Music royalties investing offers artists and investors a unique opportunity to earn passive income from existing or future song revenues, leveraging the growing global music market valued at over $60 billion. Peer-to-peer lending connects borrowers directly with investors, providing higher returns compared to traditional savings accounts, with global P2P market size expected to reach $558 billion by 2027. Discover the distinct benefits and risks of these alternative investments to diversify your portfolio effectively.

Why it is important

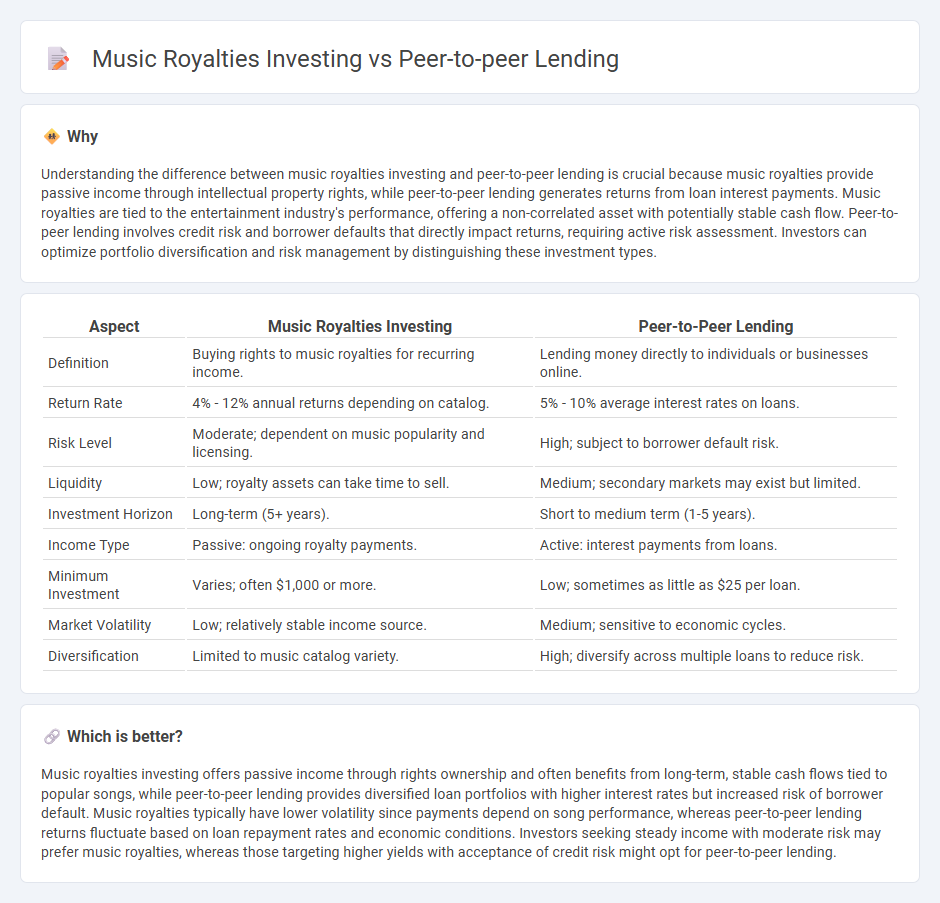

Understanding the difference between music royalties investing and peer-to-peer lending is crucial because music royalties provide passive income through intellectual property rights, while peer-to-peer lending generates returns from loan interest payments. Music royalties are tied to the entertainment industry's performance, offering a non-correlated asset with potentially stable cash flow. Peer-to-peer lending involves credit risk and borrower defaults that directly impact returns, requiring active risk assessment. Investors can optimize portfolio diversification and risk management by distinguishing these investment types.

Comparison Table

| Aspect | Music Royalties Investing | Peer-to-Peer Lending |

|---|---|---|

| Definition | Buying rights to music royalties for recurring income. | Lending money directly to individuals or businesses online. |

| Return Rate | 4% - 12% annual returns depending on catalog. | 5% - 10% average interest rates on loans. |

| Risk Level | Moderate; dependent on music popularity and licensing. | High; subject to borrower default risk. |

| Liquidity | Low; royalty assets can take time to sell. | Medium; secondary markets may exist but limited. |

| Investment Horizon | Long-term (5+ years). | Short to medium term (1-5 years). |

| Income Type | Passive: ongoing royalty payments. | Active: interest payments from loans. |

| Minimum Investment | Varies; often $1,000 or more. | Low; sometimes as little as $25 per loan. |

| Market Volatility | Low; relatively stable income source. | Medium; sensitive to economic cycles. |

| Diversification | Limited to music catalog variety. | High; diversify across multiple loans to reduce risk. |

Which is better?

Music royalties investing offers passive income through rights ownership and often benefits from long-term, stable cash flows tied to popular songs, while peer-to-peer lending provides diversified loan portfolios with higher interest rates but increased risk of borrower default. Music royalties typically have lower volatility since payments depend on song performance, whereas peer-to-peer lending returns fluctuate based on loan repayment rates and economic conditions. Investors seeking steady income with moderate risk may prefer music royalties, whereas those targeting higher yields with acceptance of credit risk might opt for peer-to-peer lending.

Connection

Music royalties investing and peer-to-peer lending both serve as alternative investment opportunities that provide investors with diversified income streams outside traditional financial markets. Each allows individuals to directly fund assets or projects--music royalties generate revenue through licensing and streaming, while peer-to-peer lending involves lending capital to borrowers in exchange for interest payments. Both markets leverage digital platforms that enhance accessibility, transparency, and liquidity for investors seeking passive income and portfolio diversification.

Key Terms

Platform Risk

Peer-to-peer lending platforms face significant platform risk due to borrower default and regulatory changes impacting loan repayment and platform viability. Music royalties investing carries platform risk through the potential failure of rights management services and marketplace liquidity constraints that affect royalty income distribution. Explore the nuances of platform risk in alternative investments to make informed financial decisions.

Diversification

Peer-to-peer lending offers diversification by spreading investments across numerous borrowers, mitigating risk through portfolio variety. Music royalties investing provides diversification through asset class exposure, generating income from diverse musical catalogs and streaming platforms. Explore these investment avenues in depth to enhance your portfolio diversification strategy.

Passive Income

Peer-to-peer lending offers fixed returns through interest payments by lending money directly to individuals or businesses, making it a relatively predictable passive income source. Music royalties investing provides income generated from the rights to songs, offering potential for long-term earnings tied to the success of the music catalog. Explore detailed comparisons and strategies to optimize your passive income portfolio.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer lending is a method where individuals borrow and lend money directly via specialized online platforms, bypassing banks, offering borrowers potentially easier qualification and lenders a new investment opportunity with interest earnings.

Peer-to-peer lending - Wikipedia - P2P lending is an online financial service where lenders and borrowers are matched through platforms that handle credit checks, payments, and loan servicing without traditional financial intermediaries, often offering unsecured loans and marketing through social networks.

Peer to peer lending: what you need to know - Peer-to-peer lending platforms connect lenders and borrowers directly, offering higher interest rates than traditional savings but with higher risk, and often allow lenders to distribute funds across multiple borrowers to manage risk.

dowidth.com

dowidth.com