Music royalties investing offers a unique revenue stream backed by intellectual property rights and consistent royalty payments, while farmland investing provides tangible asset value with potential income from crop production and land appreciation. Both asset classes present diversified opportunities, but music royalties tend to deliver passive income with lower maintenance, whereas farmland requires active management and exposure to agricultural risks. Explore the detailed comparison to determine which investment aligns best with your financial goals.

Why it is important

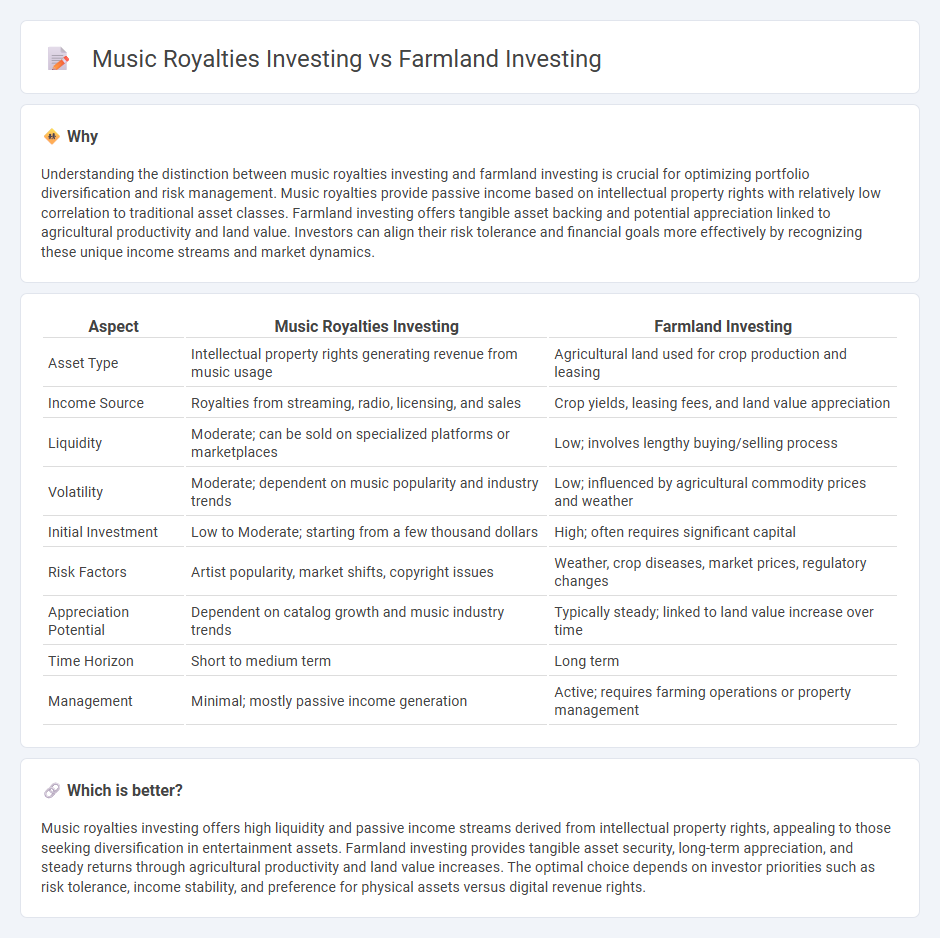

Understanding the distinction between music royalties investing and farmland investing is crucial for optimizing portfolio diversification and risk management. Music royalties provide passive income based on intellectual property rights with relatively low correlation to traditional asset classes. Farmland investing offers tangible asset backing and potential appreciation linked to agricultural productivity and land value. Investors can align their risk tolerance and financial goals more effectively by recognizing these unique income streams and market dynamics.

Comparison Table

| Aspect | Music Royalties Investing | Farmland Investing |

|---|---|---|

| Asset Type | Intellectual property rights generating revenue from music usage | Agricultural land used for crop production and leasing |

| Income Source | Royalties from streaming, radio, licensing, and sales | Crop yields, leasing fees, and land value appreciation |

| Liquidity | Moderate; can be sold on specialized platforms or marketplaces | Low; involves lengthy buying/selling process |

| Volatility | Moderate; dependent on music popularity and industry trends | Low; influenced by agricultural commodity prices and weather |

| Initial Investment | Low to Moderate; starting from a few thousand dollars | High; often requires significant capital |

| Risk Factors | Artist popularity, market shifts, copyright issues | Weather, crop diseases, market prices, regulatory changes |

| Appreciation Potential | Dependent on catalog growth and music industry trends | Typically steady; linked to land value increase over time |

| Time Horizon | Short to medium term | Long term |

| Management | Minimal; mostly passive income generation | Active; requires farming operations or property management |

Which is better?

Music royalties investing offers high liquidity and passive income streams derived from intellectual property rights, appealing to those seeking diversification in entertainment assets. Farmland investing provides tangible asset security, long-term appreciation, and steady returns through agricultural productivity and land value increases. The optimal choice depends on investor priorities such as risk tolerance, income stability, and preference for physical assets versus digital revenue rights.

Connection

Music royalties investing and farmland investing both provide alternative income streams through asset-backed cash flows, appealing to investors seeking diversification beyond traditional stocks and bonds. These investments generate steady, predictable returns by leveraging intellectual property rights and agricultural land's intrinsic value, respectively. Their connection lies in offering long-term, inflation-resistant income with relatively low correlation to conventional financial markets.

Key Terms

**Farmland Investing:**

Farmland investing offers stable returns driven by increasing global food demand and limited arable land, providing a hedge against inflation and long-term capital appreciation. This asset class benefits from predictable cash flows through crop yields and government subsidies, with a relatively low correlation to traditional markets. Explore how farmland investments can diversify your portfolio and secure sustainable income by learning more.

Crop Yield

Farmland investing offers returns closely tied to crop yield, which fluctuates based on factors like weather conditions, soil health, and crop prices. In contrast, music royalties provide more predictable income streams, largely unaffected by seasonal or environmental variables impacting agriculture. Explore the detailed comparison for insights on optimizing your investment portfolio.

Land Appreciation

Farmland investing offers substantial land appreciation potential driven by rising agricultural demand and limited arable land supply. Music royalties investing provides income through rights payments but lacks tangible asset appreciation tied to market inflation or scarcity. Explore how each investment aligns with your financial goals and growth strategies.

Source and External Links

Farmland Investing - Goldleaf - Farmland investing can be accessed through various methods including direct farm purchase, Farmland REITs which offer liquidity and diversification, although REITs rely on long-term tenants for farm operation which can misalign incentives between landowners and operators.

Investing in Farmland - Nuveen - Farmland investing offers stable returns and inflation hedging with a variety of asset types like row crops and permanent crops; investors can choose domestic or global exposure to diversify risk and benefit from different markets and agricultural products.

Best Farmland Investing Platforms - Benzinga - Platforms like AcreTrader and FarmTogether allow individuals to invest in farmland with varying approaches including direct ownership, REIT shares, and agriculture stocks, with management handled by the platform to simplify the process and provide income through yields and appreciation.

dowidth.com

dowidth.com