Blue economy funds focus on sustainable investments in marine and coastal resources, targeting sectors like renewable ocean energy, fisheries, and marine biotechnology to drive ecological conservation alongside financial returns. Technology funds, conversely, invest in innovative tech industries such as software development, artificial intelligence, and semiconductor manufacturing, emphasizing rapid growth and cutting-edge advancements. Explore the unique benefits and risks of these fund types to align your investment strategy with your financial goals.

Why it is important

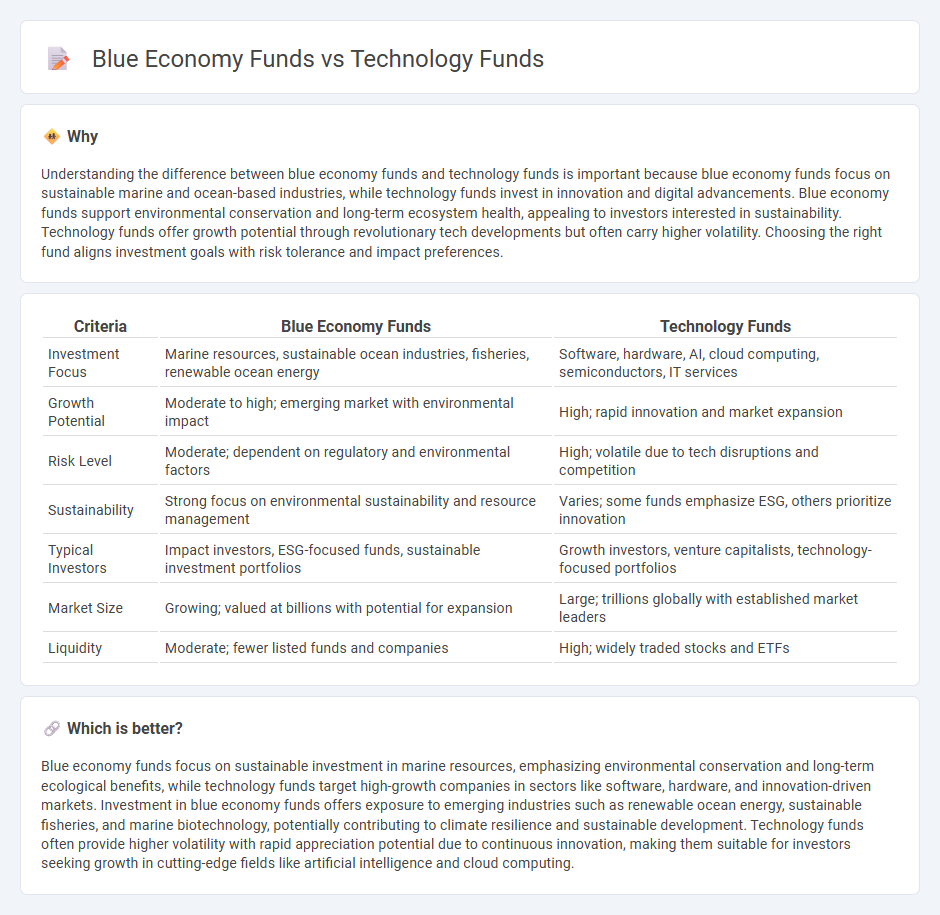

Understanding the difference between blue economy funds and technology funds is important because blue economy funds focus on sustainable marine and ocean-based industries, while technology funds invest in innovation and digital advancements. Blue economy funds support environmental conservation and long-term ecosystem health, appealing to investors interested in sustainability. Technology funds offer growth potential through revolutionary tech developments but often carry higher volatility. Choosing the right fund aligns investment goals with risk tolerance and impact preferences.

Comparison Table

| Criteria | Blue Economy Funds | Technology Funds |

|---|---|---|

| Investment Focus | Marine resources, sustainable ocean industries, fisheries, renewable ocean energy | Software, hardware, AI, cloud computing, semiconductors, IT services |

| Growth Potential | Moderate to high; emerging market with environmental impact | High; rapid innovation and market expansion |

| Risk Level | Moderate; dependent on regulatory and environmental factors | High; volatile due to tech disruptions and competition |

| Sustainability | Strong focus on environmental sustainability and resource management | Varies; some funds emphasize ESG, others prioritize innovation |

| Typical Investors | Impact investors, ESG-focused funds, sustainable investment portfolios | Growth investors, venture capitalists, technology-focused portfolios |

| Market Size | Growing; valued at billions with potential for expansion | Large; trillions globally with established market leaders |

| Liquidity | Moderate; fewer listed funds and companies | High; widely traded stocks and ETFs |

Which is better?

Blue economy funds focus on sustainable investment in marine resources, emphasizing environmental conservation and long-term ecological benefits, while technology funds target high-growth companies in sectors like software, hardware, and innovation-driven markets. Investment in blue economy funds offers exposure to emerging industries such as renewable ocean energy, sustainable fisheries, and marine biotechnology, potentially contributing to climate resilience and sustainable development. Technology funds often provide higher volatility with rapid appreciation potential due to continuous innovation, making them suitable for investors seeking growth in cutting-edge fields like artificial intelligence and cloud computing.

Connection

Blue economy funds focus on sustainable investments in marine resources, while technology funds drive innovations enhancing efficiency and environmental monitoring in ocean industries. Both fund types collaborate to finance advancements in areas like offshore renewable energy, marine biotechnology, and smart aquaculture systems. The integration of technology within blue economy projects accelerates sustainable growth and maximizes returns by leveraging data analytics, automation, and remote sensing.

Key Terms

**Technology Funds:**

Technology funds concentrate on investments in cutting-edge sectors such as software, semiconductors, artificial intelligence, and cloud computing, offering exposure to rapidly evolving innovations with high growth potential. These funds typically invest in companies driving digital transformation and technological advancements that reshape industries worldwide. Explore how technology funds can enhance your portfolio by capitalizing on future tech trends.

Innovation

Technology funds primarily invest in cutting-edge sectors such as artificial intelligence, blockchain, and cybersecurity, driving innovation through technological advancements and startup growth. Blue economy funds focus on sustainable ocean-related industries like marine biotechnology, renewable energy, and aquaculture, promoting innovation aligned with environmental preservation and resource efficiency. Explore detailed comparisons to understand how each fund type fosters innovation in its unique domain.

Disruption

Technology funds primarily invest in companies driving innovation through artificial intelligence, cloud computing, and blockchain, targeting sectors that disrupt traditional markets with rapid scalability. Blue economy funds focus on sustainable ocean-related industries such as renewable marine energy, fisheries, and maritime transport, promoting environmental conservation alongside economic growth. Explore the distinct impact and growth potential of these disruptive investment approaches to understand which aligns better with your portfolio goals.

Source and External Links

The Best ETFs for Tech Stock Investors - Highlights top-rated technology ETFs, such as the Xtrackers MSCI World Information Technology UCITS ETF and iShares Digital Security UCITS ETF, both recognized for strong past-year performance and Morningstar accolades.

5 Best-Performing Tech ETFs for July 2025 - Lists the five best-performing tech ETFs by one-year returns, including ProShares On-Demand ETF (OND), KraneShares Hang Seng TECH Index ETF (KTEC), and KraneShares Emerging Markets Consumer Technology Index ETF (KEMQ), all with returns above 35% annually.

XLK: The Technology Select Sector SPDR(r) Fund - Seeks to track the price and yield performance of the technology sector within the S&P 500, providing broad exposure to major U.S. tech companies.

dowidth.com

dowidth.com