Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions, such as reforestation or renewable energy initiatives, to balance out carbon footprints. Blue bonds are debt instruments specifically designed to finance marine and ocean conservation efforts, supporting sustainable fisheries, pollution reduction, and coastal habitat restoration. Explore the unique benefits and impacts of these green investment strategies to make informed decisions for a sustainable future.

Why it is important

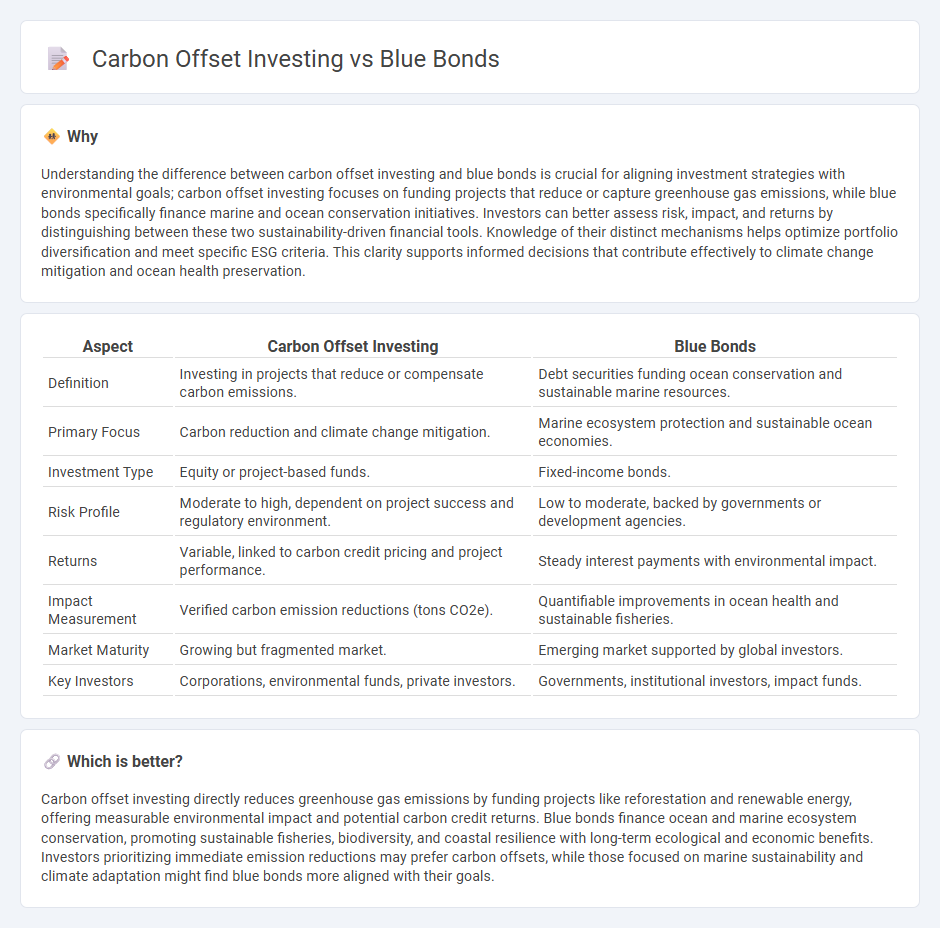

Understanding the difference between carbon offset investing and blue bonds is crucial for aligning investment strategies with environmental goals; carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions, while blue bonds specifically finance marine and ocean conservation initiatives. Investors can better assess risk, impact, and returns by distinguishing between these two sustainability-driven financial tools. Knowledge of their distinct mechanisms helps optimize portfolio diversification and meet specific ESG criteria. This clarity supports informed decisions that contribute effectively to climate change mitigation and ocean health preservation.

Comparison Table

| Aspect | Carbon Offset Investing | Blue Bonds |

|---|---|---|

| Definition | Investing in projects that reduce or compensate carbon emissions. | Debt securities funding ocean conservation and sustainable marine resources. |

| Primary Focus | Carbon reduction and climate change mitigation. | Marine ecosystem protection and sustainable ocean economies. |

| Investment Type | Equity or project-based funds. | Fixed-income bonds. |

| Risk Profile | Moderate to high, dependent on project success and regulatory environment. | Low to moderate, backed by governments or development agencies. |

| Returns | Variable, linked to carbon credit pricing and project performance. | Steady interest payments with environmental impact. |

| Impact Measurement | Verified carbon emission reductions (tons CO2e). | Quantifiable improvements in ocean health and sustainable fisheries. |

| Market Maturity | Growing but fragmented market. | Emerging market supported by global investors. |

| Key Investors | Corporations, environmental funds, private investors. | Governments, institutional investors, impact funds. |

Which is better?

Carbon offset investing directly reduces greenhouse gas emissions by funding projects like reforestation and renewable energy, offering measurable environmental impact and potential carbon credit returns. Blue bonds finance ocean and marine ecosystem conservation, promoting sustainable fisheries, biodiversity, and coastal resilience with long-term ecological and economic benefits. Investors prioritizing immediate emission reductions may prefer carbon offsets, while those focused on marine sustainability and climate adaptation might find blue bonds more aligned with their goals.

Connection

Carbon offset investing funds projects that reduce or capture greenhouse gas emissions, while blue bonds finance ocean conservation and sustainable marine activities. Both investment strategies aim to address environmental challenges by channeling capital into measurable ecological benefits, such as carbon sequestration and ocean health restoration. Integrating carbon offset investing with blue bonds creates synergistic opportunities to mitigate climate change and protect marine ecosystems through sustainable finance.

Key Terms

Ocean conservation

Blue bonds finance ocean conservation projects by channeling capital into sustainable fisheries, marine protected areas, and pollution reduction. Carbon offset investing focuses on reducing carbon emissions by funding projects that absorb or avoid greenhouse gases, including blue carbon initiatives like mangrove restoration. Explore the differences and benefits of these investment strategies to support ocean health more effectively.

Emissions reduction

Blue bonds finance marine and ocean conservation projects that directly reduce emissions by protecting carbon-rich ecosystems like mangroves and seagrasses, which capture significant CO2. Carbon offset investing funds activities such as reforestation or renewable energy projects that compensate for emissions by balancing carbon footprints elsewhere. Explore how these approaches contribute uniquely to global emissions reduction strategies.

Impact measurement

Blue bonds finance projects that protect marine ecosystems while generating measurable environmental and social benefits, using impact metrics like ocean health indices and biodiversity preservation rates. Carbon offset investing focuses on quantifying greenhouse gas emissions reductions through verified carbon credits or sequestration projects, emphasizing accurate measurement of CO2 equivalent reductions. Explore detailed methodologies and case studies to understand which impact measurement approach aligns best with your sustainability goals.

Source and External Links

Blue Bonds - NAP Global Network - Blue bonds are a type of green bond focused on marine resource betterment, financing projects like mangrove restoration, marine protected areas, water management, and coastal climate adaptation, with guidelines provided by the IFC and Asian Development Bank to launch and impact these bonds.

Blue Finance - IFC - Blue bonds and loans are financial tools raised for investment in ocean-related projects such as water management and marine plastics reduction, with IFC having mobilized over $2 billion since 2020, including pioneering blue bonds in East Asia Pacific countries like the Philippines and Thailand.

Blue bonds | Orsted - Orsted's blue bond supports resilient renewable energy projects that enhance marine ecosystems and the sustainable ocean economy, contributing to biodiversity and water quality improvements through partnerships and are part of a broader effort to close the global blue finance gap.

dowidth.com

dowidth.com