The secondaries market involves buying and selling pre-existing investor commitments to private equity funds, offering liquidity and reduced risk compared to the primaries market, where investors commit capital directly to new funds at inception. Secondaries typically provide quicker returns and lower blind pool risk, while primaries enable participation in early fund stages and potential higher long-term gains. Explore deeper insights into how these markets shape investment strategies and portfolio diversification.

Why it is important

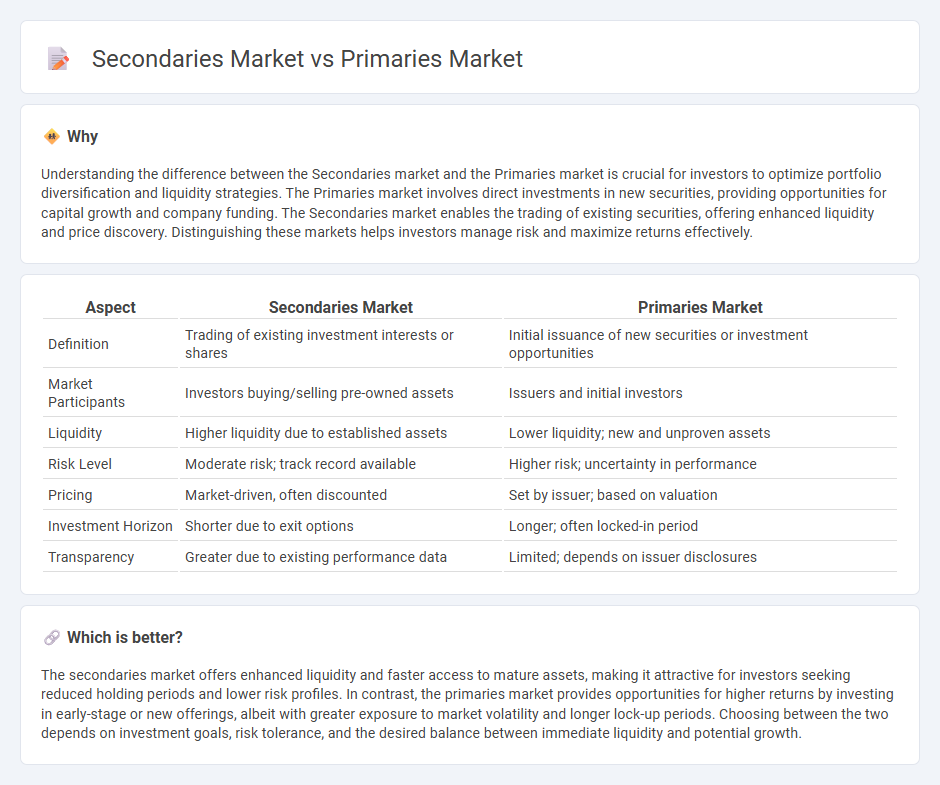

Understanding the difference between the Secondaries market and the Primaries market is crucial for investors to optimize portfolio diversification and liquidity strategies. The Primaries market involves direct investments in new securities, providing opportunities for capital growth and company funding. The Secondaries market enables the trading of existing securities, offering enhanced liquidity and price discovery. Distinguishing these markets helps investors manage risk and maximize returns effectively.

Comparison Table

| Aspect | Secondaries Market | Primaries Market |

|---|---|---|

| Definition | Trading of existing investment interests or shares | Initial issuance of new securities or investment opportunities |

| Market Participants | Investors buying/selling pre-owned assets | Issuers and initial investors |

| Liquidity | Higher liquidity due to established assets | Lower liquidity; new and unproven assets |

| Risk Level | Moderate risk; track record available | Higher risk; uncertainty in performance |

| Pricing | Market-driven, often discounted | Set by issuer; based on valuation |

| Investment Horizon | Shorter due to exit options | Longer; often locked-in period |

| Transparency | Greater due to existing performance data | Limited; depends on issuer disclosures |

Which is better?

The secondaries market offers enhanced liquidity and faster access to mature assets, making it attractive for investors seeking reduced holding periods and lower risk profiles. In contrast, the primaries market provides opportunities for higher returns by investing in early-stage or new offerings, albeit with greater exposure to market volatility and longer lock-up periods. Choosing between the two depends on investment goals, risk tolerance, and the desired balance between immediate liquidity and potential growth.

Connection

The secondaries market and primaries market are connected through the lifecycle of private equity investments, where the primaries market involves the initial direct purchase of new fund interests from private equity funds, while the secondaries market allows investors to buy and sell existing stakes in those funds before the end of their term. Transaction activity in the primaries market often drives demand in the secondaries market, as limited partners seek liquidity or portfolio rebalancing options. Price discovery and valuation trends in the secondaries market also influence investment decisions and fund-raising strategies in the primaries market.

Key Terms

Initial Public Offering (IPO)

The primary market facilitates companies raising capital through Initial Public Offerings (IPOs), where new shares are issued directly to investors, establishing the initial public valuation. In contrast, the secondary market enables trading of these shares among investors post-IPO, influencing stock liquidity and market prices without impacting the company's capital structure. Explore deeper insights on IPO dynamics and market interactions to understand investment strategies better.

Liquidity

The primary market facilitates the initial issuance of securities directly from companies to investors, providing capital formation but limited liquidity. The secondary market enables investors to buy and sell securities among themselves, offering high liquidity and price discovery. Explore more about how liquidity differences impact trading strategies and investor behavior.

Price Discovery

The primary market establishes initial price discovery through the issuance of new securities, where the offering price is influenced by underwriters' evaluation and investor demand. In contrast, the secondary market facilitates ongoing price discovery by enabling trading between investors, with prices continuously adjusted based on supply, demand, and market sentiment. Explore further to understand how these markets interact to shape asset valuation dynamically.

Source and External Links

Primary market - Wikipedia - The primary market is the capital market segment where new securities are issued and sold directly by the issuer to investors, enabling companies or governments to raise funds through IPOs or bond issues.

Primary Market - How New Securities are Issued to the Public - The primary market facilitates the issuance of new securities like IPOs and FPOs, where companies raise capital by selling new shares directly to investors before trading on secondary markets.

Glossary:Primary market - Statistics Explained - Eurostat - The primary market is where new stocks and bonds are initially sold with proceeds going to the issuer, distinguishing it from the secondary market where securities are subsequently traded among investors.

dowidth.com

dowidth.com