Vintage sneaker portfolios offer dynamic growth potential driven by the booming sneaker resale market, appealing to younger, trend-focused investors. Antique furniture funds provide stable long-term value influenced by historical rarity and craftsmanship, attracting traditional collectors and investors. Explore the unique advantages and risks of each investment to determine the best fit for your portfolio.

Why it is important

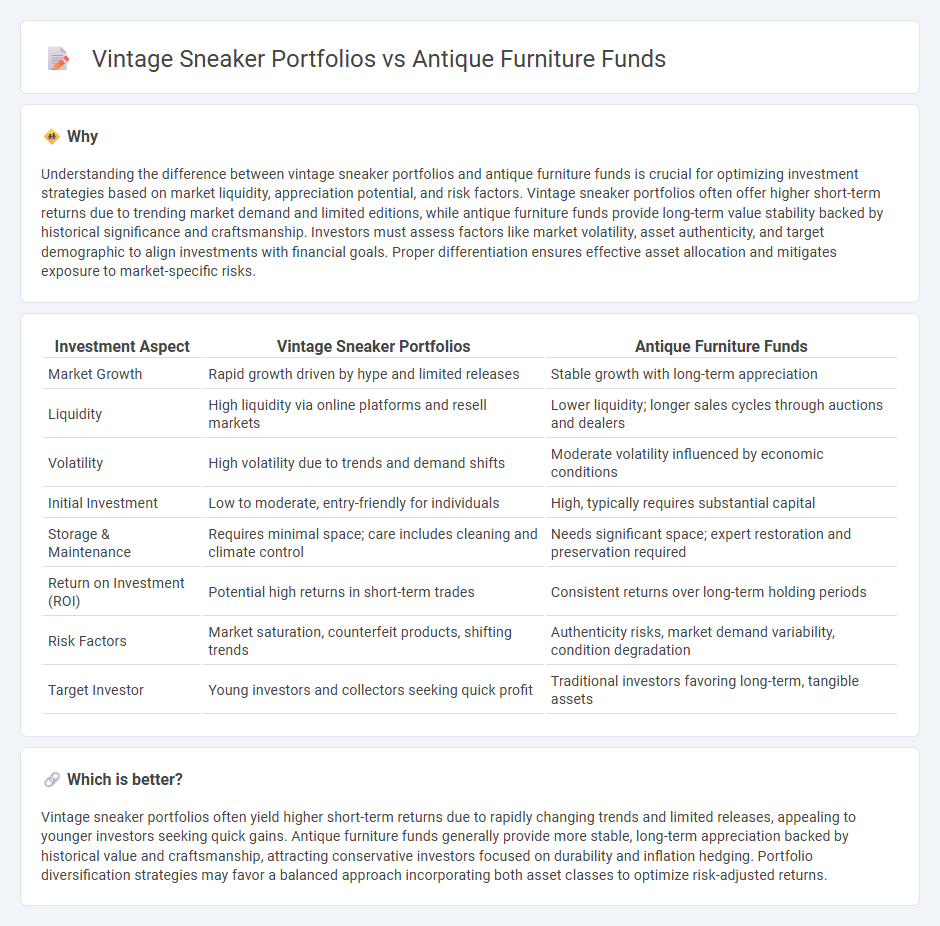

Understanding the difference between vintage sneaker portfolios and antique furniture funds is crucial for optimizing investment strategies based on market liquidity, appreciation potential, and risk factors. Vintage sneaker portfolios often offer higher short-term returns due to trending market demand and limited editions, while antique furniture funds provide long-term value stability backed by historical significance and craftsmanship. Investors must assess factors like market volatility, asset authenticity, and target demographic to align investments with financial goals. Proper differentiation ensures effective asset allocation and mitigates exposure to market-specific risks.

Comparison Table

| Investment Aspect | Vintage Sneaker Portfolios | Antique Furniture Funds |

|---|---|---|

| Market Growth | Rapid growth driven by hype and limited releases | Stable growth with long-term appreciation |

| Liquidity | High liquidity via online platforms and resell markets | Lower liquidity; longer sales cycles through auctions and dealers |

| Volatility | High volatility due to trends and demand shifts | Moderate volatility influenced by economic conditions |

| Initial Investment | Low to moderate, entry-friendly for individuals | High, typically requires substantial capital |

| Storage & Maintenance | Requires minimal space; care includes cleaning and climate control | Needs significant space; expert restoration and preservation required |

| Return on Investment (ROI) | Potential high returns in short-term trades | Consistent returns over long-term holding periods |

| Risk Factors | Market saturation, counterfeit products, shifting trends | Authenticity risks, market demand variability, condition degradation |

| Target Investor | Young investors and collectors seeking quick profit | Traditional investors favoring long-term, tangible assets |

Which is better?

Vintage sneaker portfolios often yield higher short-term returns due to rapidly changing trends and limited releases, appealing to younger investors seeking quick gains. Antique furniture funds generally provide more stable, long-term appreciation backed by historical value and craftsmanship, attracting conservative investors focused on durability and inflation hedging. Portfolio diversification strategies may favor a balanced approach incorporating both asset classes to optimize risk-adjusted returns.

Connection

Vintage sneaker portfolios and antique furniture funds are interconnected through their status as alternative investments that capitalize on the rising demand for rare, tangible assets with historical value. Both asset classes appeal to investors seeking diversification beyond traditional stocks and bonds, leveraging market trends driven by cultural significance and collector enthusiasm. Their performance often depends on scarcity, condition, provenance, and market sentiment within specialized niches.

Key Terms

Provenance

Antique furniture funds emphasize provenance through documented ownership history, authenticity certificates, and expert appraisals to establish value and minimize investment risk. Vintage sneaker portfolios rely on limited edition releases, signature collaborations, and wear patterns paired with provenance verification tools such as original receipts and sneaker authentication services. Explore how provenance enhances investment transparency and value across these unique asset classes.

Authentication

Authentication plays a crucial role in both antique furniture funds and vintage sneaker portfolios, ensuring the legitimacy and value of each asset. Expert verification, provenance documentation, and condition reports are essential for preventing fraud and maintaining investor confidence. Explore in-depth methods and strategies for authenticating these valuable collectibles to maximize your investment returns.

Market Liquidity

Antique furniture funds often face lower market liquidity due to the niche buyer base and higher transaction costs, making quick asset liquidation challenging. In contrast, vintage sneaker portfolios benefit from a growing global demand and digital marketplaces, enhancing liquidity and enabling faster sales. Discover how market liquidity impacts investment strategies in both asset classes for optimized portfolio management.

Source and External Links

Donate Collectibles to Charity - Fair Market Tax Deduction - Antique furniture donors can receive substantial tax deductions based on the current market value of their items, with appreciation over time increasing the deductible amount; donations support charitable causes and are recommended to be discussed with a CPA for tax benefits.

11 Antiques Experts Say Will Only Increase in Value Over Time - Investment advice on antique furniture highlights 20th-century Danish and French pieces, as well as vintage Louis XV and XVI reproductions, emphasizing the importance of condition and avoiding DIY refurbishment to maintain value.

A Beginner's Guide to Valuing Vintage Furniture - Antique furniture values vary by goal, with fair market value often highest and used for trade or insurance; researching comparable items online and in books helps provide accurate valuations.

dowidth.com

dowidth.com