Investing in wine futures involves purchasing wine while it is still aging in barrels, offering potential high returns as the wine matures and gains value. Art funds pool investors' money to acquire and manage diverse art collections, aiming for appreciation over time and portfolio diversification. Explore the distinctive benefits and risks of wine futures and art funds to determine the best fit for your investment strategy.

Why it is important

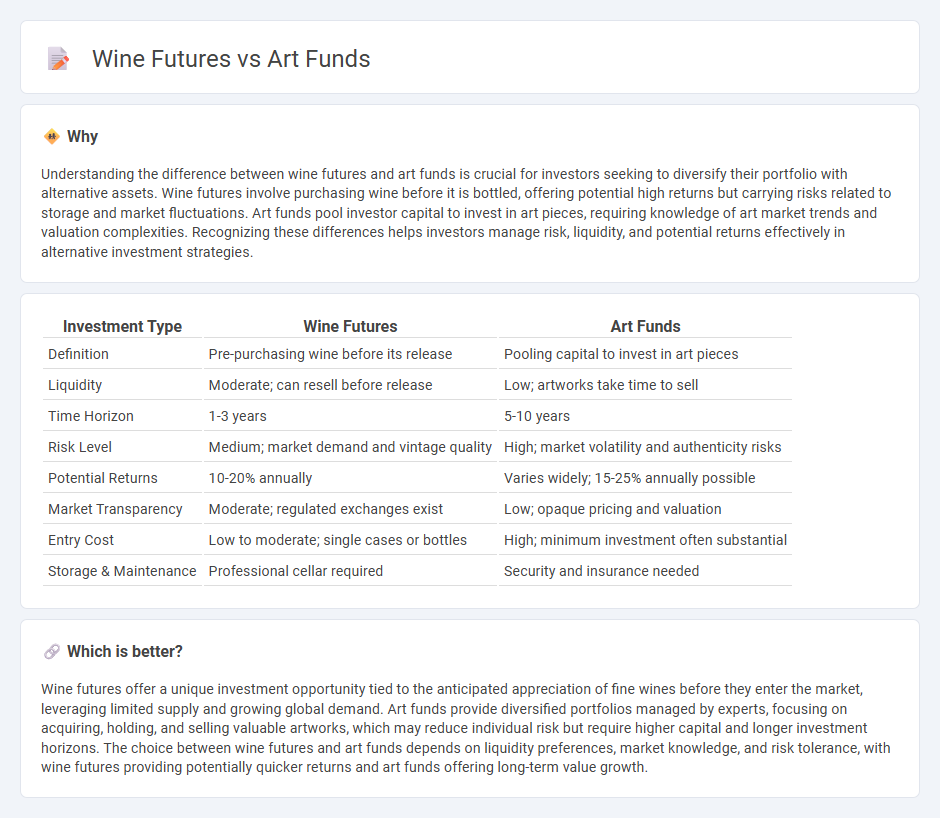

Understanding the difference between wine futures and art funds is crucial for investors seeking to diversify their portfolio with alternative assets. Wine futures involve purchasing wine before it is bottled, offering potential high returns but carrying risks related to storage and market fluctuations. Art funds pool investor capital to invest in art pieces, requiring knowledge of art market trends and valuation complexities. Recognizing these differences helps investors manage risk, liquidity, and potential returns effectively in alternative investment strategies.

Comparison Table

| Investment Type | Wine Futures | Art Funds |

|---|---|---|

| Definition | Pre-purchasing wine before its release | Pooling capital to invest in art pieces |

| Liquidity | Moderate; can resell before release | Low; artworks take time to sell |

| Time Horizon | 1-3 years | 5-10 years |

| Risk Level | Medium; market demand and vintage quality | High; market volatility and authenticity risks |

| Potential Returns | 10-20% annually | Varies widely; 15-25% annually possible |

| Market Transparency | Moderate; regulated exchanges exist | Low; opaque pricing and valuation |

| Entry Cost | Low to moderate; single cases or bottles | High; minimum investment often substantial |

| Storage & Maintenance | Professional cellar required | Security and insurance needed |

Which is better?

Wine futures offer a unique investment opportunity tied to the anticipated appreciation of fine wines before they enter the market, leveraging limited supply and growing global demand. Art funds provide diversified portfolios managed by experts, focusing on acquiring, holding, and selling valuable artworks, which may reduce individual risk but require higher capital and longer investment horizons. The choice between wine futures and art funds depends on liquidity preferences, market knowledge, and risk tolerance, with wine futures providing potentially quicker returns and art funds offering long-term value growth.

Connection

Wine futures and art funds both represent alternative investments leveraging the appreciation potential of tangible assets. Wine futures involve purchasing vintages before release, capitalizing on demand forecasts and storage benefits, while art funds pool investor capital to acquire and manage diverse artwork portfolios aiming for capital gains. Both investment types rely on market expertise and asset rarity, offering portfolio diversification beyond traditional equities and bonds.

Key Terms

Art funds:

Art funds offer investors diversified exposure to high-value artworks by pooling capital to acquire pieces with potential appreciation, providing access to the art market without direct ownership. These funds benefit from professional management, market expertise, and varying investment strategies, which can reduce risks compared to individual art purchases. Explore the advantages and dynamics of art funds to enhance your investment portfolio.

Provenance

Art funds emphasize the importance of provenance to authenticate the artwork's origin, ownership history, and legitimacy, which directly influences its market value and investment potential. Wine futures rely heavily on vineyard provenance, vintage quality, and producer reputation to predict the wine's future worth upon release, ensuring buyer confidence in the product's uniqueness and authenticity. Explore the key differences in provenance impact on art funds and wine futures to optimize your investment strategy.

Valuation

Art funds leverage expert appraisals, auction results, and market trends to establish valuation, offering investors a diversified portfolio with potentially high returns. Wine futures rely on vineyard reputation, vintage quality, and aging potential to assess value, often requiring deep knowledge of terroir and en primeur releases. Explore detailed comparisons to understand which investment suits your portfolio's risk and growth objectives.

Source and External Links

Art Funds: Exploring Collective Investment in the Art Market - MoMAA - Art funds are collective investment schemes where investors pool capital to buy, manage, and sell diversified art portfolios professionally, aiming for financial returns through art appreciation over time.

Basics of Art Funds and their Managers, The Art Fund Association - Art funds use strategies such as "buy and hold," geographic arbitrage, emerging artists focus, and leveraging to generate returns by investing in artworks, often managing risks by diversification and co-ownership.

Invest in Art - Own Shares in Masterpieces - Yieldstreet - Yieldstreet offers an art equity fund that allows fractional ownership of a diversified portfolio of contemporary artworks, providing access to art investment with historical returns outperforming traditional markets like the S&P 500.

dowidth.com

dowidth.com