Hedge fund replication employs quantitative models to mimic hedge fund returns by replicating key risk factors, offering lower fees and greater liquidity compared to traditional hedge funds. Private equity involves direct investments in private companies, aiming for higher returns through active management and long-term growth, but with increased illiquidity and complexity. Explore the differences between hedge fund replication and private equity to determine the best investment strategy for your portfolio.

Why it is important

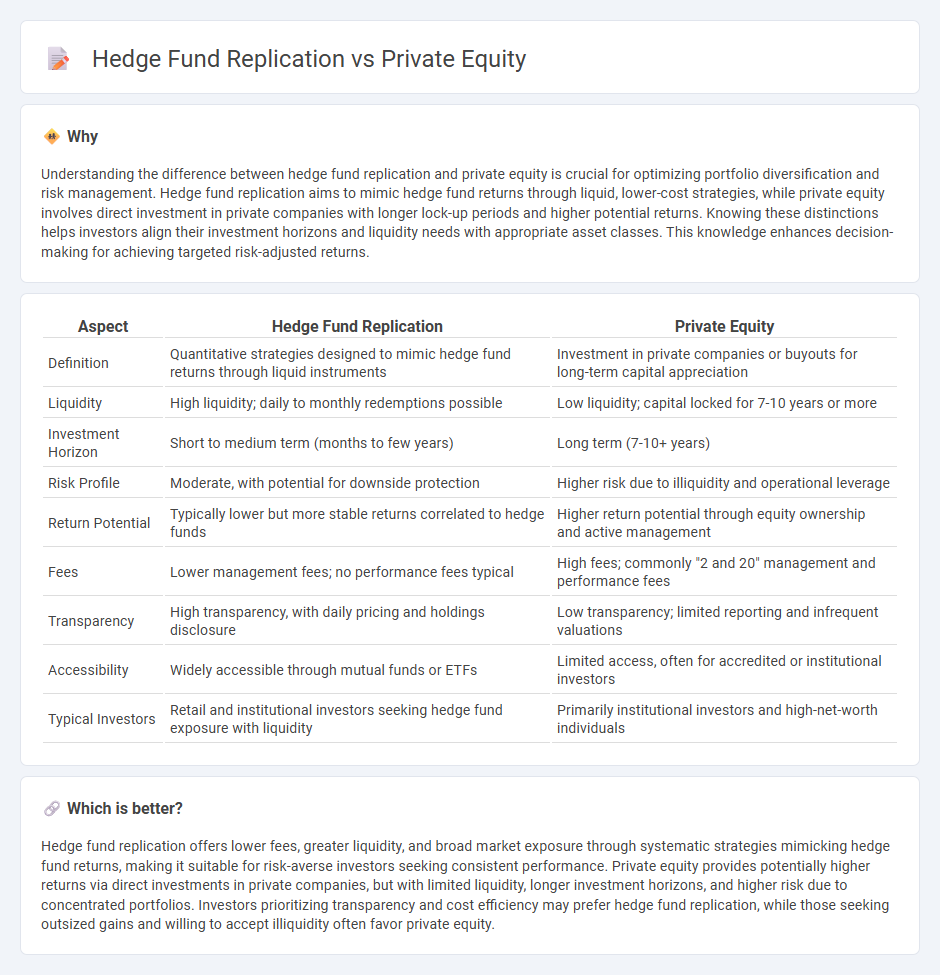

Understanding the difference between hedge fund replication and private equity is crucial for optimizing portfolio diversification and risk management. Hedge fund replication aims to mimic hedge fund returns through liquid, lower-cost strategies, while private equity involves direct investment in private companies with longer lock-up periods and higher potential returns. Knowing these distinctions helps investors align their investment horizons and liquidity needs with appropriate asset classes. This knowledge enhances decision-making for achieving targeted risk-adjusted returns.

Comparison Table

| Aspect | Hedge Fund Replication | Private Equity |

|---|---|---|

| Definition | Quantitative strategies designed to mimic hedge fund returns through liquid instruments | Investment in private companies or buyouts for long-term capital appreciation |

| Liquidity | High liquidity; daily to monthly redemptions possible | Low liquidity; capital locked for 7-10 years or more |

| Investment Horizon | Short to medium term (months to few years) | Long term (7-10+ years) |

| Risk Profile | Moderate, with potential for downside protection | Higher risk due to illiquidity and operational leverage |

| Return Potential | Typically lower but more stable returns correlated to hedge funds | Higher return potential through equity ownership and active management |

| Fees | Lower management fees; no performance fees typical | High fees; commonly "2 and 20" management and performance fees |

| Transparency | High transparency, with daily pricing and holdings disclosure | Low transparency; limited reporting and infrequent valuations |

| Accessibility | Widely accessible through mutual funds or ETFs | Limited access, often for accredited or institutional investors |

| Typical Investors | Retail and institutional investors seeking hedge fund exposure with liquidity | Primarily institutional investors and high-net-worth individuals |

Which is better?

Hedge fund replication offers lower fees, greater liquidity, and broad market exposure through systematic strategies mimicking hedge fund returns, making it suitable for risk-averse investors seeking consistent performance. Private equity provides potentially higher returns via direct investments in private companies, but with limited liquidity, longer investment horizons, and higher risk due to concentrated portfolios. Investors prioritizing transparency and cost efficiency may prefer hedge fund replication, while those seeking outsized gains and willing to accept illiquidity often favor private equity.

Connection

Hedge fund replication strategies mimic the risk-return profiles of hedge funds by using liquid assets and quantitative models, making them accessible alternatives to traditional hedge fund investments. Private equity involves direct investments in private companies, yielding less liquid but potentially higher returns. Both asset classes target alpha generation and portfolio diversification, with replication offering liquidity and cost advantages while private equity provides exposure to long-term, illiquid growth opportunities.

Key Terms

Liquidity

Private equity and hedge fund replication strategies significantly differ in terms of liquidity, with hedge fund replication typically offering greater liquidity by using liquid financial instruments to mimic hedge fund returns. Private equity investments are generally illiquid, locked in for extended periods due to the nature of direct ownership in private companies. Explore further to understand how liquidity impacts portfolio construction and risk management in these alternative investment strategies.

Fee structure

Private equity typically charges a 2% management fee and 20% performance fee, while hedge fund replication strategies often feature lower fixed fees with success-based components aligned to benchmark returns. The fee structure for private equity is designed to compensate for long-term illiquidity and active management, contrasting with the lower costs and passive management style associated with hedge fund replication. Explore our detailed fee comparison to understand the cost implications and optimize your investment strategy.

Investment strategy

Private equity investment strategy centers on acquiring and actively managing private companies to unlock value through operational improvements and growth, often involving longer holding periods and illiquid assets. Hedge fund replication aims to mimic hedge fund returns by using liquid, transparent, and cost-effective instruments, employing strategies like factor-based investing, derivatives, and systematic trading to replicate complex hedge fund exposures. Explore in-depth differences and implications of these strategies for portfolio diversification and risk management.

Source and External Links

Private equity - Wikipedia - Private equity involves investing in private companies (not publicly traded) by specialized funds, using a mix of equity and debt, with strategies focused on revenue growth, cost reduction, and operational restructuring to drive returns over several years.

What is Private Equity? - BVCA - Private equity provides medium- to long-term capital in exchange for an equity stake in unquoted companies, often through management buyouts, and works closely with company management to improve operations, drive growth, and enhance value before exiting the investment.

Private Equity Funds | Investor.gov - Private equity funds pool investor money to take controlling or significant stakes in companies, actively managing them to increase value, typically with a long-term investment horizon and less regulatory disclosure compared to public markets.

dowidth.com

dowidth.com