Virtual land real estate offers investors a unique opportunity to own digital parcels within metaverse platforms, leveraging blockchain technology for secure ownership and potential value appreciation. Collectibles, encompassing digital art and NFTs, provide a diverse asset class driven by rarity, cultural significance, and community engagement. Explore the evolving dynamics between virtual land real estate and collectibles to make informed investment decisions.

Why it is important

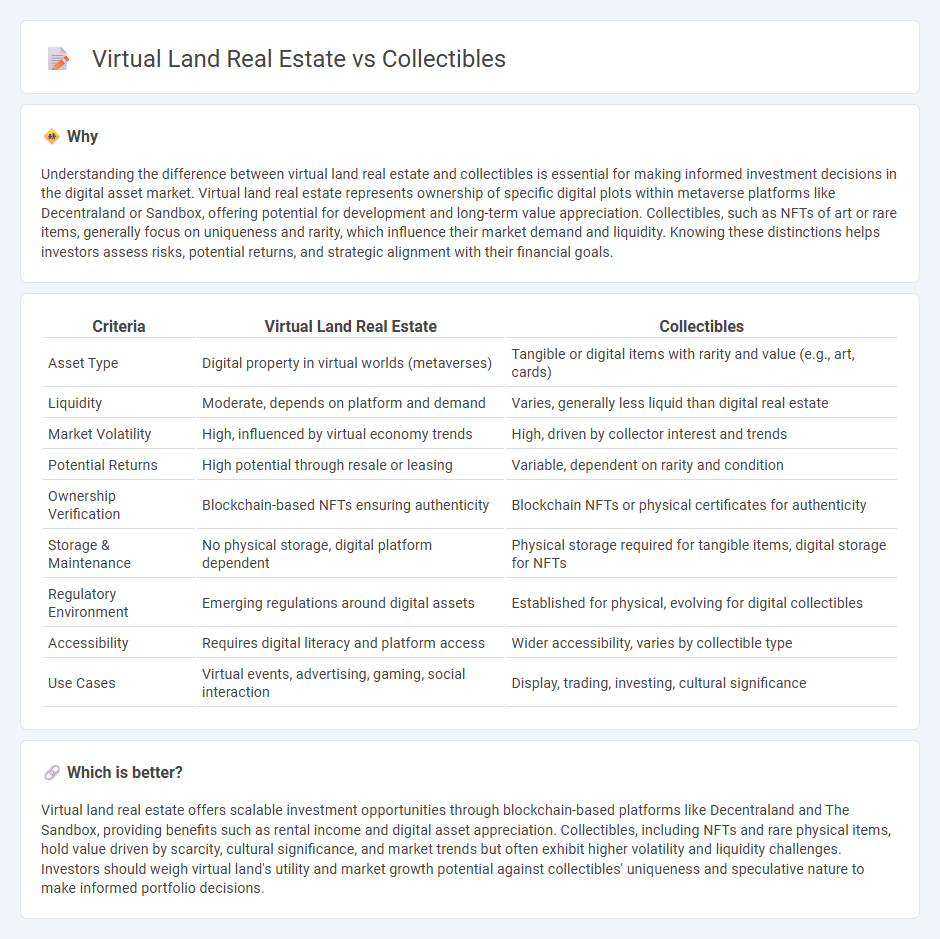

Understanding the difference between virtual land real estate and collectibles is essential for making informed investment decisions in the digital asset market. Virtual land real estate represents ownership of specific digital plots within metaverse platforms like Decentraland or Sandbox, offering potential for development and long-term value appreciation. Collectibles, such as NFTs of art or rare items, generally focus on uniqueness and rarity, which influence their market demand and liquidity. Knowing these distinctions helps investors assess risks, potential returns, and strategic alignment with their financial goals.

Comparison Table

| Criteria | Virtual Land Real Estate | Collectibles |

|---|---|---|

| Asset Type | Digital property in virtual worlds (metaverses) | Tangible or digital items with rarity and value (e.g., art, cards) |

| Liquidity | Moderate, depends on platform and demand | Varies, generally less liquid than digital real estate |

| Market Volatility | High, influenced by virtual economy trends | High, driven by collector interest and trends |

| Potential Returns | High potential through resale or leasing | Variable, dependent on rarity and condition |

| Ownership Verification | Blockchain-based NFTs ensuring authenticity | Blockchain NFTs or physical certificates for authenticity |

| Storage & Maintenance | No physical storage, digital platform dependent | Physical storage required for tangible items, digital storage for NFTs |

| Regulatory Environment | Emerging regulations around digital assets | Established for physical, evolving for digital collectibles |

| Accessibility | Requires digital literacy and platform access | Wider accessibility, varies by collectible type |

| Use Cases | Virtual events, advertising, gaming, social interaction | Display, trading, investing, cultural significance |

Which is better?

Virtual land real estate offers scalable investment opportunities through blockchain-based platforms like Decentraland and The Sandbox, providing benefits such as rental income and digital asset appreciation. Collectibles, including NFTs and rare physical items, hold value driven by scarcity, cultural significance, and market trends but often exhibit higher volatility and liquidity challenges. Investors should weigh virtual land's utility and market growth potential against collectibles' uniqueness and speculative nature to make informed portfolio decisions.

Connection

Virtual land real estate and collectibles intersect in the metaverse economy, where digital assets represent ownership of unique, blockchain-verified properties and items. Investors leverage non-fungible tokens (NFTs) to secure exclusive virtual plots and rare digital collectibles, enhancing value through scarcity and provenance. This convergence drives new financial models combining digital real estate appreciation with collectible asset trading.

Key Terms

Tangible Assets (Collectibles)

Tangible assets such as collectibles offer intrinsic value through physical ownership, rarity, and historical significance, often appreciating based on condition and provenance. Unlike virtual land real estate, which exists solely in digital ecosystems and relies on platform stability and user engagement, collectibles provide a sensory and emotional connection, appealing to traditional investors and hobbyists. Explore the contrasting benefits and investment strategies between physical collectibles and digital property to make informed asset decisions.

Digital Ownership (Virtual Land Real Estate)

Digital ownership in virtual land real estate enables users to buy, sell, and develop parcels of land within metaverse platforms, providing tangible value and utility beyond mere collectibles. Unlike digital collectibles, virtual land offers customizable spaces that can generate income through leasing, advertising, or hosting virtual events, enhancing long-term investment potential. Explore the nuances of digital property rights and how virtual land redefines ownership in the evolving digital economy.

Liquidity

Collectibles often face low liquidity due to niche markets and limited buyer pools, making rapid sales challenging compared to virtual land real estate, which benefits from growing digital ecosystems and increased demand in metaverse platforms. Virtual land real estate offers higher liquidity through established marketplaces like Decentraland and The Sandbox, where transactions are frequent and supported by blockchain technology ensuring transparent ownership transfers. Explore more about how liquidity impacts value and investment strategies in these emerging asset classes.

Source and External Links

Collectibles | Home Decor - Offers a curated selection of elegant collectibles including Limoges boxes, Steiff teddy bears, and Baccarat crystal items, focusing on high-quality home decor collectibles.

Collectibles - Walmart.com - Features a wide range of collectibles from popular franchises like Star Wars, Marvel, WWE, and includes categories such as action figures, trading cards, vinyl figures, and more, with ongoing releases and exclusives.

Toys, Games & Collectibles - Provides a variety of collectibles including LEGO sets, Pokemon items, action figures, and plush toys, catering to both casual and serious collectors with popular licensed merchandise.

dowidth.com

dowidth.com