Livestock investment platforms offer opportunities focused on animal agriculture, providing returns through meat, dairy, and breeding sectors, while forestry investment platforms center on timber production, carbon credits, and ecosystem services. Both platforms provide sustainable investment alternatives with distinct asset characteristics, risks, and growth potentials shaped by environmental factors and market demand. Explore the key differences and benefits of livestock and forestry investments to diversify your portfolio effectively.

Why it is important

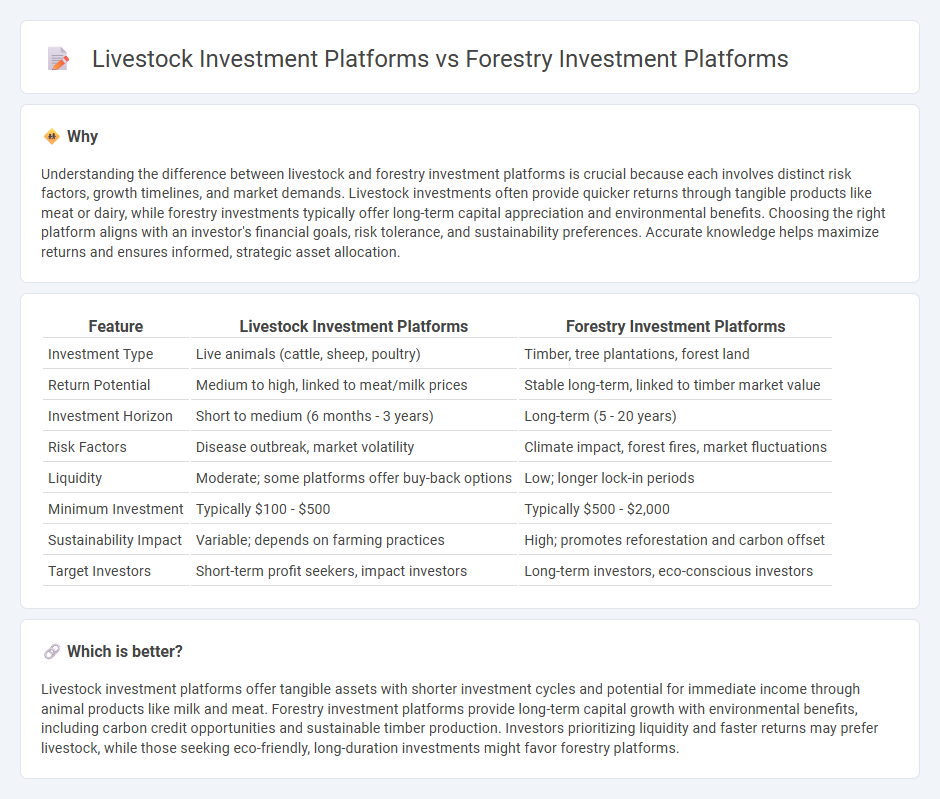

Understanding the difference between livestock and forestry investment platforms is crucial because each involves distinct risk factors, growth timelines, and market demands. Livestock investments often provide quicker returns through tangible products like meat or dairy, while forestry investments typically offer long-term capital appreciation and environmental benefits. Choosing the right platform aligns with an investor's financial goals, risk tolerance, and sustainability preferences. Accurate knowledge helps maximize returns and ensures informed, strategic asset allocation.

Comparison Table

| Feature | Livestock Investment Platforms | Forestry Investment Platforms |

|---|---|---|

| Investment Type | Live animals (cattle, sheep, poultry) | Timber, tree plantations, forest land |

| Return Potential | Medium to high, linked to meat/milk prices | Stable long-term, linked to timber market value |

| Investment Horizon | Short to medium (6 months - 3 years) | Long-term (5 - 20 years) |

| Risk Factors | Disease outbreak, market volatility | Climate impact, forest fires, market fluctuations |

| Liquidity | Moderate; some platforms offer buy-back options | Low; longer lock-in periods |

| Minimum Investment | Typically $100 - $500 | Typically $500 - $2,000 |

| Sustainability Impact | Variable; depends on farming practices | High; promotes reforestation and carbon offset |

| Target Investors | Short-term profit seekers, impact investors | Long-term investors, eco-conscious investors |

Which is better?

Livestock investment platforms offer tangible assets with shorter investment cycles and potential for immediate income through animal products like milk and meat. Forestry investment platforms provide long-term capital growth with environmental benefits, including carbon credit opportunities and sustainable timber production. Investors prioritizing liquidity and faster returns may prefer livestock, while those seeking eco-friendly, long-duration investments might favor forestry platforms.

Connection

Livestock investment platforms and forestry investment platforms both offer alternative asset classes focused on sustainable agriculture and natural resource management. These platforms enable investors to diversify portfolios by supporting environmentally responsible ventures that yield long-term financial returns. Integration of these sectors capitalizes on synergies in land use, carbon credits, and ecosystem services, enhancing overall investment resilience.

Key Terms

Asset Type (Timberland vs. Livestock)

Timberland investments offer long-term asset growth through sustainable forestry management, capitalizing on carbon credits and timber sales, while livestock investments generate income from animal husbandry and product markets such as meat and dairy. Forestry platforms emphasize ecological asset appreciation and environmental impact, whereas livestock platforms focus on operational efficiency and market volatility. Explore the detailed advantages and risks associated with each asset type to make an informed investment decision.

Biological Growth Cycle

Forestry investment platforms capitalize on the long biological growth cycles of tree species, typically spanning decades, allowing for substantial carbon sequestration and timber value appreciation over time. Livestock investment platforms focus on shorter, cyclical growth phases such as breeding, fattening, and market readiness, enabling quicker turnover and cash flow but with higher volatility linked to health and market demand. Explore detailed insights on how these biological growth dynamics impact investment returns and risk profiles.

Market Risk Factors

Forestry investment platforms are influenced by market risk factors such as timber price volatility, environmental regulations, and climate-related impacts on forest growth. In contrast, livestock investment platforms face risks including animal disease outbreaks, feed cost fluctuations, and changing consumer demand for meat products. Explore these market dynamics further to optimize your investment strategy effectively.

Source and External Links

Forestry Funds: The Emerging Star of Alternative Investments - EY - Forestry funds, also known as timber funds, are investment vehicles that invest in forested land or timber assets aiming for long-term capital growth and sustainable management, making them an emerging alternative asset class.

New Forests: Nature-based investments for a sustainable future - New Forests is a global investment manager specializing in sustainable timber plantations, conservation areas, and natural capital strategies, managing AUD 11.7 billion in assets with a focus on sustainability and shared prosperity.

Timberland - J.P. Morgan Asset Management - J.P. Morgan offers access to diversified timberland assets that provide returns with inflation protection, portfolio diversification, and sustainability benefits including carbon sequestration.

dowidth.com

dowidth.com