Investment in wine futures offers unique opportunities for portfolio diversification through acquiring wine at current prices before it is bottled and released, potentially yielding significant returns as rare vintages appreciate in value. Collectible cars combine passion with value growth, with models from renowned manufacturers like Ferrari and Porsche often experiencing substantial long-term appreciation due to their rarity and historical significance. Explore the distinctive benefits and risks of wine futures versus collectible cars to determine the investment strategy that aligns with your financial goals.

Why it is important

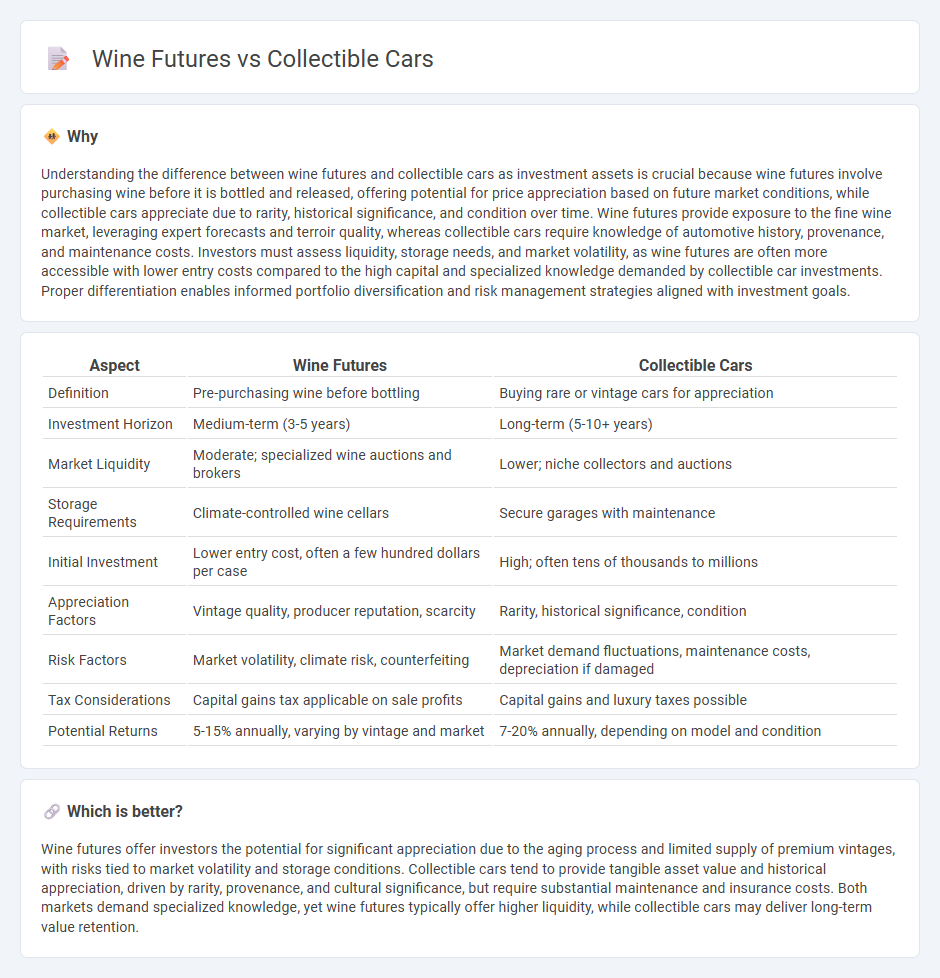

Understanding the difference between wine futures and collectible cars as investment assets is crucial because wine futures involve purchasing wine before it is bottled and released, offering potential for price appreciation based on future market conditions, while collectible cars appreciate due to rarity, historical significance, and condition over time. Wine futures provide exposure to the fine wine market, leveraging expert forecasts and terroir quality, whereas collectible cars require knowledge of automotive history, provenance, and maintenance costs. Investors must assess liquidity, storage needs, and market volatility, as wine futures are often more accessible with lower entry costs compared to the high capital and specialized knowledge demanded by collectible car investments. Proper differentiation enables informed portfolio diversification and risk management strategies aligned with investment goals.

Comparison Table

| Aspect | Wine Futures | Collectible Cars |

|---|---|---|

| Definition | Pre-purchasing wine before bottling | Buying rare or vintage cars for appreciation |

| Investment Horizon | Medium-term (3-5 years) | Long-term (5-10+ years) |

| Market Liquidity | Moderate; specialized wine auctions and brokers | Lower; niche collectors and auctions |

| Storage Requirements | Climate-controlled wine cellars | Secure garages with maintenance |

| Initial Investment | Lower entry cost, often a few hundred dollars per case | High; often tens of thousands to millions |

| Appreciation Factors | Vintage quality, producer reputation, scarcity | Rarity, historical significance, condition |

| Risk Factors | Market volatility, climate risk, counterfeiting | Market demand fluctuations, maintenance costs, depreciation if damaged |

| Tax Considerations | Capital gains tax applicable on sale profits | Capital gains and luxury taxes possible |

| Potential Returns | 5-15% annually, varying by vintage and market | 7-20% annually, depending on model and condition |

Which is better?

Wine futures offer investors the potential for significant appreciation due to the aging process and limited supply of premium vintages, with risks tied to market volatility and storage conditions. Collectible cars tend to provide tangible asset value and historical appreciation, driven by rarity, provenance, and cultural significance, but require substantial maintenance and insurance costs. Both markets demand specialized knowledge, yet wine futures typically offer higher liquidity, while collectible cars may deliver long-term value retention.

Connection

Wine futures and collectible cars both serve as alternative investment assets that appeal to collectors seeking value appreciation outside traditional markets. Both investments rely heavily on rarity, provenance, and market demand to drive prices, making expert knowledge and authentic certification critical for success. Their illiquid nature and potential for high returns attract investors interested in tangible luxury goods with cultural and historical significance.

Key Terms

Appreciation

Collectible cars have shown an average annual appreciation rate of 5-10%, driven by rarity, condition, and historical significance, while wine futures offer returns typically around 7-12%, influenced by vintage quality and storage conditions. Both assets face market volatility but provide diversification benefits in alternative investment portfolios. Explore detailed performance comparisons and risk factors to decide which asset aligns best with your investment strategy.

Liquidity

Collectible cars offer niche liquidity, driven by enthusiast demand and auction visibility, yet transactions can be sporadic due to valuation volatility and maintenance costs. Wine futures provide comparatively higher liquidity through established contracts traded in wine markets, facilitating earlier access to emerging vintages but with risks tied to market speculation and storage conditions. Explore detailed comparisons of liquidity profiles in collectible cars and wine futures to make informed investment decisions.

Provenance

Provenance plays a crucial role in both collectible cars and wine futures, as documented history significantly impacts value and authenticity. In collectible cars, well-maintained ownership records, original parts, and verified service history enhance desirability and market price. Explore detailed provenance strategies to maximize investment potential in these luxury assets.

Source and External Links

Collectible Cars & Diecast Vehicles - Mattel Creations - Discover exclusive collectible diecast cars, including limited-edition Hot Wheels and Matchbox models, crafted for collectors seeking precise detail and cultural significance.

Explore Diecast Model Cars - Fairfield Collectibles - Browse a wide range of meticulously detailed diecast replicas, from classic muscle cars to modern supercars, available in various scales for both collectors and hobbyists.

Classic Cars for Sale - Collector Car Marketplace - Hemmings - Shop for authentic classic and collector cars, including muscle cars, vintage trucks, and exotics, from trusted sellers across the U.S..

dowidth.com

dowidth.com