Fine art micro-shares and agricultural farmland investing represent innovative avenues for portfolio diversification, each with distinct risk profiles and market dynamics. Fine art micro-shares allow fractional ownership of valuable artworks, providing liquidity and access to a traditionally illiquid asset class, while agricultural farmland offers tangible asset investment with income potential from crop production and land appreciation. Explore the benefits and challenges of both investment types to determine which aligns with your financial goals.

Why it is important

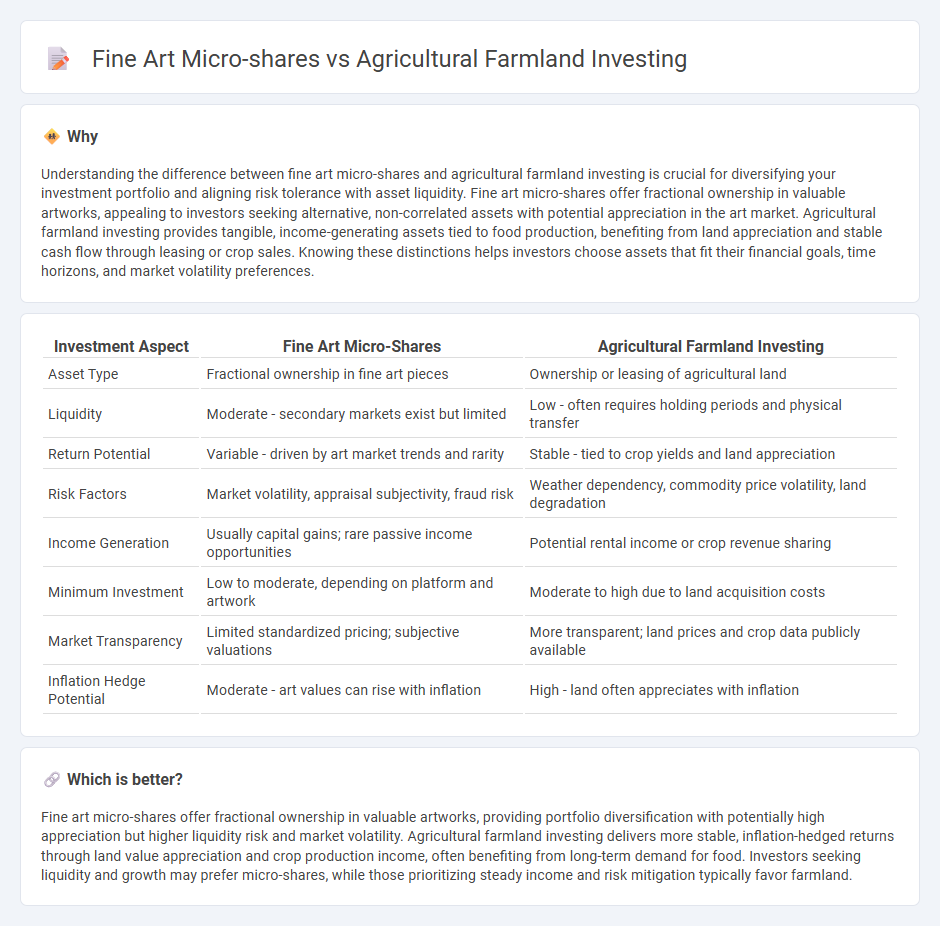

Understanding the difference between fine art micro-shares and agricultural farmland investing is crucial for diversifying your investment portfolio and aligning risk tolerance with asset liquidity. Fine art micro-shares offer fractional ownership in valuable artworks, appealing to investors seeking alternative, non-correlated assets with potential appreciation in the art market. Agricultural farmland investing provides tangible, income-generating assets tied to food production, benefiting from land appreciation and stable cash flow through leasing or crop sales. Knowing these distinctions helps investors choose assets that fit their financial goals, time horizons, and market volatility preferences.

Comparison Table

| Investment Aspect | Fine Art Micro-Shares | Agricultural Farmland Investing |

|---|---|---|

| Asset Type | Fractional ownership in fine art pieces | Ownership or leasing of agricultural land |

| Liquidity | Moderate - secondary markets exist but limited | Low - often requires holding periods and physical transfer |

| Return Potential | Variable - driven by art market trends and rarity | Stable - tied to crop yields and land appreciation |

| Risk Factors | Market volatility, appraisal subjectivity, fraud risk | Weather dependency, commodity price volatility, land degradation |

| Income Generation | Usually capital gains; rare passive income opportunities | Potential rental income or crop revenue sharing |

| Minimum Investment | Low to moderate, depending on platform and artwork | Moderate to high due to land acquisition costs |

| Market Transparency | Limited standardized pricing; subjective valuations | More transparent; land prices and crop data publicly available |

| Inflation Hedge Potential | Moderate - art values can rise with inflation | High - land often appreciates with inflation |

Which is better?

Fine art micro-shares offer fractional ownership in valuable artworks, providing portfolio diversification with potentially high appreciation but higher liquidity risk and market volatility. Agricultural farmland investing delivers more stable, inflation-hedged returns through land value appreciation and crop production income, often benefiting from long-term demand for food. Investors seeking liquidity and growth may prefer micro-shares, while those prioritizing steady income and risk mitigation typically favor farmland.

Connection

Fine art micro-shares and agricultural farmland investing both represent innovative asset classes that allow fractional ownership, lowering entry barriers for individual investors. These investment models leverage tokenization and digital platforms to enhance liquidity and diversify portfolios with tangible, alternative assets. By offering access to appreciating real-world commodities, they align investor interests with long-term value creation in physical markets.

Key Terms

**Agricultural Farmland Investing:**

Agricultural farmland investing offers tangible assets that provide consistent returns through crop yields and land appreciation, benefiting from increasing global food demand and sustainable farming trends. Farmland investments also act as inflation hedges due to rising land values and agricultural commodity prices, with the added advantage of diversification in investment portfolios. Discover more about how agricultural farmland can secure long-term wealth and impact your investment strategy.

Crop Yield

Agricultural farmland investing directly benefits from crop yield fluctuations, as higher yields increase revenue through greater commodity sales, enhancing land value and rental income potential. Fine art micro-shares remain unaffected by agricultural factors, with returns tied to art market trends rather than physical produce outcomes. Explore the distinct financial dynamics and risk profiles of these investment avenues to optimize your portfolio strategy.

Land Appreciation

Agricultural farmland investing offers tangible asset appreciation driven by rising land values, crop yields, and sustainable farming practices, often providing inflation-hedged returns. Fine art micro-shares enable fractional ownership in high-value artworks, with potential appreciation linked to artist reputation, market trends, and limited supply. Discover how each investment path leverages unique drivers for land appreciation and portfolio diversification.

Source and External Links

Investing in farmland | Nuveen - Institutional farmland investing offers strong fundamentals, inflation hedging, and portfolio diversification through exposure to global markets and different crop types such as row crops and permanent crops, with the U.S. market providing greater liquidity and regulatory clarity.

Farmland Investing - Gold Leaf Farming - Farmland REITs allow individuals to invest in shares of companies owning farmland, providing liquidity and diversification but with indirect operational control and certain legal/tax constraints, making farmland accessible without direct farm ownership.

FarmFundr | Agriculture Crowdfunding Investment Farms - Crowdfunding platforms enable accredited investors to participate in farmland investments starting with relatively low capital, benefiting from farmland's strong inflation hedging, consistent returns since 1990, and long-term demand driven by shrinking farmland supply and global population growth.

dowidth.com

dowidth.com