Sports memorabilia investment offers unique opportunities tied to cultural significance and athlete legacy, often resulting in high appreciation for rare items such as signed jerseys and championship memorabilia. Precious metals investment, including gold and silver, provides a stable hedge against inflation and economic uncertainty, backed by intrinsic value and global demand. Explore the differences between these asset classes to make informed investment decisions.

Why it is important

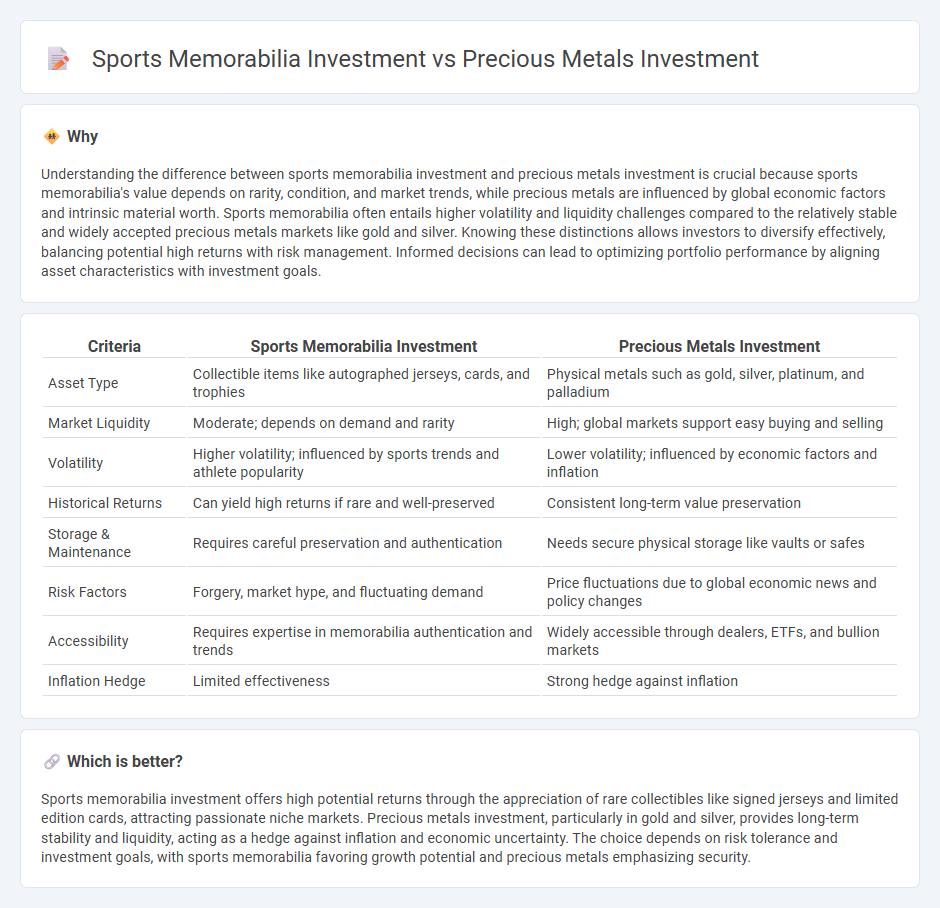

Understanding the difference between sports memorabilia investment and precious metals investment is crucial because sports memorabilia's value depends on rarity, condition, and market trends, while precious metals are influenced by global economic factors and intrinsic material worth. Sports memorabilia often entails higher volatility and liquidity challenges compared to the relatively stable and widely accepted precious metals markets like gold and silver. Knowing these distinctions allows investors to diversify effectively, balancing potential high returns with risk management. Informed decisions can lead to optimizing portfolio performance by aligning asset characteristics with investment goals.

Comparison Table

| Criteria | Sports Memorabilia Investment | Precious Metals Investment |

|---|---|---|

| Asset Type | Collectible items like autographed jerseys, cards, and trophies | Physical metals such as gold, silver, platinum, and palladium |

| Market Liquidity | Moderate; depends on demand and rarity | High; global markets support easy buying and selling |

| Volatility | Higher volatility; influenced by sports trends and athlete popularity | Lower volatility; influenced by economic factors and inflation |

| Historical Returns | Can yield high returns if rare and well-preserved | Consistent long-term value preservation |

| Storage & Maintenance | Requires careful preservation and authentication | Needs secure physical storage like vaults or safes |

| Risk Factors | Forgery, market hype, and fluctuating demand | Price fluctuations due to global economic news and policy changes |

| Accessibility | Requires expertise in memorabilia authentication and trends | Widely accessible through dealers, ETFs, and bullion markets |

| Inflation Hedge | Limited effectiveness | Strong hedge against inflation |

Which is better?

Sports memorabilia investment offers high potential returns through the appreciation of rare collectibles like signed jerseys and limited edition cards, attracting passionate niche markets. Precious metals investment, particularly in gold and silver, provides long-term stability and liquidity, acting as a hedge against inflation and economic uncertainty. The choice depends on risk tolerance and investment goals, with sports memorabilia favoring growth potential and precious metals emphasizing security.

Connection

Sports memorabilia investment and precious metals investment are connected through their shared role as alternative assets that offer portfolio diversification and hedge against market volatility. Both asset classes exhibit intrinsic value and are influenced by rarity, condition, and market demand, making them appealing to investors seeking long-term appreciation. Collectors and investors often leverage these tangible assets to preserve wealth and capitalize on niche markets distinct from traditional stocks and bonds.

Key Terms

**Precious metals investment:**

Investing in precious metals like gold, silver, platinum, and palladium offers a reliable hedge against inflation and currency fluctuations, with global markets providing high liquidity and transparent pricing. These metals serve as a store of value during economic uncertainty, supported by historical demand across industries such as electronics, jewelry, and central bank reserves. Discover the strategic benefits and market dynamics of precious metals investment to diversify your portfolio effectively.

Bullion

Bullion, including gold and silver bars and coins, offers a highly liquid and globally recognized form of investment with intrinsic value tied to precious metals' market demand. Unlike sports memorabilia, which can be subject to fluctuating collector interest and market trends, bullion provides a more stable hedge against inflation and economic uncertainty. Explore detailed insights and strategies to understand the advantages of bullion within your diversified investment portfolio.

Purity

Precious metals investment centers on purity standards such as 99.99% gold or silver content, which directly impacts market value and liquidity. In contrast, sports memorabilia investment relies on authenticity and condition, with purity referring more to provenance than material composition. Explore the nuances of purity in these investment types to make more informed decisions.

Source and External Links

Investing in Precious Metals: A Guide for Beginners - Money - Investors can invest in precious metals such as gold, silver, palladium, and platinum through physical bullion (coins, bars, rounds) or by purchasing mining company stocks and mutual funds that reflect the metal prices, though stocks may be more influenced by market forces than the metals themselves.

Seven things to consider when investing in precious metals - TD Bank - Precious metals like gold, silver, and platinum help diversify portfolios by reducing correlation with stock and bond markets; investment options include physical metals, futures contracts, and secure storage, although physical forms require safeguarding against theft.

Investor Advisory: Precious Metals and Coin Investments - Mutual funds and exchange-traded funds (ETFs) are accessible ways to gain exposure to precious metals and mining companies, offering lower risk and liquidity, though they involve fees and certain tax implications impacting returns.

dowidth.com

dowidth.com