Music royalties platforms offer investors access to steady income streams derived from artists' intellectual property, leveraging the growing demand for digital music consumption and licensing. Private credit platforms provide alternative lending opportunities with potentially higher yields by financing businesses directly, often bypassing traditional banking channels. Explore the unique advantages and risks of both investment options to make informed decisions tailored to your financial goals.

Why it is important

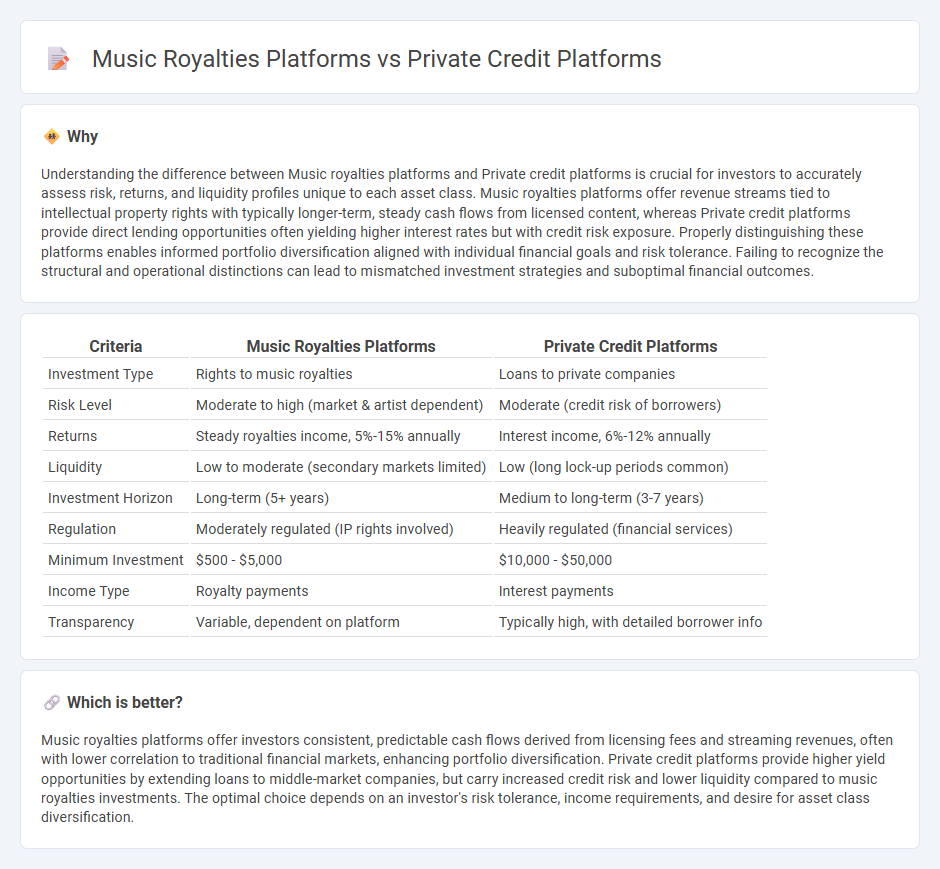

Understanding the difference between Music royalties platforms and Private credit platforms is crucial for investors to accurately assess risk, returns, and liquidity profiles unique to each asset class. Music royalties platforms offer revenue streams tied to intellectual property rights with typically longer-term, steady cash flows from licensed content, whereas Private credit platforms provide direct lending opportunities often yielding higher interest rates but with credit risk exposure. Properly distinguishing these platforms enables informed portfolio diversification aligned with individual financial goals and risk tolerance. Failing to recognize the structural and operational distinctions can lead to mismatched investment strategies and suboptimal financial outcomes.

Comparison Table

| Criteria | Music Royalties Platforms | Private Credit Platforms |

|---|---|---|

| Investment Type | Rights to music royalties | Loans to private companies |

| Risk Level | Moderate to high (market & artist dependent) | Moderate (credit risk of borrowers) |

| Returns | Steady royalties income, 5%-15% annually | Interest income, 6%-12% annually |

| Liquidity | Low to moderate (secondary markets limited) | Low (long lock-up periods common) |

| Investment Horizon | Long-term (5+ years) | Medium to long-term (3-7 years) |

| Regulation | Moderately regulated (IP rights involved) | Heavily regulated (financial services) |

| Minimum Investment | $500 - $5,000 | $10,000 - $50,000 |

| Income Type | Royalty payments | Interest payments |

| Transparency | Variable, dependent on platform | Typically high, with detailed borrower info |

Which is better?

Music royalties platforms offer investors consistent, predictable cash flows derived from licensing fees and streaming revenues, often with lower correlation to traditional financial markets, enhancing portfolio diversification. Private credit platforms provide higher yield opportunities by extending loans to middle-market companies, but carry increased credit risk and lower liquidity compared to music royalties investments. The optimal choice depends on an investor's risk tolerance, income requirements, and desire for asset class diversification.

Connection

Music royalties platforms and private credit platforms intersect through the securitization of music royalties, transforming future royalty payments into investable assets. Private credit platforms provide alternative financing by offering loans secured against these predictable revenue streams, enabling artists and rights holders to access immediate capital. This financial innovation enhances liquidity in the music industry while offering private credit investors stable, non-correlated returns.

Key Terms

Underwriting Standards

Private credit platforms implement stringent underwriting standards centered on comprehensive credit analysis, cash flow assessment, and borrower financial history to mitigate default risk. Music royalties platforms emphasize evaluating an artist's catalog performance, royalty payment consistency, and market trends to ensure accurate valuation and sustainable income streams. Explore in-depth differences in underwriting to understand risk management across these alternative investment platforms.

Recurring Revenue Streams

Private credit platforms generate consistent income by facilitating loan repayments with fixed interest schedules, ensuring predictable cash flows for investors. Music royalties platforms provide recurring revenue by allowing investors to earn a share of continuous royalty payments from music catalogs, benefiting from continuous streaming and licensing activities. Explore how these distinct recurring revenue models create diverse investment opportunities and risk profiles.

Asset Liquidity

Private credit platforms often offer higher asset liquidity by enabling investors to access secondary markets and trade loan positions, providing more flexible exit opportunities. Music royalties platforms typically exhibit lower liquidity due to the niche market and the longer-term nature of royalty payments, which limits the frequency and volume of transactions. Explore how asset liquidity variations impact investment strategies in private credit and music royalties to make informed decisions.

Source and External Links

Percent -- Private credit investing. Simplified. - Percent is a leading platform that connects both accredited and institutional investors with corporate borrowers, offering access to a marketplace of private credit deals with flexible terms, low fees, and advanced technology for deal comparison and performance tracking.

Middle Market Private Credit | Investing & Lending - ORIX USA - ORIX USA provides a broad private credit platform for the middle market, offering direct lending, growth capital, infrastructure finance, securitized credit, and syndicated loans through integrated teams with deep industry expertise and a focus on customized, long-term investor solutions.

Private Credit - Pantheon Ventures - Pantheon Ventures operates a global private credit platform investing across the entire credit spectrum, including senior secured lending and opportunistic credit strategies, with a focus on high-quality assets, downside protection, and partnerships with top-tier fund managers.

dowidth.com

dowidth.com