Virtual land real estate offers unique investment opportunities in digital worlds with scarcity-driven value and potential for high returns, while commodities provide tangible assets like gold, oil, and agricultural products with historically stable demand and inflation-hedging properties. Both asset classes have distinct market dynamics, risk profiles, and liquidity factors important for diversifying an investment portfolio. Explore more to understand which investment aligns best with your financial goals.

Why it is important

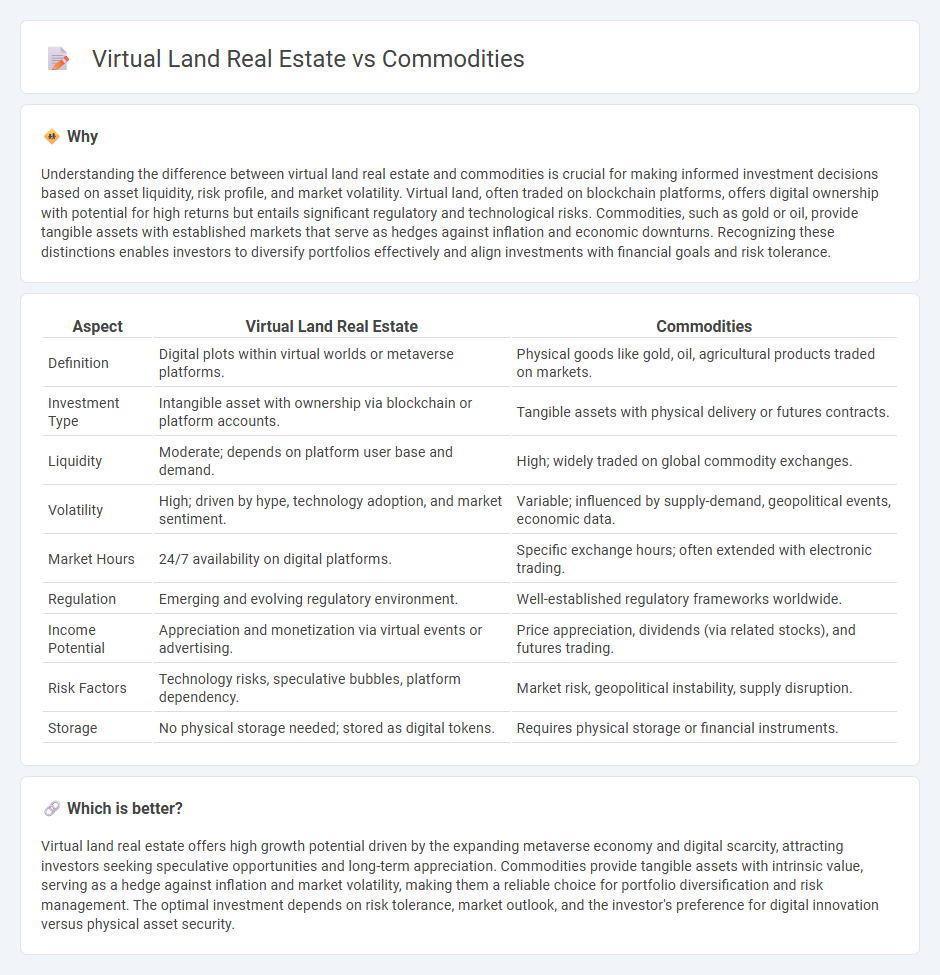

Understanding the difference between virtual land real estate and commodities is crucial for making informed investment decisions based on asset liquidity, risk profile, and market volatility. Virtual land, often traded on blockchain platforms, offers digital ownership with potential for high returns but entails significant regulatory and technological risks. Commodities, such as gold or oil, provide tangible assets with established markets that serve as hedges against inflation and economic downturns. Recognizing these distinctions enables investors to diversify portfolios effectively and align investments with financial goals and risk tolerance.

Comparison Table

| Aspect | Virtual Land Real Estate | Commodities |

|---|---|---|

| Definition | Digital plots within virtual worlds or metaverse platforms. | Physical goods like gold, oil, agricultural products traded on markets. |

| Investment Type | Intangible asset with ownership via blockchain or platform accounts. | Tangible assets with physical delivery or futures contracts. |

| Liquidity | Moderate; depends on platform user base and demand. | High; widely traded on global commodity exchanges. |

| Volatility | High; driven by hype, technology adoption, and market sentiment. | Variable; influenced by supply-demand, geopolitical events, economic data. |

| Market Hours | 24/7 availability on digital platforms. | Specific exchange hours; often extended with electronic trading. |

| Regulation | Emerging and evolving regulatory environment. | Well-established regulatory frameworks worldwide. |

| Income Potential | Appreciation and monetization via virtual events or advertising. | Price appreciation, dividends (via related stocks), and futures trading. |

| Risk Factors | Technology risks, speculative bubbles, platform dependency. | Market risk, geopolitical instability, supply disruption. |

| Storage | No physical storage needed; stored as digital tokens. | Requires physical storage or financial instruments. |

Which is better?

Virtual land real estate offers high growth potential driven by the expanding metaverse economy and digital scarcity, attracting investors seeking speculative opportunities and long-term appreciation. Commodities provide tangible assets with intrinsic value, serving as a hedge against inflation and market volatility, making them a reliable choice for portfolio diversification and risk management. The optimal investment depends on risk tolerance, market outlook, and the investor's preference for digital innovation versus physical asset security.

Connection

Virtual land real estate and commodities intersect as alternative investment classes offering portfolio diversification and inflation hedging opportunities. Virtual land in blockchain-based metaverses derives value similarly to physical commodities through scarcity and demand dynamics influenced by digital economies. Investors leverage commodities like gold or oil to balance risk while exploring virtual real estate for speculative growth driven by technological adoption and digital asset tokenization.

Key Terms

Tangibility

Commodities like gold and oil possess physical tangibility, allowing direct ownership and traditional trading with measurable supply constraints, unlike virtual land real estate which exists solely in digital environments such as metaverse platforms. Virtual land relies on blockchain technology for ownership verification and offers unique opportunities for digital interactions and developments without physical limitations. Explore the differences and potential of tangible commodities versus digital real estate to understand evolving investment landscapes.

Volatility

Commodities like oil and gold exhibit high volatility due to geopolitical events and supply-demand imbalances, often experiencing sharp price fluctuations within short periods. Virtual land real estate in metaverses can show even greater volatility driven by speculative trading and platform developments, influenced by user engagement and platform popularity. Explore deeper insights into volatility patterns and investment risks in commodities versus virtual land real estate markets.

Liquidity

Commodities like gold and oil offer high liquidity due to established global markets and continuous trading, whereas virtual land real estate in metaverses often faces lower liquidity driven by niche platforms and fewer buyers. Market volatility in commodities can impact liquidity quickly, while virtual land liquidity depends heavily on platform popularity, user engagement, and blockchain technology integration. Explore the intricacies of liquidity differences between traditional commodities and virtual land real estate to understand the potential risks and opportunities.

Source and External Links

Understanding Commodities - PIMCO - Commodities are raw materials such as agricultural products, energy, and metals that serve as a distinct asset class with returns largely independent of stocks and bonds and are traded mainly through standardized futures contracts on global exchanges.

Commodities Versus Differentiated Products | Ag Decision Maker - Commodities are fungible raw materials like corn or oil that are identical regardless of producer and traded on futures markets, where producers are price takers with no influence over market price.

Futures and Commodities | FINRA.org - Investors can gain exposure to commodities through direct investment in physical assets or via futures contracts and exchange-traded products, which are often used by commercial enterprises to manage price risk.

dowidth.com

dowidth.com