Digital real estate offers investors virtual properties and online assets that generate income through advertising, leasing, or resale, leveraging growth in the metaverse and digital platforms. Peer-to-peer lending connects borrowers directly with lenders via online platforms, providing opportunities for diversified fixed-income returns by funding personal or business loans. Explore the unique benefits and risks of each investment to optimize your portfolio strategy.

Why it is important

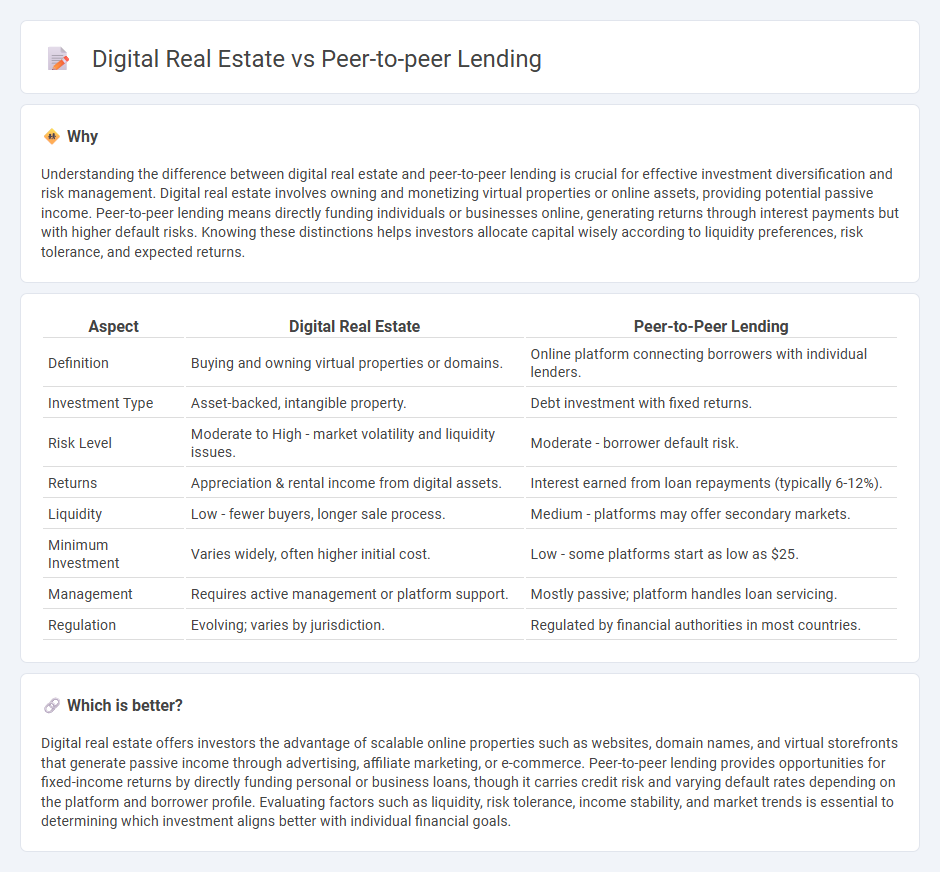

Understanding the difference between digital real estate and peer-to-peer lending is crucial for effective investment diversification and risk management. Digital real estate involves owning and monetizing virtual properties or online assets, providing potential passive income. Peer-to-peer lending means directly funding individuals or businesses online, generating returns through interest payments but with higher default risks. Knowing these distinctions helps investors allocate capital wisely according to liquidity preferences, risk tolerance, and expected returns.

Comparison Table

| Aspect | Digital Real Estate | Peer-to-Peer Lending |

|---|---|---|

| Definition | Buying and owning virtual properties or domains. | Online platform connecting borrowers with individual lenders. |

| Investment Type | Asset-backed, intangible property. | Debt investment with fixed returns. |

| Risk Level | Moderate to High - market volatility and liquidity issues. | Moderate - borrower default risk. |

| Returns | Appreciation & rental income from digital assets. | Interest earned from loan repayments (typically 6-12%). |

| Liquidity | Low - fewer buyers, longer sale process. | Medium - platforms may offer secondary markets. |

| Minimum Investment | Varies widely, often higher initial cost. | Low - some platforms start as low as $25. |

| Management | Requires active management or platform support. | Mostly passive; platform handles loan servicing. |

| Regulation | Evolving; varies by jurisdiction. | Regulated by financial authorities in most countries. |

Which is better?

Digital real estate offers investors the advantage of scalable online properties such as websites, domain names, and virtual storefronts that generate passive income through advertising, affiliate marketing, or e-commerce. Peer-to-peer lending provides opportunities for fixed-income returns by directly funding personal or business loans, though it carries credit risk and varying default rates depending on the platform and borrower profile. Evaluating factors such as liquidity, risk tolerance, income stability, and market trends is essential to determining which investment aligns better with individual financial goals.

Connection

Digital real estate and peer-to-peer lending intersect as innovative investment opportunities leveraging blockchain technology for increased transparency and decentralization. Investors use peer-to-peer lending platforms to fund digital property developments or acquire virtual land in metaverse environments, enabling diversified portfolios with lower entry barriers. This synergy enhances liquidity and access in digital asset markets, transforming traditional real estate investment dynamics.

Key Terms

Peer-to-Peer Lending:

Peer-to-peer lending connects individual borrowers with investors through online platforms, offering competitive interest rates and streamlined access to capital without traditional banks. This method provides investors with diversified portfolios and potentially higher returns by bypassing intermediaries. Explore more about how peer-to-peer lending reshapes finance and investment opportunities.

Borrower Risk Assessment

Peer-to-peer lending platforms utilize advanced algorithms and credit scoring models to evaluate borrower risk based on credit history, income stability, and debt-to-income ratios, aiming to reduce default rates and maximize investor returns. Digital real estate investment platforms assess risk by analyzing property valuations, market trends, and potential rental income, with less emphasis on individual borrower credit profiles. Explore how these differing risk assessment approaches influence investment decisions and portfolio strategies.

Interest Rate

Peer-to-peer lending platforms typically offer interest rates ranging from 5% to 12%, influenced by borrower credit profiles and loan terms, providing higher returns compared to traditional savings accounts. Digital real estate investments generally yield annual returns between 6% and 10%, driven by property appreciation and rental income, with lower volatility and long-term growth potential. Explore detailed comparisons on interest rates to determine which investment aligns best with your financial goals.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P) is an online service that matches lenders and borrowers, allowing individuals or businesses to lend money without traditional financial intermediaries, often through unsecured loans with loan servicing and credit assessment managed by the P2P platform itself.

PEER-TO-PEER LENDING - NASAA - Peer-to-peer lending is an online financial marketplace allowing lenders to fund unsecured loans for individuals and small businesses, often ranging from $1,000 to $25,000, providing alternatives when traditional banks are reluctant to lend.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending connects people or businesses seeking loans with lenders via marketplaces online, offering higher interest rates to lenders than traditional savings but posing higher risks, and platforms should be FCA-regulated to ensure compliance and protection.

dowidth.com

dowidth.com