Litigation finance offers investors the potential for high returns by funding legal cases, while fixed income investments provide steady, predictable interest payments with lower risk. Understanding the risk-reward profiles and cash flow characteristics of each option is crucial for building a balanced portfolio. Explore the intricacies of litigation finance versus fixed income to make informed investment decisions.

Why it is important

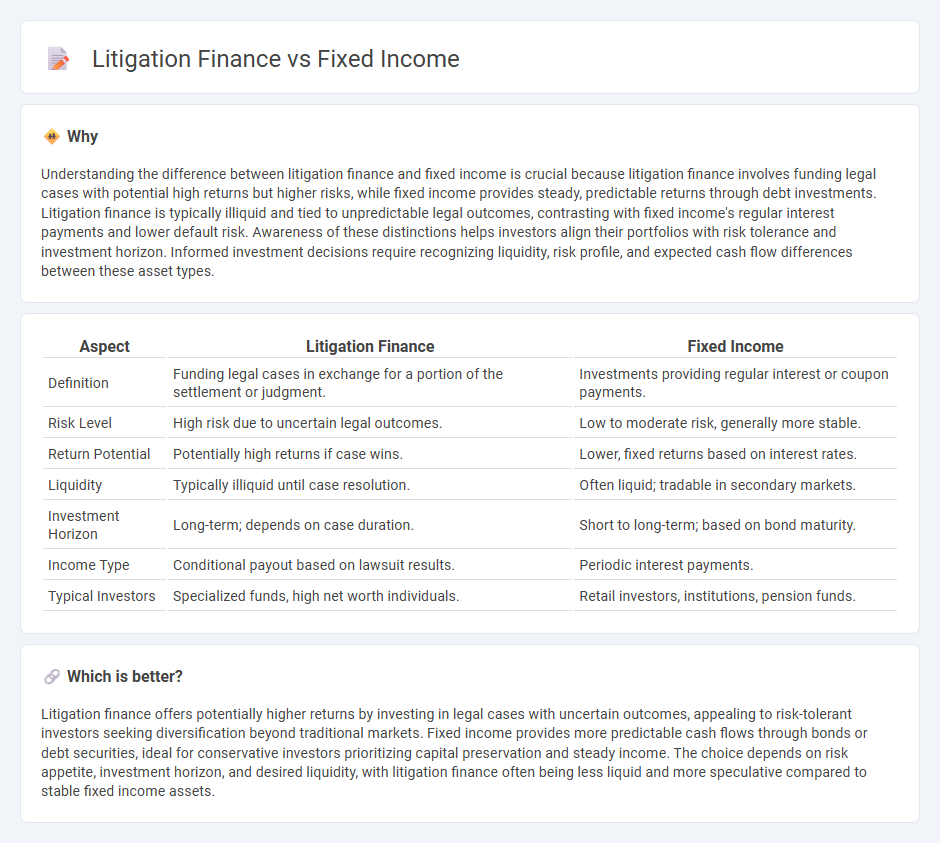

Understanding the difference between litigation finance and fixed income is crucial because litigation finance involves funding legal cases with potential high returns but higher risks, while fixed income provides steady, predictable returns through debt investments. Litigation finance is typically illiquid and tied to unpredictable legal outcomes, contrasting with fixed income's regular interest payments and lower default risk. Awareness of these distinctions helps investors align their portfolios with risk tolerance and investment horizon. Informed investment decisions require recognizing liquidity, risk profile, and expected cash flow differences between these asset types.

Comparison Table

| Aspect | Litigation Finance | Fixed Income |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the settlement or judgment. | Investments providing regular interest or coupon payments. |

| Risk Level | High risk due to uncertain legal outcomes. | Low to moderate risk, generally more stable. |

| Return Potential | Potentially high returns if case wins. | Lower, fixed returns based on interest rates. |

| Liquidity | Typically illiquid until case resolution. | Often liquid; tradable in secondary markets. |

| Investment Horizon | Long-term; depends on case duration. | Short to long-term; based on bond maturity. |

| Income Type | Conditional payout based on lawsuit results. | Periodic interest payments. |

| Typical Investors | Specialized funds, high net worth individuals. | Retail investors, institutions, pension funds. |

Which is better?

Litigation finance offers potentially higher returns by investing in legal cases with uncertain outcomes, appealing to risk-tolerant investors seeking diversification beyond traditional markets. Fixed income provides more predictable cash flows through bonds or debt securities, ideal for conservative investors prioritizing capital preservation and steady income. The choice depends on risk appetite, investment horizon, and desired liquidity, with litigation finance often being less liquid and more speculative compared to stable fixed income assets.

Connection

Litigation finance intersects with fixed income through structured settlements and portfolio diversification strategies, where predictable cash flows from legal claim investments resemble fixed income's stable returns. Investors in litigation finance receive regular repayments akin to bond coupon payments, enhancing fixed income portfolios with alternative risk-adjusted yield sources. This connection enables diversification by integrating non-correlated assets, reducing overall portfolio volatility while maintaining steady income streams.

Key Terms

Yield

Fixed income investments typically offer predictable yields through interest payments on bonds or loans, providing steady cash flow with comparatively lower risk. Litigation finance, however, can deliver higher yields due to the potential for significant payouts from successful legal cases, albeit with greater uncertainty and longer investment horizons. Explore the unique risk-return profiles and yield potentials of both to determine the best fit for your portfolio.

Duration

Fixed income investments typically offer predictable cash flows and are sensitive to duration, which measures interest rate risk over the investment's timeline. Litigation finance has a more uncertain duration since legal cases can extend unpredictably, making its cash flow timing less certain compared to fixed income securities. Explore the nuances of duration's impact on these asset classes to better understand their risk and return profiles.

Risk assessment

Fixed income investments typically involve evaluating credit risk, interest rate risk, and market volatility to ensure predictable returns, while litigation finance focuses on assessing case merits, legal uncertainties, and potential settlement outcomes to manage investment exposure. Fixed income risk assessment relies heavily on financial statements and credit ratings, whereas litigation finance requires deep legal expertise and case-specific analysis. Explore how these distinct risk frameworks influence investment decisions in both sectors.

Source and External Links

What Are Fixed-Income Investments | Edward Jones - Fixed-income investments pay a fixed amount of interest on a set schedule, offering stability and regular payments, including options such as municipal, corporate, treasury, and agency bonds as well as certificates of deposit.

Fixed income - Wikipedia - Fixed income refers to investments where the borrower must pay fixed payments on a schedule, typically including bonds and loans, and contrasts with variable or equity income due to the predictable payment and default implications.

Fixed Income Investments | Charles Schwab - Fixed income investments provide consistent interest income, portfolio diversification, and capital preservation with lower risk than stocks, including bonds, CDs, and bond funds, while facing risks like inflation and interest rate changes.

dowidth.com

dowidth.com