Fractionalized art investment enables investors to own shares of high-value artworks, providing access to the lucrative art market with lower capital requirements and increased liquidity compared to traditional art purchases. Precious metals investing typically involves buying physical or digital assets like gold, silver, or platinum, which serve as a hedge against inflation and geopolitical risks due to their intrinsic value and market stability. Explore the differences between these investment options to discover which strategy aligns with your financial goals.

Why it is important

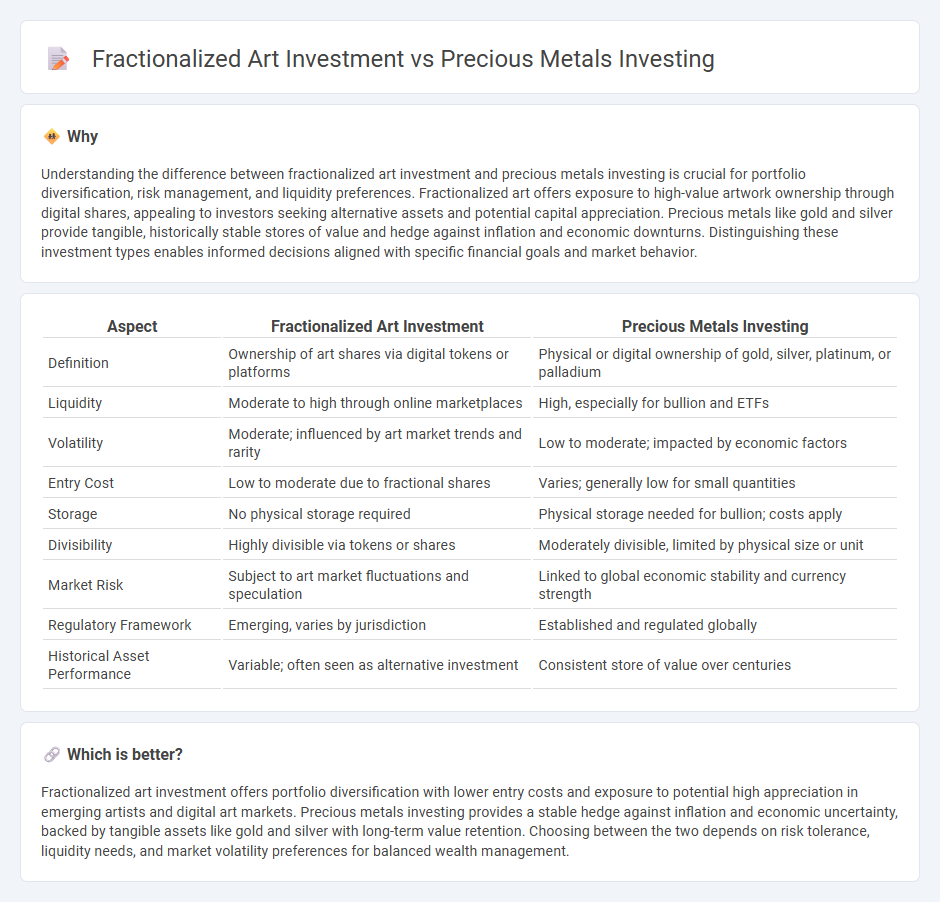

Understanding the difference between fractionalized art investment and precious metals investing is crucial for portfolio diversification, risk management, and liquidity preferences. Fractionalized art offers exposure to high-value artwork ownership through digital shares, appealing to investors seeking alternative assets and potential capital appreciation. Precious metals like gold and silver provide tangible, historically stable stores of value and hedge against inflation and economic downturns. Distinguishing these investment types enables informed decisions aligned with specific financial goals and market behavior.

Comparison Table

| Aspect | Fractionalized Art Investment | Precious Metals Investing |

|---|---|---|

| Definition | Ownership of art shares via digital tokens or platforms | Physical or digital ownership of gold, silver, platinum, or palladium |

| Liquidity | Moderate to high through online marketplaces | High, especially for bullion and ETFs |

| Volatility | Moderate; influenced by art market trends and rarity | Low to moderate; impacted by economic factors |

| Entry Cost | Low to moderate due to fractional shares | Varies; generally low for small quantities |

| Storage | No physical storage required | Physical storage needed for bullion; costs apply |

| Divisibility | Highly divisible via tokens or shares | Moderately divisible, limited by physical size or unit |

| Market Risk | Subject to art market fluctuations and speculation | Linked to global economic stability and currency strength |

| Regulatory Framework | Emerging, varies by jurisdiction | Established and regulated globally |

| Historical Asset Performance | Variable; often seen as alternative investment | Consistent store of value over centuries |

Which is better?

Fractionalized art investment offers portfolio diversification with lower entry costs and exposure to potential high appreciation in emerging artists and digital art markets. Precious metals investing provides a stable hedge against inflation and economic uncertainty, backed by tangible assets like gold and silver with long-term value retention. Choosing between the two depends on risk tolerance, liquidity needs, and market volatility preferences for balanced wealth management.

Connection

Fractionalized art investment and precious metals investing both offer accessible entry points into alternative asset classes, allowing investors to diversify portfolios beyond traditional stocks and bonds. Fractionalized art enables shared ownership of high-value artworks through blockchain technology, similar to precious metals which are divisible and tradable in small quantities. Both investment forms provide liquidity and tangible asset exposure, appealing to investors seeking long-term value preservation and inflation hedge.

Key Terms

Liquidity

Precious metals like gold and silver offer high liquidity due to their established global markets and ease of trading through various platforms, making them a preferred choice for quick asset liquidation. Fractionalized art investment, while providing access to high-value art pieces, often experiences lower liquidity because it depends on niche marketplaces and investor interest for timely sales. Explore further to understand how liquidity impacts investment strategies across these asset classes.

Ownership structure

Precious metals investment features direct ownership of physical assets such as gold or silver bars, offering tangible value and liquidity with clear legal title. Fractionalized art investment divides expensive artworks into shares, allowing multiple investors to own portions through blockchain-based tokens, which introduces complexity in legal rights and resale processes. Explore the nuances of ownership structures to determine the best fit for your investment goals.

Market volatility

Precious metals investing offers a stable hedge against market volatility due to their intrinsic value and historical performance during economic downturns. Fractionalized art investment presents higher risk with potential for greater returns, as art market cycles often fluctuate based on trends, artist reputation, and economic sentiment. Explore deeper insights on managing risk and maximizing returns in both asset classes.

Source and External Links

Investing in Precious Metals: A Guide for Beginners - Money - Explains common precious metals like gold, silver, palladium, and platinum, and details investment options including physical bullion, mining stocks, and mutual funds, emphasizing the importance of reputable dealers and market factors.

Seven things to consider when investing in precious metals - Describes portfolio diversification benefits of precious metals and investment methods such as ETFs, ETRs, precious metal certificates, and mining company shares, noting risks like management fees and company-specific performance.

Gold, Silver, Platinum, and Palladium Trading - Offers precious metals investing through physical purchases, mutual funds, and ETFs with a focus on diversification, highlights market volatility and IRA-specific regulations, and notes that metals can hedge against inflation and economic uncertainty.

dowidth.com

dowidth.com