Fractional real estate investing offers individual investors the opportunity to buy a share of a specific property, allowing for direct ownership with lower capital requirements. Real estate syndication pools funds from multiple investors to collectively purchase larger properties managed by professional sponsors, providing diversification and passive income. Explore the benefits and differences between these investment methods to make informed decisions.

Why it is important

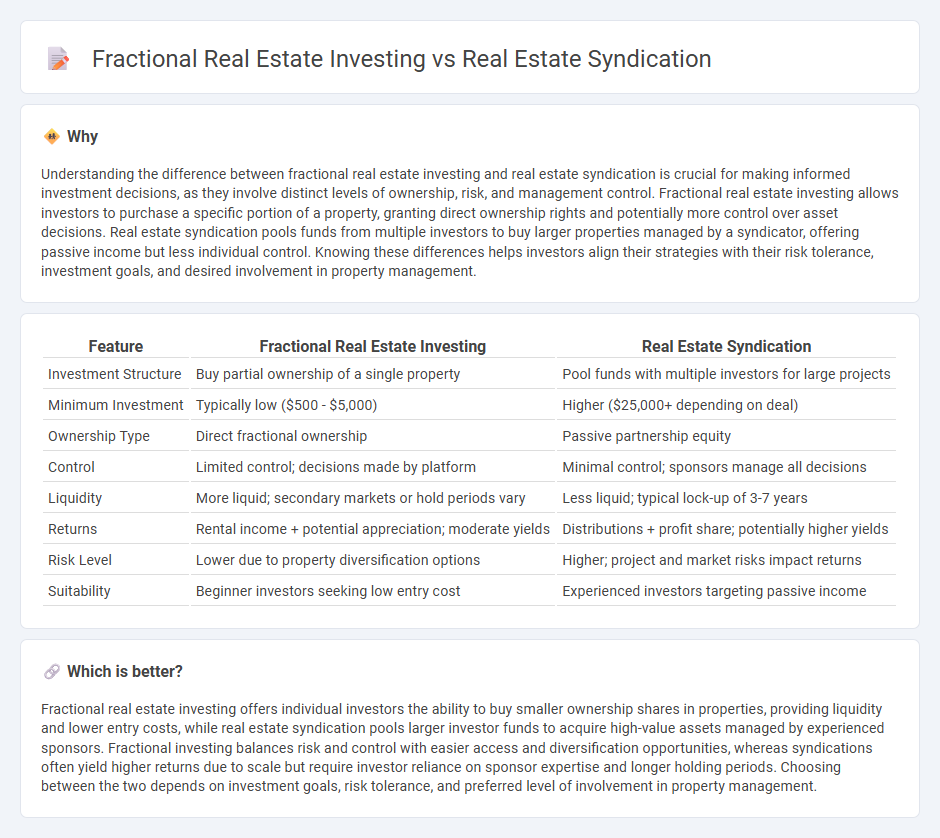

Understanding the difference between fractional real estate investing and real estate syndication is crucial for making informed investment decisions, as they involve distinct levels of ownership, risk, and management control. Fractional real estate investing allows investors to purchase a specific portion of a property, granting direct ownership rights and potentially more control over asset decisions. Real estate syndication pools funds from multiple investors to buy larger properties managed by a syndicator, offering passive income but less individual control. Knowing these differences helps investors align their strategies with their risk tolerance, investment goals, and desired involvement in property management.

Comparison Table

| Feature | Fractional Real Estate Investing | Real Estate Syndication |

|---|---|---|

| Investment Structure | Buy partial ownership of a single property | Pool funds with multiple investors for large projects |

| Minimum Investment | Typically low ($500 - $5,000) | Higher ($25,000+ depending on deal) |

| Ownership Type | Direct fractional ownership | Passive partnership equity |

| Control | Limited control; decisions made by platform | Minimal control; sponsors manage all decisions |

| Liquidity | More liquid; secondary markets or hold periods vary | Less liquid; typical lock-up of 3-7 years |

| Returns | Rental income + potential appreciation; moderate yields | Distributions + profit share; potentially higher yields |

| Risk Level | Lower due to property diversification options | Higher; project and market risks impact returns |

| Suitability | Beginner investors seeking low entry cost | Experienced investors targeting passive income |

Which is better?

Fractional real estate investing offers individual investors the ability to buy smaller ownership shares in properties, providing liquidity and lower entry costs, while real estate syndication pools larger investor funds to acquire high-value assets managed by experienced sponsors. Fractional investing balances risk and control with easier access and diversification opportunities, whereas syndications often yield higher returns due to scale but require investor reliance on sponsor expertise and longer holding periods. Choosing between the two depends on investment goals, risk tolerance, and preferred level of involvement in property management.

Connection

Fractional real estate investing and real estate syndication both enable multiple investors to pool funds for property acquisition, reducing individual capital requirements and risk exposure. Fractional investing divides property ownership into smaller shares, allowing investors to buy fractions of high-value assets, while syndication organizes a group of investors under a lead sponsor to manage larger real estate projects collectively. These methods enhance market accessibility, diversify investment portfolios, and provide passive income opportunities through shared property revenue.

Key Terms

Ownership structure

Real estate syndication involves multiple investors pooling funds to collectively own and manage a property, typically through a limited partnership or LLC, where a syndicator handles operations and investors have passive ownership. Fractional real estate investing grants individuals specific ownership shares in a property, giving them direct equity and proportional rights in the asset without an intermediary managing the investment. Explore detailed differences in ownership structure and benefits to choose the best investment path fitting your goals.

Liquidity

Real estate syndication offers limited liquidity as investors typically commit capital for the duration of the project, which can span several years until property sale or refinancing occurs. Fractional real estate investing provides greater liquidity by allowing investors to buy and sell shares in properties on secondary markets or through structured platforms. Explore more insights on how liquidity impacts your real estate investment strategy.

Minimum investment

Real estate syndication typically requires a minimum investment ranging from $25,000 to $50,000, with investors pooling capital to acquire larger properties under a professional management team. Fractional real estate investing usually has a lower entry point, starting around $5,000 to $10,000, allowing individuals to purchase shares of a single property without full ownership responsibilities. Explore detailed comparisons to determine which investment suits your financial goals and risk appetite.

Source and External Links

Real Estate Syndicates and Investment Trusts - Real estate syndication allows multiple investors to pool their capital under a sponsor's management to invest in properties that require more financing than a single buyer could provide, typically involving a three-phase cycle: origination, operation, and disposition.

An Introduction to Real Estate Syndication - Real estate syndication is an organized partnership (often as an LLC or LP) where unrelated investors pool money for a specific real estate opportunity, managed by a syndicator (sponsor), enabling investment in larger, otherwise unaffordable properties.

Real Estate Syndications vs. REITs for Investors - Real estate syndications involve direct property ownership by pooled investors, with a sponsor managing the investment and operations, offering participants a share in specific real estate assets.

dowidth.com

dowidth.com