Forestry investment offers tangible assets with long-term growth potential through sustainable timber production, carbon credits, and biodiversity conservation, providing stability and environmental benefits. Cryptocurrency investment, characterized by high volatility and rapid market fluctuations, presents opportunities for significant short-term gains through digital asset trading and blockchain technology adoption. Explore the benefits and risks of both asset classes to determine which aligns best with your investment strategy.

Why it is important

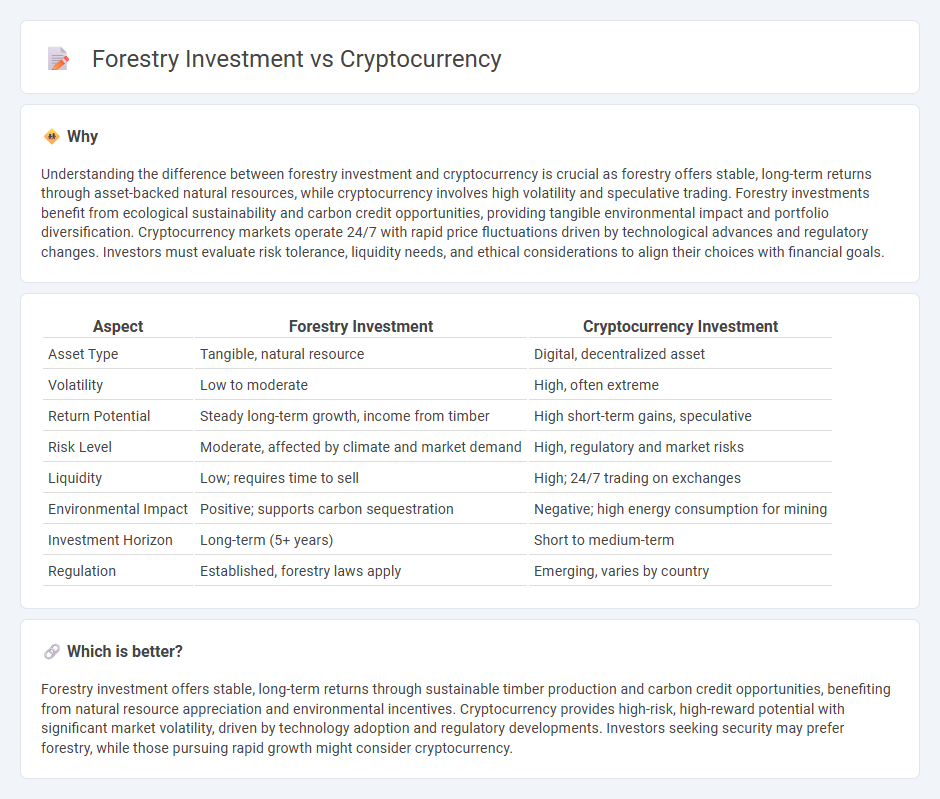

Understanding the difference between forestry investment and cryptocurrency is crucial as forestry offers stable, long-term returns through asset-backed natural resources, while cryptocurrency involves high volatility and speculative trading. Forestry investments benefit from ecological sustainability and carbon credit opportunities, providing tangible environmental impact and portfolio diversification. Cryptocurrency markets operate 24/7 with rapid price fluctuations driven by technological advances and regulatory changes. Investors must evaluate risk tolerance, liquidity needs, and ethical considerations to align their choices with financial goals.

Comparison Table

| Aspect | Forestry Investment | Cryptocurrency Investment |

|---|---|---|

| Asset Type | Tangible, natural resource | Digital, decentralized asset |

| Volatility | Low to moderate | High, often extreme |

| Return Potential | Steady long-term growth, income from timber | High short-term gains, speculative |

| Risk Level | Moderate, affected by climate and market demand | High, regulatory and market risks |

| Liquidity | Low; requires time to sell | High; 24/7 trading on exchanges |

| Environmental Impact | Positive; supports carbon sequestration | Negative; high energy consumption for mining |

| Investment Horizon | Long-term (5+ years) | Short to medium-term |

| Regulation | Established, forestry laws apply | Emerging, varies by country |

Which is better?

Forestry investment offers stable, long-term returns through sustainable timber production and carbon credit opportunities, benefiting from natural resource appreciation and environmental incentives. Cryptocurrency provides high-risk, high-reward potential with significant market volatility, driven by technology adoption and regulatory developments. Investors seeking security may prefer forestry, while those pursuing rapid growth might consider cryptocurrency.

Connection

Forestry investment and cryptocurrency intersect through blockchain technology, which enhances transparency and traceability in timber asset management and carbon credit trading. Tokenization of forestry assets allows fractional ownership, enabling investors to participate in sustainable land management with crypto-backed assets. This fusion supports eco-friendly investments while leveraging digital currencies for secure, efficient transactions.

Key Terms

Volatility

Cryptocurrency investments exhibit extreme volatility with price swings often exceeding 10% in a single day, driven by market speculation and regulatory news. Forestry investments, in contrast, offer more stable returns backed by long-term asset growth and carbon credits, with minimal sensitivity to daily market fluctuations. Explore how these divergent volatility profiles affect investment risk and portfolio diversification.

Liquidity

Cryptocurrency investments offer high liquidity due to their 24/7 trading on global exchanges, enabling quick asset conversion to cash. Forestry investments, while providing stable long-term returns and ecological benefits, typically lack liquidity with longer holding periods and limited secondary markets. Explore in-depth comparisons to determine which asset aligns best with your liquidity needs.

Sustainability

Forestry investment offers a sustainable alternative to cryptocurrency by providing tangible environmental benefits such as carbon sequestration, biodiversity conservation, and renewable timber resources. Unlike the energy-intensive computational processes in cryptocurrencies, forestry projects contribute to long-term ecological balance and climate change mitigation. Explore detailed comparisons and sustainability impacts to understand which investment aligns with your environmental goals.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital payment system operating on a decentralized blockchain without central banks, where transactions are secured by encryption and recorded on a public ledger; it originated with Bitcoin in 2009 and is used mainly for peer-to-peer payments and trading for profit.

Cryptocurrency - Wikipedia - Cryptocurrencies are digital currencies that operate on computer networks without central authorities, recorded on blockchain ledgers secured by consensus mechanisms like proof of work or stake, with Bitcoin being the first and most well-known, and as of 2025 there are over 25,000 cryptocurrencies with a market cap around $2.76 trillion.

Digital Currencies | Explainer | Education - Reserve Bank of Australia - Cryptocurrencies are digital tokens allowing direct peer-to-peer payments without intrinsic or legal tender value, characterized by high market volatility and speculative interest rather than widespread use as conventional money.

dowidth.com

dowidth.com