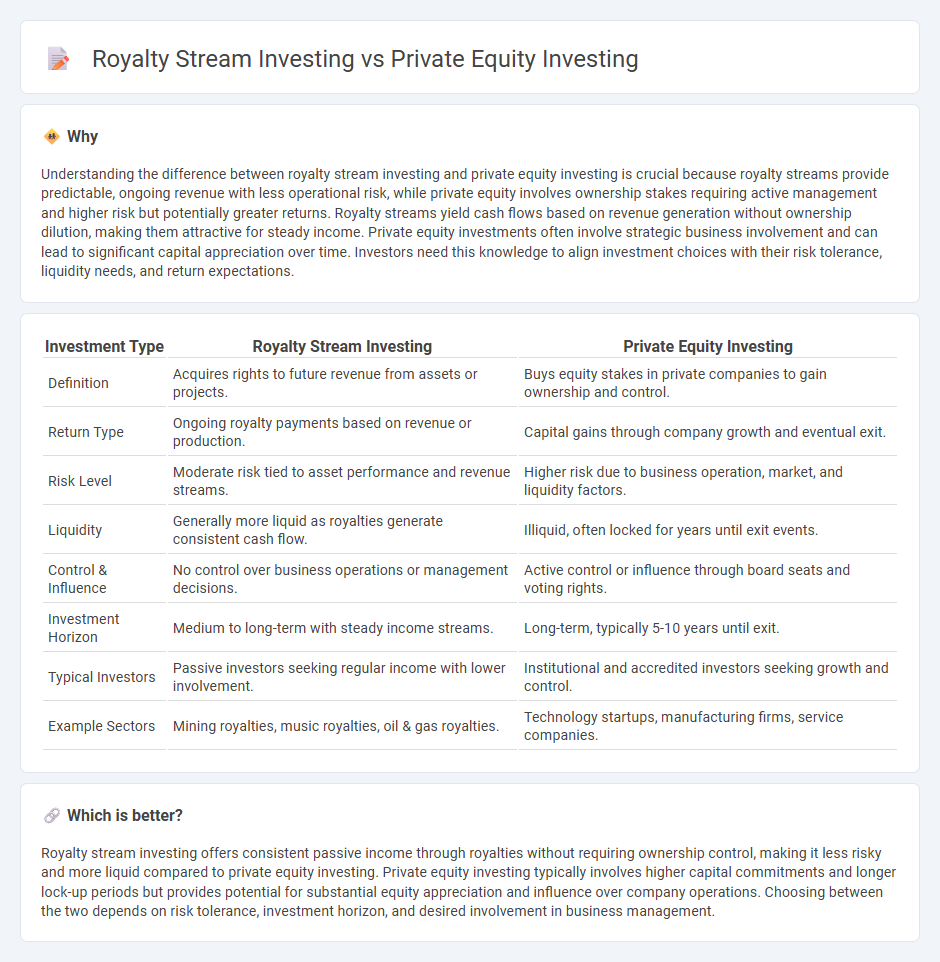

Understanding the difference between royalty stream investing and private equity investing is crucial because royalty streams provide predictable, ongoing revenue with less operational risk, while private equity involves ownership stakes requiring active management and higher risk but potentially greater returns. Royalty streams yield cash flows based on revenue generation without ownership dilution, making them attractive for steady income. Private equity investments often involve strategic business involvement and can lead to significant capital appreciation over time. Investors need this knowledge to align investment choices with their risk tolerance, liquidity needs, and return expectations.

Comparison Table

| Investment Type | Royalty Stream Investing | Private Equity Investing |

|---|---|---|

| Definition | Acquires rights to future revenue from assets or projects. | Buys equity stakes in private companies to gain ownership and control. |

| Return Type | Ongoing royalty payments based on revenue or production. | Capital gains through company growth and eventual exit. |

| Risk Level | Moderate risk tied to asset performance and revenue streams. | Higher risk due to business operation, market, and liquidity factors. |

| Liquidity | Generally more liquid as royalties generate consistent cash flow. | Illiquid, often locked for years until exit events. |

| Control & Influence | No control over business operations or management decisions. | Active control or influence through board seats and voting rights. |

| Investment Horizon | Medium to long-term with steady income streams. | Long-term, typically 5-10 years until exit. |

| Typical Investors | Passive investors seeking regular income with lower involvement. | Institutional and accredited investors seeking growth and control. |

| Example Sectors | Mining royalties, music royalties, oil & gas royalties. | Technology startups, manufacturing firms, service companies. |

Which is better?

Royalty stream investing offers consistent passive income through royalties without requiring ownership control, making it less risky and more liquid compared to private equity investing. Private equity investing typically involves higher capital commitments and longer lock-up periods but provides potential for substantial equity appreciation and influence over company operations. Choosing between the two depends on risk tolerance, investment horizon, and desired involvement in business management.

Connection

Royalty stream investing and private equity investing are connected through their focus on generating returns from business cash flows without direct equity ownership. Both investment types prioritize long-term income streams, with royalty stream investing earning consistent royalties from intellectual property or natural resources, while private equity investing acquires ownership stakes to enhance corporate value. Institutional investors leverage these strategies for portfolio diversification, balancing risk and steady cash flow generation.

Key Terms

Equity Ownership vs. Revenue Share

Private equity investing centers on acquiring equity ownership in companies, granting investors voting rights and potential capital appreciation as the business grows. In contrast, royalty stream investing provides investors with a percentage of a company's revenue without ownership or control, offering steady income but limited upside potential. Explore the nuances between these investment strategies to determine which aligns best with your financial goals.

Exit Strategy vs. Ongoing Payments

Private equity investing centers on significant capital deployment with returns realized mainly during exit events such as IPOs or company sales, focusing on high-value liquidity events that may take years to materialize. Royalty stream investing provides ongoing payments derived from a percentage of revenue or sales, delivering consistent cash flow without the need for ownership transfer or waiting for an exit. Explore how these distinct approaches align with different investment goals and risk profiles.

Capital Appreciation vs. Cash Flow

Private equity investing prioritizes capital appreciation by acquiring ownership stakes in companies expected to grow significantly over time, resulting in substantial equity value increases upon exit events like IPOs or acquisitions. Royalty stream investing, conversely, emphasizes predictable cash flow through contractual rights to a percentage of revenue or production, offering steady income without ownership responsibilities. Explore further to understand which investment strategy aligns with your financial goals and risk tolerance.

Source and External Links

What Is Private Equity? How to Invest - NerdWallet - Private equity involves investors pooling money in a fund managed by a private equity firm that invests in private companies, offering potentially higher returns than public markets but with higher risk and limited liquidity, typically structured through limited partnerships where investors are limited partners earning returns when the firm sells its holdings.

An Introduction to Private Equity Basics | Morgan Stanley - Private equity includes buyout, growth equity, and venture capital strategies, primarily accessed by institutional investors and family offices, with options such as co-investments and multi-manager funds providing diversification and tailored exposure to private companies.

Private equity - Wikipedia - Private equity funds raise capital from limited partners and invest in private companies using equity and debt to drive value through revenue growth, margin expansion, and operational improvements over typical investment horizons of 4-7 years, with fund managers as general partners overseeing investments.

dowidth.com

dowidth.com