Fractional ownership allows investors to acquire a portion of high-value assets such as real estate, art, or luxury vehicles, providing direct equity and potential appreciation without full capital commitment. Derivatives, including options and futures, offer exposure to asset price movements through contracts without owning the underlying assets, enabling strategies for hedging or speculation. Explore the differences and benefits of fractional ownership versus derivatives to optimize your investment portfolio.

Why it is important

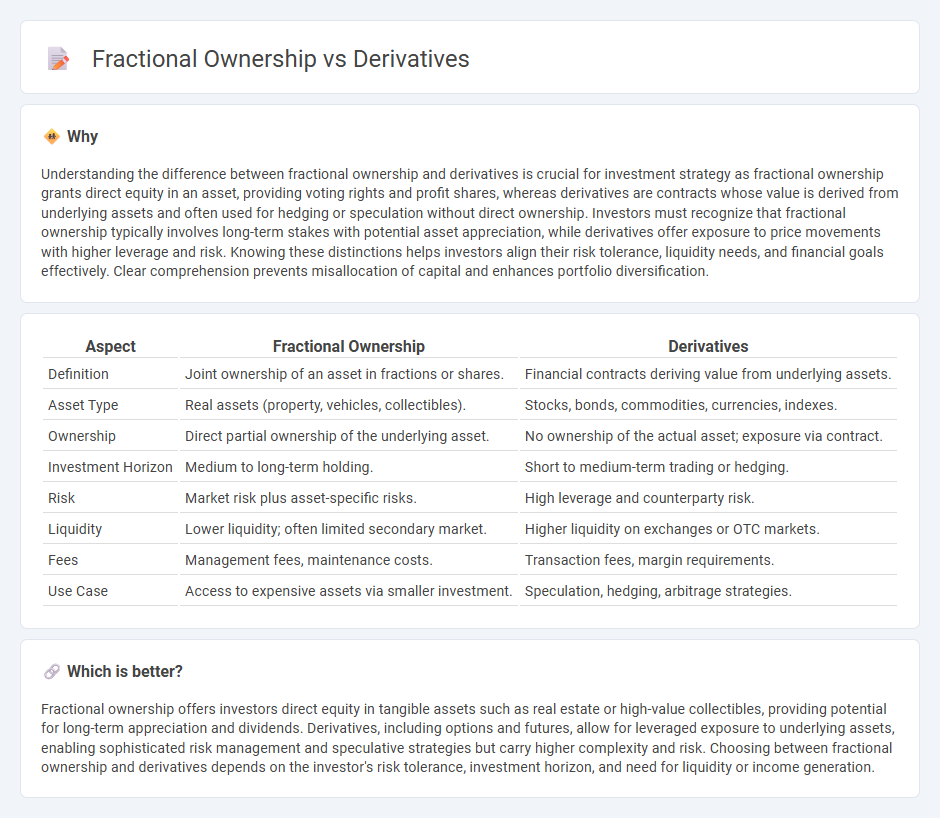

Understanding the difference between fractional ownership and derivatives is crucial for investment strategy as fractional ownership grants direct equity in an asset, providing voting rights and profit shares, whereas derivatives are contracts whose value is derived from underlying assets and often used for hedging or speculation without direct ownership. Investors must recognize that fractional ownership typically involves long-term stakes with potential asset appreciation, while derivatives offer exposure to price movements with higher leverage and risk. Knowing these distinctions helps investors align their risk tolerance, liquidity needs, and financial goals effectively. Clear comprehension prevents misallocation of capital and enhances portfolio diversification.

Comparison Table

| Aspect | Fractional Ownership | Derivatives |

|---|---|---|

| Definition | Joint ownership of an asset in fractions or shares. | Financial contracts deriving value from underlying assets. |

| Asset Type | Real assets (property, vehicles, collectibles). | Stocks, bonds, commodities, currencies, indexes. |

| Ownership | Direct partial ownership of the underlying asset. | No ownership of the actual asset; exposure via contract. |

| Investment Horizon | Medium to long-term holding. | Short to medium-term trading or hedging. |

| Risk | Market risk plus asset-specific risks. | High leverage and counterparty risk. |

| Liquidity | Lower liquidity; often limited secondary market. | Higher liquidity on exchanges or OTC markets. |

| Fees | Management fees, maintenance costs. | Transaction fees, margin requirements. |

| Use Case | Access to expensive assets via smaller investment. | Speculation, hedging, arbitrage strategies. |

Which is better?

Fractional ownership offers investors direct equity in tangible assets such as real estate or high-value collectibles, providing potential for long-term appreciation and dividends. Derivatives, including options and futures, allow for leveraged exposure to underlying assets, enabling sophisticated risk management and speculative strategies but carry higher complexity and risk. Choosing between fractional ownership and derivatives depends on the investor's risk tolerance, investment horizon, and need for liquidity or income generation.

Connection

Fractional ownership enables multiple investors to hold shares in high-value assets, increasing accessibility and liquidity in investment markets. Derivatives, such as options and futures, are often used to hedge or speculate on the value changes of these fractional interests. This connection enhances portfolio diversification and risk management strategies for investors.

Key Terms

**Derivatives:**

Derivatives are financial contracts whose value is derived from an underlying asset, index, or rate, including options, futures, and swaps, used for hedging risk or speculative purposes. These instruments allow investors to gain exposure to assets without owning them directly, providing leverage and liquidity advantages but carrying potential for significant risk. Explore detailed insights on how derivatives function and their impact on modern financial markets.

Futures Contracts

Futures contracts represent a type of derivative allowing investors to buy or sell an asset at a predetermined future date and price, offering leveraged exposure without owning the underlying asset. Unlike fractional ownership, which grants actual partial equity in an asset such as real estate or art, futures contracts are standardized agreements traded on exchanges, primarily used for hedging or speculative purposes. Explore the distinctions between these financial instruments to better understand their strategic applications and risk profiles.

Options

Options are a type of derivative allowing investors to buy or sell an asset at a predetermined price before a specific date, providing leverage and risk management opportunities. Unlike fractional ownership, where investors hold a portion of the physical asset, options offer exposure without direct asset possession. Explore more to understand how options can enhance your trading strategies and portfolio diversification.

Source and External Links

Derivative - Wikipedia - In mathematics, a derivative quantifies the sensitivity of a function's output with respect to changes in its input and includes concepts like higher-order derivatives representing rates such as velocity, acceleration, and jerk.

Derivative (finance) - Wikipedia - In finance, derivatives are contracts between parties whose value is based on an underlying asset, allowing trading of market risks without owning the asset itself.

Introduction to Derivatives - Math is Fun - Derivatives measure the slope of a function at any point and are found by calculating the limit of the ratio of changes in function value over changes in input as the input changes approach zero.

dowidth.com

dowidth.com