Investing in collectibles offers tangible assets such as art, coins, or vintage items that can appreciate in value due to rarity and demand, while mutual funds provide diversified portfolios managed by professionals, spreading risk across stocks and bonds. Collectibles may yield high returns but involve greater liquidity risk and market unpredictability, whereas mutual funds ensure regular income and are more accessible to everyday investors. Explore more to understand which investment strategy aligns with your financial goals and risk tolerance.

Why it is important

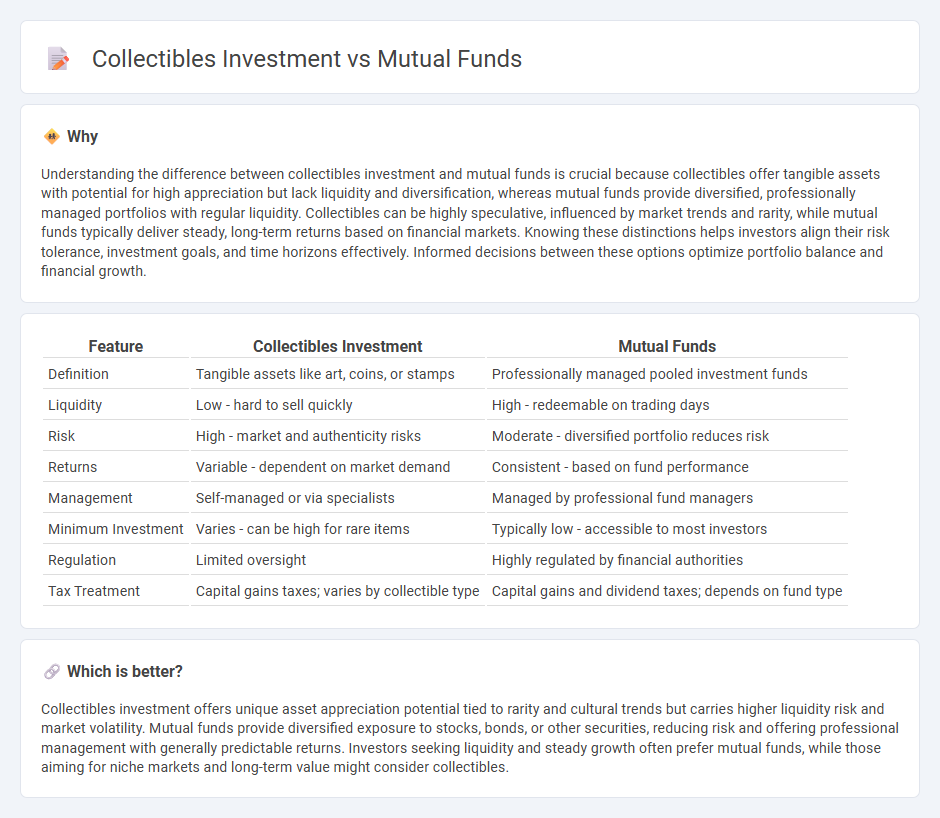

Understanding the difference between collectibles investment and mutual funds is crucial because collectibles offer tangible assets with potential for high appreciation but lack liquidity and diversification, whereas mutual funds provide diversified, professionally managed portfolios with regular liquidity. Collectibles can be highly speculative, influenced by market trends and rarity, while mutual funds typically deliver steady, long-term returns based on financial markets. Knowing these distinctions helps investors align their risk tolerance, investment goals, and time horizons effectively. Informed decisions between these options optimize portfolio balance and financial growth.

Comparison Table

| Feature | Collectibles Investment | Mutual Funds |

|---|---|---|

| Definition | Tangible assets like art, coins, or stamps | Professionally managed pooled investment funds |

| Liquidity | Low - hard to sell quickly | High - redeemable on trading days |

| Risk | High - market and authenticity risks | Moderate - diversified portfolio reduces risk |

| Returns | Variable - dependent on market demand | Consistent - based on fund performance |

| Management | Self-managed or via specialists | Managed by professional fund managers |

| Minimum Investment | Varies - can be high for rare items | Typically low - accessible to most investors |

| Regulation | Limited oversight | Highly regulated by financial authorities |

| Tax Treatment | Capital gains taxes; varies by collectible type | Capital gains and dividend taxes; depends on fund type |

Which is better?

Collectibles investment offers unique asset appreciation potential tied to rarity and cultural trends but carries higher liquidity risk and market volatility. Mutual funds provide diversified exposure to stocks, bonds, or other securities, reducing risk and offering professional management with generally predictable returns. Investors seeking liquidity and steady growth often prefer mutual funds, while those aiming for niche markets and long-term value might consider collectibles.

Connection

Collectibles investment and mutual funds are connected through portfolio diversification, as both offer unique avenues for spreading risk across different asset classes. While mutual funds pool investor money to buy stocks, bonds, or other securities, collectibles such as art, antiques, or rare coins provide alternative investments less correlated with traditional markets. This complementary relationship helps investors balance potential returns and volatility in their overall investment strategy.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investments across various asset classes such as stocks, bonds, and money markets, reducing risk through extensive portfolio management. In contrast, collectibles like art, rare coins, or antiques provide limited diversification and can be highly volatile due to market demand and rarity factors. Explore more about strategic asset allocation to optimize your investment portfolio with diversification insights.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares quickly through the stock market or fund manager, often within a single trading day. Collectibles, such as art, coins, or antiques, generally have low liquidity due to limited buyer pools and the time needed to appraise or sell items at a desirable price. Explore more about how liquidity impacts your investment strategy between mutual funds and collectibles.

Valuation

Mutual funds are valued based on their Net Asset Value (NAV), which reflects the total market value of the fund's underlying securities divided by the number of outstanding shares, ensuring a transparent and frequently updated pricing model. Collectibles, such as art or rare coins, rely on subjective valuation methods influenced by rarity, condition, and market demand, often making their pricing less liquid and more volatile. Explore the detailed valuation dynamics for both investment types to make informed financial decisions.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered investment companies that pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities, managed by professionals to provide diversification, liquidity, and relatively low minimum investments.

Mutual fund - Wikipedia - Mutual funds combine investors' money to buy a portfolio of securities and are categorized by investment type or management style (active or passive), offering benefits like diversification, professional management, and liquidity but entail fees and expenses.

Understanding mutual funds - Charles Schwab - Mutual funds pool money to buy a variety of investments, managed by professionals to provide diversification, convenience, and lower transaction costs, with a range of strategies including active and index funds.

dowidth.com

dowidth.com