Wine investing offers unique portfolio diversification through tangible assets with potential value appreciation linked to vintage quality and scarcity, while real estate investing provides stable cash flow and equity growth driven by market demand and location. Both investment types involve different risk profiles; wine investments depend heavily on market trends and storage conditions, whereas real estate is influenced by economic cycles and property management. Explore detailed comparisons to determine which asset aligns best with your investment goals.

Why it is important

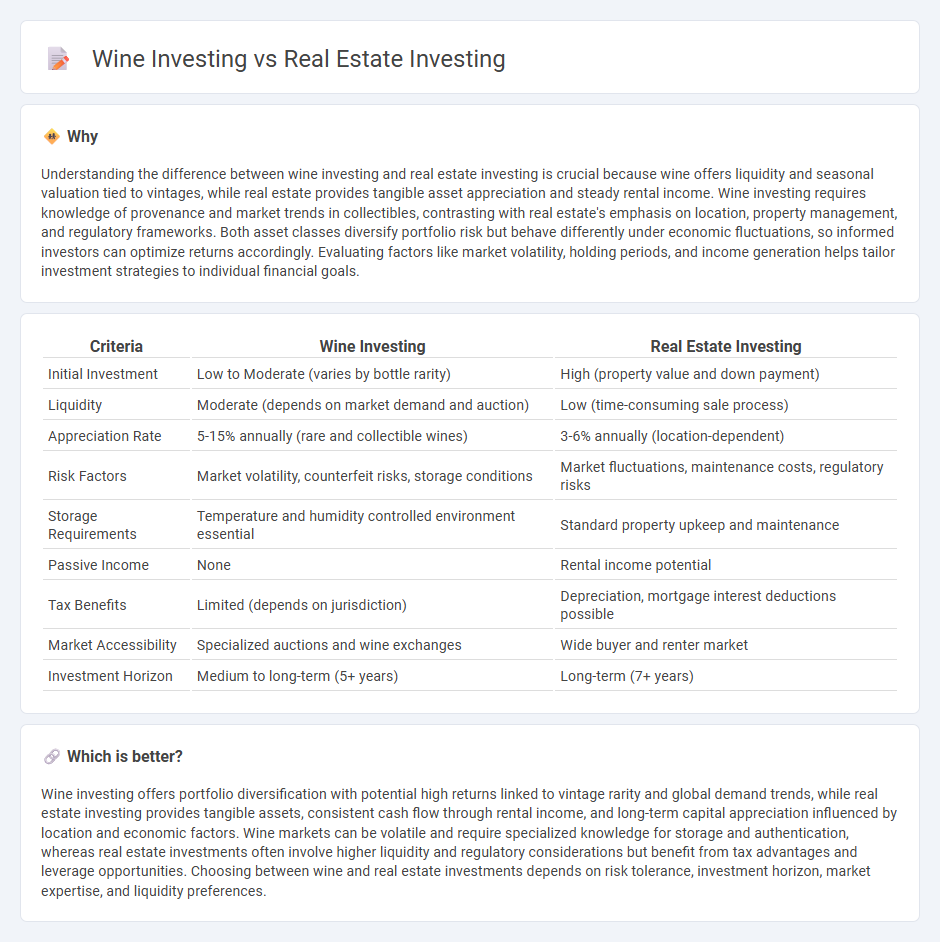

Understanding the difference between wine investing and real estate investing is crucial because wine offers liquidity and seasonal valuation tied to vintages, while real estate provides tangible asset appreciation and steady rental income. Wine investing requires knowledge of provenance and market trends in collectibles, contrasting with real estate's emphasis on location, property management, and regulatory frameworks. Both asset classes diversify portfolio risk but behave differently under economic fluctuations, so informed investors can optimize returns accordingly. Evaluating factors like market volatility, holding periods, and income generation helps tailor investment strategies to individual financial goals.

Comparison Table

| Criteria | Wine Investing | Real Estate Investing |

|---|---|---|

| Initial Investment | Low to Moderate (varies by bottle rarity) | High (property value and down payment) |

| Liquidity | Moderate (depends on market demand and auction) | Low (time-consuming sale process) |

| Appreciation Rate | 5-15% annually (rare and collectible wines) | 3-6% annually (location-dependent) |

| Risk Factors | Market volatility, counterfeit risks, storage conditions | Market fluctuations, maintenance costs, regulatory risks |

| Storage Requirements | Temperature and humidity controlled environment essential | Standard property upkeep and maintenance |

| Passive Income | None | Rental income potential |

| Tax Benefits | Limited (depends on jurisdiction) | Depreciation, mortgage interest deductions possible |

| Market Accessibility | Specialized auctions and wine exchanges | Wide buyer and renter market |

| Investment Horizon | Medium to long-term (5+ years) | Long-term (7+ years) |

Which is better?

Wine investing offers portfolio diversification with potential high returns linked to vintage rarity and global demand trends, while real estate investing provides tangible assets, consistent cash flow through rental income, and long-term capital appreciation influenced by location and economic factors. Wine markets can be volatile and require specialized knowledge for storage and authentication, whereas real estate investments often involve higher liquidity and regulatory considerations but benefit from tax advantages and leverage opportunities. Choosing between wine and real estate investments depends on risk tolerance, investment horizon, market expertise, and liquidity preferences.

Connection

Wine investing and real estate investing are connected through their shared potential for long-term asset appreciation and portfolio diversification. Both asset classes benefit from scarcity and location-based value, where fine wine vintages and prime real estate properties increase in worth due to limited supply and high demand. Investors leverage market trends, expert appraisals, and historical data to optimize returns in these tangible asset markets.

Key Terms

Real Estate Investing:

Real estate investing offers tangible asset ownership with potential for steady rental income and property value appreciation, making it a popular choice for portfolio diversification. Unlike wine investing, real estate provides leverage opportunities through mortgages and tax benefits such as depreciation deductions, enhancing overall returns. Explore comprehensive strategies to maximize your real estate investments and secure long-term financial growth.

Cash Flow

Real estate investing generates consistent cash flow through rental income, providing investors with predictable monthly returns and potential property appreciation. In contrast, wine investing typically lacks regular cash flow and relies on long-term value appreciation, influenced by rarity, vintage quality, and market demand. Explore the key factors shaping cash flow outcomes in both asset classes to optimize your investment strategy.

Appreciation

Real estate investing typically offers steady appreciation driven by location, market demand, and property improvements, often yielding long-term value growth and income through rental returns. Wine investing appreciates based on rarity, vintage, provenance, and market trends, with fine wines appreciating substantially over decades in niche collector markets. Explore detailed comparisons to understand which asset class best aligns with your financial goals and risk tolerance.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Real estate investing can be approached through REITs, online platforms, rental properties, property flipping, or renting out, offering options from low maintenance to active management.

4 ways to invest in real estate - Fidelity - Common ways to invest include purchasing a home, investing in REITs or mutual funds/ETFs, and becoming a landlord, each with distinct benefits such as equity building and potential tax advantages.

Real estate investment made easy - Yieldstreet - Yieldstreet offers access to private real estate investments with minimums starting at $10,000, highlighting real estate's historical ability to outpace inflation and provide diversified portfolio exposure.

dowidth.com

dowidth.com