Sports memorabilia trading capitalizes on the growing fan base and celebrity culture, offering tangible assets like autographed items and game-worn gear that can appreciate in value with player success and historical significance. Rare book investing focuses on acquiring first editions, limited prints, and historically important manuscripts, valued for their scarcity, condition, and literary importance. Explore the unique opportunities and risks to determine which investment aligns best with your portfolio goals.

Why it is important

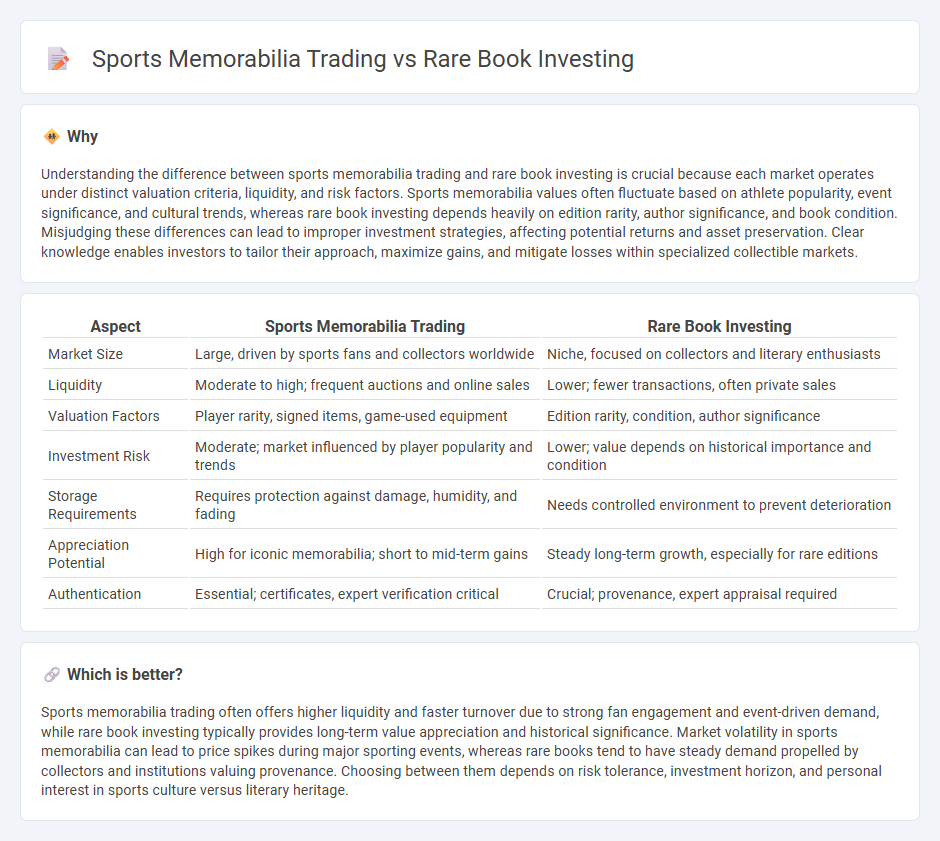

Understanding the difference between sports memorabilia trading and rare book investing is crucial because each market operates under distinct valuation criteria, liquidity, and risk factors. Sports memorabilia values often fluctuate based on athlete popularity, event significance, and cultural trends, whereas rare book investing depends heavily on edition rarity, author significance, and book condition. Misjudging these differences can lead to improper investment strategies, affecting potential returns and asset preservation. Clear knowledge enables investors to tailor their approach, maximize gains, and mitigate losses within specialized collectible markets.

Comparison Table

| Aspect | Sports Memorabilia Trading | Rare Book Investing |

|---|---|---|

| Market Size | Large, driven by sports fans and collectors worldwide | Niche, focused on collectors and literary enthusiasts |

| Liquidity | Moderate to high; frequent auctions and online sales | Lower; fewer transactions, often private sales |

| Valuation Factors | Player rarity, signed items, game-used equipment | Edition rarity, condition, author significance |

| Investment Risk | Moderate; market influenced by player popularity and trends | Lower; value depends on historical importance and condition |

| Storage Requirements | Requires protection against damage, humidity, and fading | Needs controlled environment to prevent deterioration |

| Appreciation Potential | High for iconic memorabilia; short to mid-term gains | Steady long-term growth, especially for rare editions |

| Authentication | Essential; certificates, expert verification critical | Crucial; provenance, expert appraisal required |

Which is better?

Sports memorabilia trading often offers higher liquidity and faster turnover due to strong fan engagement and event-driven demand, while rare book investing typically provides long-term value appreciation and historical significance. Market volatility in sports memorabilia can lead to price spikes during major sporting events, whereas rare books tend to have steady demand propelled by collectors and institutions valuing provenance. Choosing between them depends on risk tolerance, investment horizon, and personal interest in sports culture versus literary heritage.

Connection

Sports memorabilia trading and rare book investing are connected through their shared reliance on provenance, rarity, and condition to determine value. Both markets attract collectors who prioritize authenticity and historical significance, driving demand for unique and well-preserved items. Investment strategies in these fields focus on long-term appreciation by acquiring limited-edition pieces with strong cultural or historical associations.

Key Terms

**Rare book investing:**

Rare book investing centers on acquiring valuable first editions, limited prints, and historically significant manuscripts, often appreciating in value due to rarity, condition, and provenance. Key factors include the book's edition, author prominence, and market demand among collectors and institutions. Explore expert insights and market trends to master rare book investing strategies.

Provenance

Provenance is a critical factor in rare book investing, providing verifiable documentation of a book's history, ownership, and authenticity, which can significantly increase its market value. In sports memorabilia trading, provenance establishes the item's legitimacy through certificates, photographs, or event connections, often influencing collectors' trust and willingness to pay premium prices. Explore how provenance shapes investment decisions in both markets to enhance your collection's value and authenticity.

Edition

Rare book investing centers around first editions, signed copies, and limited prints that significantly enhance a book's value and appeal to collectors. Sports memorabilia trading emphasizes authenticated items from key games or athletes, with limited edition merchandise often commanding premium prices. Explore further to understand which edition-focused asset better aligns with your investment goals.

Source and External Links

How to invest in rare books | Square Mile - Rare books are increasingly popular investment assets due to higher demand and better market transparency via the internet, with strategies including focusing on true rarity, modern editions with unique design, or first editions by emerging authors.

Counsel From the Antique Bookworm in Me | Insights - Rare books are better collected for personal joy rather than as financial investments, as traditional securities historically offer more reliable compound growth.

Investing In Rare Books - For novice investors, select affordable first editions of classic titles like "Charlie and the Chocolate Factory" by Roald Dahl or "Secret Water" by Arthur Ransome, which can be good entry points into the rare book market.

dowidth.com

dowidth.com