Litigation funding provides capital to plaintiffs involved in lawsuits in exchange for a portion of the settlement, offering an alternative investment with potential high returns uncorrelated to traditional markets. Exchange-traded funds (ETFs) are investment funds traded on stock exchanges that hold diversified portfolios of assets like stocks or bonds, promoting liquidity and passive income growth. Explore in-depth comparisons to understand which type suits your investment strategy.

Why it is important

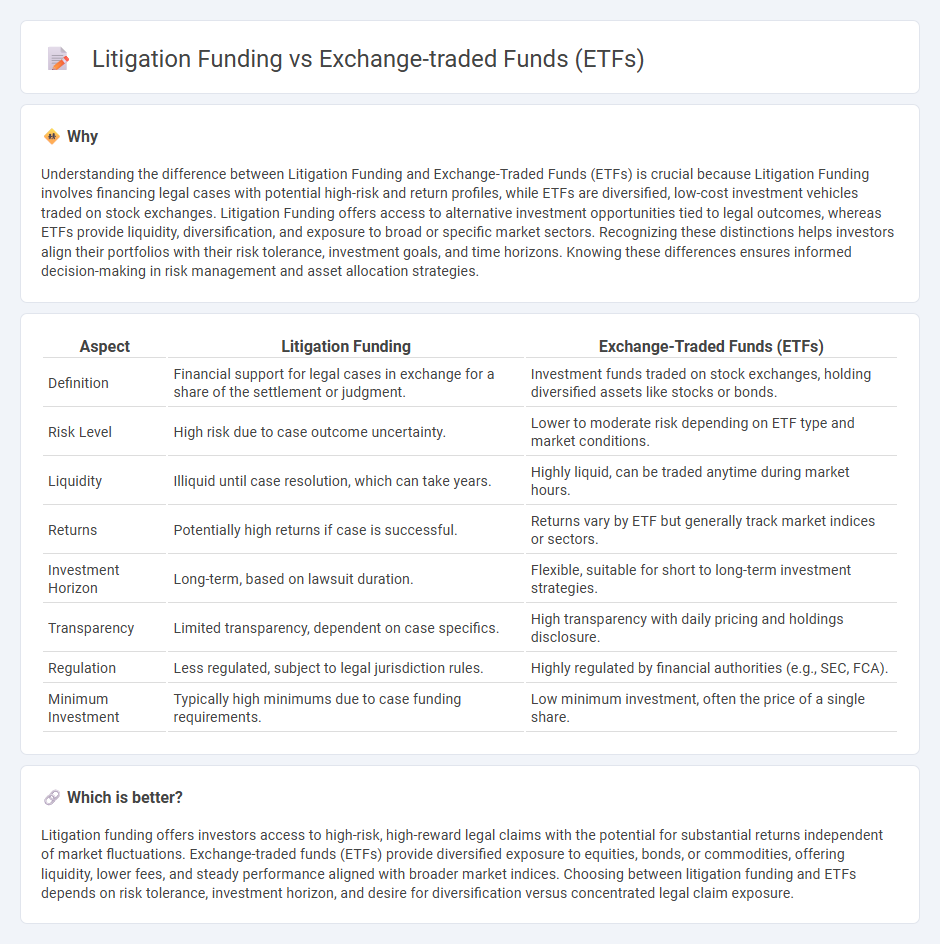

Understanding the difference between Litigation Funding and Exchange-Traded Funds (ETFs) is crucial because Litigation Funding involves financing legal cases with potential high-risk and return profiles, while ETFs are diversified, low-cost investment vehicles traded on stock exchanges. Litigation Funding offers access to alternative investment opportunities tied to legal outcomes, whereas ETFs provide liquidity, diversification, and exposure to broad or specific market sectors. Recognizing these distinctions helps investors align their portfolios with their risk tolerance, investment goals, and time horizons. Knowing these differences ensures informed decision-making in risk management and asset allocation strategies.

Comparison Table

| Aspect | Litigation Funding | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Financial support for legal cases in exchange for a share of the settlement or judgment. | Investment funds traded on stock exchanges, holding diversified assets like stocks or bonds. |

| Risk Level | High risk due to case outcome uncertainty. | Lower to moderate risk depending on ETF type and market conditions. |

| Liquidity | Illiquid until case resolution, which can take years. | Highly liquid, can be traded anytime during market hours. |

| Returns | Potentially high returns if case is successful. | Returns vary by ETF but generally track market indices or sectors. |

| Investment Horizon | Long-term, based on lawsuit duration. | Flexible, suitable for short to long-term investment strategies. |

| Transparency | Limited transparency, dependent on case specifics. | High transparency with daily pricing and holdings disclosure. |

| Regulation | Less regulated, subject to legal jurisdiction rules. | Highly regulated by financial authorities (e.g., SEC, FCA). |

| Minimum Investment | Typically high minimums due to case funding requirements. | Low minimum investment, often the price of a single share. |

Which is better?

Litigation funding offers investors access to high-risk, high-reward legal claims with the potential for substantial returns independent of market fluctuations. Exchange-traded funds (ETFs) provide diversified exposure to equities, bonds, or commodities, offering liquidity, lower fees, and steady performance aligned with broader market indices. Choosing between litigation funding and ETFs depends on risk tolerance, investment horizon, and desire for diversification versus concentrated legal claim exposure.

Connection

Litigation funding provides capital to plaintiffs in legal cases, enabling them to pursue claims without financial strain, which can indirectly impact the performance of exchange-traded funds (ETFs) that invest in litigation finance companies or related sectors. ETFs focused on alternative investments may include holdings in litigation finance firms, offering investors exposure to the litigation funding market's risk and return dynamics. This connection allows investors to diversify portfolios with assets influenced by legal industry trends and the growing field of litigation funding.

Key Terms

Liquidity

ETFs provide high liquidity by allowing investors to buy and sell shares on stock exchanges throughout the trading day, with prices updated in real-time. Litigation funding, by contrast, offers limited liquidity as returns are contingent on the resolution of legal cases, which can take months or years. Explore deeper insights into liquidity dynamics and risk factors in both investment types to make informed decisions.

Diversification

Exchange-traded funds (ETFs) offer broad market exposure and diversification across multiple asset classes, industries, and geographies, reducing individual investment risk. Litigation funding, however, involves specialized investment in legal cases, which can provide high returns but carries significant risk due to case outcomes and limited diversification. Explore how these investment strategies compare to balance potential rewards with risk management effectively.

Risk-return profile

Exchange-traded funds (ETFs) typically offer diversified exposure to markets with relatively lower risk and moderate returns, as they track broad indexes or specific sectors. Litigation funding involves financing legal cases, presenting higher risk due to the uncertainty of legal outcomes but potentially yielding substantial returns if successful. Explore deeper insights into risk-return dynamics between ETFs and litigation funding for informed investment decisions.

Source and External Links

Exchange-Traded Fund (ETF) - ETFs are investment products traded on stock exchanges that pool money to invest in a portfolio of assets like stocks or bonds, with shares representing partial ownership of the fund's portfolio and income generated; they must register with the SEC and can be more tax efficient than mutual funds.

What is an ETF (Exchange-Traded Fund)? - ETFs combine the trading flexibility of stocks with the diversification of mutual funds, allowing investors to access various asset classes affordably, with typically lower costs and greater tax efficiency than mutual funds.

Exchange-Traded Funds and Products - ETFs are pooled investment funds mainly trading on exchanges throughout the day, using authorized participants to create or redeem shares in large blocks, and they can be either passively or actively managed.

dowidth.com

dowidth.com