Blue economy funds focus on sustainable investments in ocean-based industries such as fisheries, renewable energy, and marine conservation, driving growth while protecting marine ecosystems. Microfinance funds provide financial services to underserved populations, empowering small entrepreneurs with capital and fostering economic development in low-income communities. Explore the distinct roles and impacts of blue economy and microfinance funds in shaping a balanced investment portfolio.

Why it is important

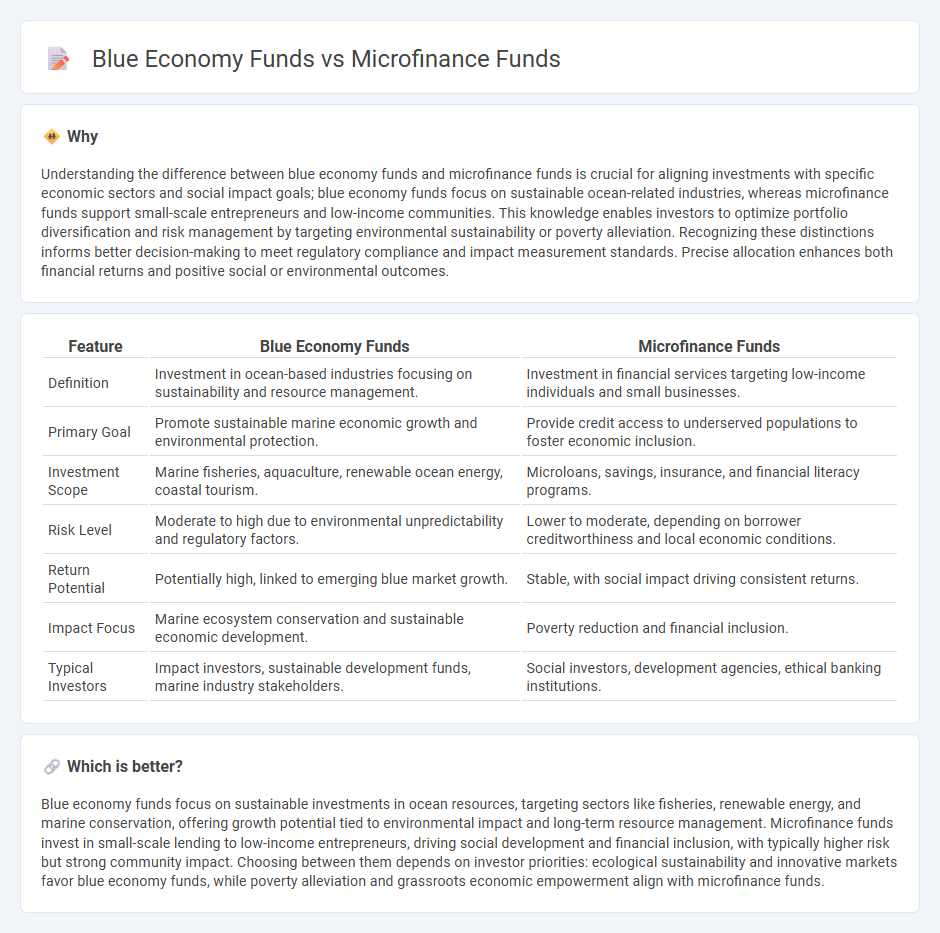

Understanding the difference between blue economy funds and microfinance funds is crucial for aligning investments with specific economic sectors and social impact goals; blue economy funds focus on sustainable ocean-related industries, whereas microfinance funds support small-scale entrepreneurs and low-income communities. This knowledge enables investors to optimize portfolio diversification and risk management by targeting environmental sustainability or poverty alleviation. Recognizing these distinctions informs better decision-making to meet regulatory compliance and impact measurement standards. Precise allocation enhances both financial returns and positive social or environmental outcomes.

Comparison Table

| Feature | Blue Economy Funds | Microfinance Funds |

|---|---|---|

| Definition | Investment in ocean-based industries focusing on sustainability and resource management. | Investment in financial services targeting low-income individuals and small businesses. |

| Primary Goal | Promote sustainable marine economic growth and environmental protection. | Provide credit access to underserved populations to foster economic inclusion. |

| Investment Scope | Marine fisheries, aquaculture, renewable ocean energy, coastal tourism. | Microloans, savings, insurance, and financial literacy programs. |

| Risk Level | Moderate to high due to environmental unpredictability and regulatory factors. | Lower to moderate, depending on borrower creditworthiness and local economic conditions. |

| Return Potential | Potentially high, linked to emerging blue market growth. | Stable, with social impact driving consistent returns. |

| Impact Focus | Marine ecosystem conservation and sustainable economic development. | Poverty reduction and financial inclusion. |

| Typical Investors | Impact investors, sustainable development funds, marine industry stakeholders. | Social investors, development agencies, ethical banking institutions. |

Which is better?

Blue economy funds focus on sustainable investments in ocean resources, targeting sectors like fisheries, renewable energy, and marine conservation, offering growth potential tied to environmental impact and long-term resource management. Microfinance funds invest in small-scale lending to low-income entrepreneurs, driving social development and financial inclusion, with typically higher risk but strong community impact. Choosing between them depends on investor priorities: ecological sustainability and innovative markets favor blue economy funds, while poverty alleviation and grassroots economic empowerment align with microfinance funds.

Connection

Blue economy funds and microfinance funds intersect through their shared focus on sustainable economic development and poverty alleviation. Blue economy funds invest in ocean-based industries such as fisheries and marine renewable energy, promoting environmental conservation alongside economic growth. Microfinance funds provide small-scale financial services to underserved coastal communities, enabling local entrepreneurs to participate in blue economy initiatives and enhance livelihoods.

Key Terms

Microfinance funds:

Microfinance funds provide capital to low-income entrepreneurs and small businesses in underserved communities, promoting financial inclusion and poverty alleviation through microloans and small-scale investments. These funds typically target sectors such as agriculture, handicrafts, and small retail operations, leveraging social impact metrics alongside financial returns. Explore how microfinance funds drive sustainable economic growth and empower marginalized populations.

Financial Inclusion

Microfinance funds primarily target underserved populations by providing small loans and financial services to promote financial inclusion and poverty alleviation, especially in developing regions. Blue economy funds focus on sustainable economic activities related to oceans, such as fisheries, renewable energy, and marine conservation, contributing indirectly to financial inclusion through job creation in coastal communities. Explore how these specialized funds drive inclusive growth and sustainable development in distinct yet complementary ways.

Small Enterprise Lending

Microfinance funds specialize in providing small loans to underserved entrepreneurs and microenterprises, promoting financial inclusion and local economic development. Blue economy funds concentrate on sustainable investments in marine and aquatic sectors, often targeting small enterprises involved in fisheries, aquaculture, and coastal tourism to bolster environmental and economic resilience. Explore how these fund types uniquely support small enterprise lending and drive inclusive growth in their respective domains.

Source and External Links

Microfinance investment for an impact - Microfinance funds invest in microfinance institutions that provide small loans to entrepreneurs and SMEs in developing countries, aiming to deliver both social impact and market-rate financial returns.

The Retail Investor's Guide to Microfinance - Retail investors can access microfinance through equity, debt, or specialized funds, offering portfolio diversification and the potential for stable returns alongside measurable social impact.

Small loans, big impact: Microfinance and Climate Resilience - Microfinance funds provide essential capital to climate-vulnerable communities, helping to build resilience, empower women, and expand economic opportunities in sectors like agriculture and tourism.

dowidth.com

dowidth.com